What is UBTI?- Best Detailed Overview In 2025

Table of Contents

What is UBTI (Unrelated Business Taxable Income)?

Are you wondering of “What is UBTI? Well, all we can say is that you have landed the right destination. UBTI, or Unrelated Business Taxable Income, refers to income generated by a tax-exempt entity (like an IRA, 401(k), or nonprofit) from activities unrelated to its primary exempt purpose. While these entities typically don’t pay taxes, if they earn UBTI, that income may be subject to federal income tax.

Why UBTI Matters?

Tax-exempt entities—especially retirement accounts like Self-Directed IRAs—can lose their tax advantage on income from non-passive business activities or debt-financed investments, triggering a tax bill via UBIT (Unrelated Business Income Tax).

Common Sources of UBTI

1. Active Business Operations

Income from operating a business directly (e.g., running a bakery in an IRA)

2. Debt-Financed Income (UDFI)

Using leverage or loans to buy real estate in an IRA can generate Unrelated Debt-Financed Income, which is a form of UBTI

3. Investments in LLCs or Partnerships

Investing through an LLC taxed as a partnership that earns active income can expose an IRA to UBTI

4. Real Estate Investments

Rental income is generally not UBTI unless the property is financed with debt

Relevant Tax Forms

- Form 990-T – Used by IRAs and nonprofits to report UBTI and pay UBIT

- Schedule K-1 (Form 1065) – Will indicate if the investment generated UBTI (look at Box 20, Code V)

- Form 990 – For organizations to report regular exempt activity income, if applicable

UBTI Tax Rates

UBTI is taxed at trust tax rates, which are highly compressed. As of 2025:

- 10% on income up to $3,100

- 24% on $3,101–$11,150

- 35% on $11,151–$15,200

- 37% on income over $15,200

Even modest UBTI amounts can be taxed at the highest rate.

Avoiding or Minimizing UBTI

- Invest in passive assets, like stocks, bonds, or unleveraged real estate

- Use checkbook IRAs with careful tax planning

- Use blocker corporations to shield UBTI (complex and often used in private equity or foreign investments)

- Avoid investing retirement funds in active businesses

Summary

- UBTI is taxable income earned by a tax-exempt entity from non-exempt activities

- Common in retirement accounts involved in active businesses or leveraged real estate

- Triggers UBIT, reported on Form 990-T

- Taxed at trust tax rates, up to 37%

- Proper planning is essential to avoid tax surprises

Key Criteria That Define UBTI

For income to be classified as UBTI, it must meet all three of the following conditions:

1. Income from a trade or business

A continuous and profit-driven activity (e.g., retail sales, consulting, etc.)

2. Regularly carried on

Occurs frequently or seasonally in a way that resembles for-profit businesses

3. Not substantially related to the exempt purpose

The income-generating activity doesn’t directly support the organization’s mission

Common Examples of UBTI

| Source of Income | UBTI? | Explanation |

| Operating a business within a nonprofit or IRA | Yes | Profits from a café, rental service, or store unrelated to the core mission |

| Debt-financed rental property (e.g., leveraged real estate in an IRA) | Yes | Generates Unrelated Debt-Financed Income (UDFI) |

| Advertising income | Yes | Especially in nonprofit publications or websites |

| Investment in active partnerships or LLCs | Yes | If the partnership generates business income, part of it passes as UBTI |

| Dividends, interest, capital gains | No | Generally excluded from UBTI as passive income (unless debt-financed) |

| Royalties and licensing | No | Usually not UBTI unless tied to active services |

| Passive rental income (no debt) | No | Pure rent from unleveraged real estate is exempt from UBTI |

UBTI and IRAs

Self-Directed IRAs can incur UBTI if they:

- Invest in active businesses (through LLCs or partnerships)

- Purchase real estate using a mortgage or loan

- Own operating companies (e.g., franchises, convenience stores)

Such income is taxed at trust tax rates and must be reported on Form 990-T.

How to Calculate UBTI (Unrelated Business Taxable Income)

UBTI is the portion of income that a tax-exempt organization or retirement account (like an IRA or 401(k)) earns from non-passive, unrelated business activities. When certain investments generate UBTI, the entity may owe Unrelated Business Income Tax (UBIT).

Step-by-Step Guide to Calculating UBTI

1. Identify Gross Unrelated Business Income

Start with all gross receipts from unrelated trade or business operations. This includes:

- Income from operating a business (e.g., retail, service)

- Rental income if the property is debt-financed

- Income from partnerships or LLCs that conduct active businesses

- Income from advertising, especially in nonprofit organizations

Passive income like dividends, interest, and rent without debt is excluded from UBTI.

2. Subtract Allowable Deductions

Deduct any directly connected expenses, such as:

- Salaries, wages, and benefits of employees involved in the activity

- Operating expenses like utilities, supplies, rent

- Depreciation on business-use assets

- Taxes, interest, and legal fees directly tied to the unrelated activity

These must be attributable solely to the unrelated business — not general exempt activities.

3. Adjust for Unrelated Debt-Financed Income (UDFI)

If a tax-exempt entity (like a Self-Directed IRA) uses leverage or financing to buy real estate or other assets, a portion of the income becomes UBTI. To calculate the UDFI portion:

UDFI Formula:

Example:

- $100,000 property bought with $60,000 debt

- $10,000 net rental income

→ 60% of $10,000 = $6,000 UBTI

Subtract the $1,000 Deduction (If Applicable)

The IRS allows a $1,000 standard deduction against total UBTI. This is especially useful for small UBTI-generating activities.

Note: This does not apply to income from controlled foreign corporations or PFICs.

Calculate Tax Using Trust Tax Rates

UBTI is taxed under the IRS trust tax brackets. As of 2025, they are:

| Taxable UBTI | Tax Rate |

| Up to $3,100 | 10% |

| $3,101–$