Withholding VS Composite Tax- Best Differentitaion In 2025

Table of Contents

The Comprehensive Guide On Withholding VS Composite Tax

Introduction: Understanding the Two Mechanisms

Are you ready for exploring the topic Withholding vs Composite tax? Then this guide is only for you. Withholding and composite tax returns are two distinct but sometimes overlapping mechanisms in U.S. taxation, especially in the context of pass-through entities such as partnerships, LLCs, and S corporations. Both serve to ensure tax compliance — particularly where non-resident individuals or foreign partners are concerned — but they operate at different levels (federal vs. state) and under different legal frameworks.

Understanding their roles, differences, compliance implications, and when each applies is critical for entities engaged in cross-border transactions or multi-state operations.

What is Withholding Tax?

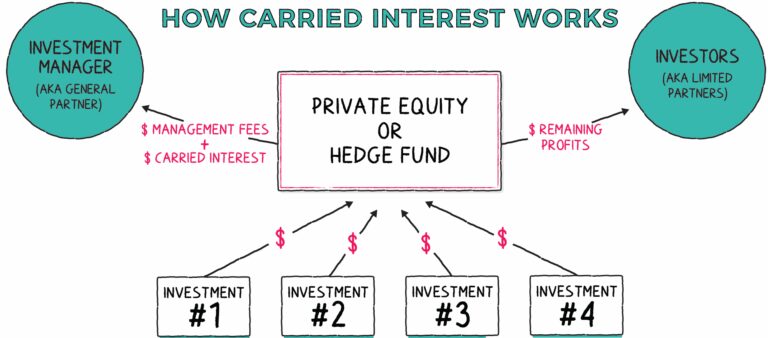

Withholding tax is a mandatory tax deduction at the source of income. It ensures that taxes are collected in real time by requiring the payer or withholding agent to deduct and remit tax before the income is disbursed.

What is a Composite Tax Return?

A composite tax return is a state-level group filing where a pass-through entity reports and pays income taxes on behalf of non-resident partners, shareholders, or members. This allows such individuals to avoid filing their own state income tax returns in certain jurisdictions.

Withholding Tax vs. Composite Tax

Overview

| Feature | Withholding Tax | Composite Tax Return |

| Purpose | Ensures tax is collected at the source before payment is made | Simplifies state income tax filing for non-resident partners/shareholders |

| Authority | Governed by federal tax law (IRC) and state tax codes | Governed by state tax law only |

| Who Withholds or Files | The payer (e.g., employer, partnership, or institution) withholds and remits tax | The pass-through entity files a group return on behalf of eligible non-resident owners |

| Level of Taxation | Federal and State | State only |

| Applicable To | Employees, foreign individuals, foreign partners, contractors, royalty recipients | Non-resident partners, shareholders, or members of pass-through entities |

| Tax Liability Reporting | Income and tax reported on Form 1042-S, 8805, 1099, W-2, etc. | Reported via state composite return forms (e.g., CA Form 540NR, NY IT-203-C) |

| Filing Requirement for Payee | Typically required to file an individual tax return, unless exempt (e.g., Form 1040-NR for non-residents) | May eliminate need for individuals to file separate state returns if they opt in |

| Opt-in/Opt-out | Mandatory (if withholding applies) | Generally optional for qualifying individuals; some states require unanimous consent |

| Rates Applied | Flat or graduated rates (e.g., 30% FDAP, 37% for foreign partners, 24% backup withholding) | Varies by state; typically uses individual marginal tax rates |

| Interaction with Tax Treaties | Treaties can reduce or eliminate federal withholding (e.g., W-8BEN, W-8BEN-E) | State composite returns generally ignore federal treaties unless state conforms |

| Use in Practice | Ensures real-time federal/state tax collection from foreign or noncompliant taxpayers | Reduces compliance burden for non-residents in multistate or pass-through investments |

| Enforcement | IRS enforces compliance with strict penalties, including Trust Fund Recovery Penalty | States impose penalties for late filings or underpayments on composite returns |

| Examples of Use | – Foreign investor receives U.S. dividends → 30% withholding – Foreign partner in U.S. LLP → 37% withholding on ECI – U.S. employee pay check → wage withholding | – NY-based partnership with 5 foreign partners files a single composite return for all – California S-corp includes 10 out-of-state shareholders in one return |

Legal Basis for Withholding Tax vs. Composite Return

Withholding Tax – Legal Basis

- Codified under IRC §1441–1446, §3401–3406, and respective state statutes

- IRS requires withholding on:

- FDAP income (Fixed, Determinable, Annual, Periodic) → Dividends, Interest, Royalties, etc.

- Effectively Connected Income (ECI) for foreign partners

- Backup withholding if taxpayer fails to provide a TIN (Form W-9 issues)

- Forms involved: 1042, 1042-S, 8804, 8805, W-2, 1099 series

Composite Returns – Legal Basis

- Authorized by state-specific statutes or guidance

- Voluntary in many states (e.g., CA, IL, GA)

- Mandatory or hybrid in others (e.g., CO and NJ for partnerships above a certain threshold)

- Key forms: CA 540NR, NY IT-203-C, MD Form 510, GA Form 700 CR

Examples of Application

Withholding Tax Scenario

- A foreign partner from India is allocated $120,000 of ECI from a U.S.-based LLC.

- The LLC is required to withhold at the individual rate (37%), remit $44,400 to the IRS using Form 8804, and furnish Form 8805 to the partner.

- If treaty benefits apply and a W-8BEN is submitted, the withholding could be reduced (though generally ECI is not exempt under treaty).

Composite Return Scenario

- A real estate partnership operating in Illinois and Indiana has 10 out-of-state partners.

- The entity elects to file a composite return in each state, eliminating the need for those partners to individually file state returns.

- The tax is calculated at the state’s non-resident individual rate and paid by the partnership from allocated distributions.

Withholding vs. Composite: Tax Filing Risks and Responsibilities

| Area | Withholding Tax | Composite Return |

| Responsibility | The payer is responsible for accurate withholding and timely remittance | The entity must comply with filing rules and collect consent from participants |

| IRS Penalties | Failure to withhold leads to severe penalties, including interest and personal liability (TFRP) | State penalties for non-filing, late payment, or failing to collect opt-in consent |

| Audit Risk | High, especially with foreign payments, Form 1042 errors, or improper treaty claims | Lower than federal, but noncompliance can result in disqualification or reassessment |

When to Apply Withholding Tax vs. Composite Filing

Use Withholding Tax When:

- You are making payments to non-resident aliens, foreign partners, or foreign entities

- You are paying U.S.-source passive income (FDAP)

- You must comply with federal or backup withholding rules

- You’re hiring U.S. employees (standard payroll tax)

Use Composite Returns When:

- You manage a pass-through entity with multiple non-resident members across states

- You want to simplify state income tax compliance

- State allows or requires composite filings

- Partners want to avoid filing separate state returns

Can Withholding Tax & Composite Tax Be Used Together?

Yes — and in many cases, they must be.

Example:

- A Delaware-based LLC with foreign partners operates in California and New York.

- It must:

- Withhold federal taxes under §1446 on ECI

- File composite state returns to report state-level income for non-resident partners

- Issue Forms 8805 federally, and submit state composite forms for each participating state

Conclusion: Withholding vs. Composite — Not Either/Or, But Both

Withholding tax and composite returns are not interchangeable — they solve different problems.

- Withholding tax is a mandatory, real-time tax collection tool focused on income recipients (often foreign or non-compliant).

- Composite tax returns are a voluntary or simplified compliance tool at the state level aimed at reducing filing burdens for non-residents in partnerships or S Corps.

For most multi-member pass-through entities, especially those with non-resident or foreign partners, using both is not just ideal — it’s essential for full tax compliance.

Frequently Asked Questions (FAQs)

1. What Is IRC §1446 Withholding?

IRC §1446 withholding refers to the mandatory federal tax withholding imposed on U.S. partnerships (and LLCs taxed as partnerships) that have foreign partners. Under this rule, the partnership must withhold and pay tax on the foreign partner’s share of effectively connected income (ECI), even if no actual cash distribution is made.

- Withholding Rates:

- 37% for foreign individual partners

- 21% for foreign corporate partners

- Forms Used: IRS Forms 8804, 8805, and 8813

- Purpose: Ensures the IRS collects tax upfront from foreign investors in U.S. partnerships.

2. How to File IRS Form 8804 and 8805?

Form 8804 is used by partnerships to report the total annual withholding tax liability under IRC §1446, while Form 8805 reports each foreign partner’s share of withheld tax.

Filing Steps:

- Calculate ECI for each foreign partner.

- Withhold tax at the applicable rate (37% or 21%).

- Make quarterly deposits using Form 8813.

- File Form 8804 by the 15th day of the third month after year-end (March 15 for calendar year).

- Issue Form 8805 to each foreign partner by the same deadline.

- File copies of Form 8805 with the IRS.

Failing to file or underreporting can result in penalties and interest.

3. What Are State Composite Return Rules by Jurisdiction?

Composite tax returns allow partnerships or S corporations to file a single group return on behalf of non-resident partners or shareholders in a particular state. Rules vary by state, including eligibility, consent requirements, and tax rates.

Key Differences by Jurisdiction:

- California (Form 540NR): Voluntary, participants must consent, income taxed at individual rates.

- New York (Form IT-203-C): Optional, but separate NY source income calculations required.

- Illinois (IL-1023-C): Composite allowed for up to 50 non-resident individuals.

- New Jersey: Mandates withholding or composite return filing for non-resident partners.

- Colorado: Composite return filing is required if the entity has non-resident partners.

Check each state’s tax authority for specific forms, rates, and deadlines.

4. How to Claim Treaty Benefits Using Form W-8BEN?

Foreign individuals can reduce or eliminate U.S. withholding tax on certain types of income (e.g., interest, dividends, royalties) by filing IRS Form W-8BEN, which claims income tax treaty benefits.

Steps:

- Complete Form W-8BEN with name, country of residence, and U.S. TIN (if available).

- Identify the treaty country and the relevant treaty article.

- Certify residency and eligibility for benefits under penalties of perjury.

- Submit the form to the withholding agent (not to the IRS).

This form is valid for 3 years unless a change in circumstances occurs. The withholding agent uses this to apply the reduced treaty rate, which may be as low as 0% depending on the country and income type.

5. What Are Backup Withholding and Form W-9 Requirements?

Backup withholding is a flat 24% federal tax applied to U.S. income payments (like interest or dividends) when a taxpayer fails to provide a valid TIN or is flagged for underreporting.

When It Applies:

- Missing or incorrect Social Security Number (SSN) or Employer Identification Number (EIN)

- Failure to return Form W-9 when requested

- IRS notification of underreporting interest/dividends

Form W-9:

- Used by U.S. persons to certify their TIN and taxpayer status

- Required to avoid backup withholding

Noncompliance may result in forced withholding and IRS penalties.

6. How Are Non-resident Partners Taxed in Multi-State Partnerships?

Non-resident partners in partnerships that operate across multiple states are typically taxed on income sourced to each state, regardless of their residency.

Key Points:

- Partnerships must allocate and apportion income to each state based on business activity.

- Non-resident partners may need to:

- File state tax returns in each state where the partnership does business, or

- Be included in a state composite return (if offered)

- Some states require withholding on the non-resident’s share of state-source income (e.g., CA, NY, NJ)

- Federal withholding under IRC §1446 also applies if the partner is foreign

Failure to comply at the state level may trigger penalties, disqualify treaty benefits, and increase audit risk.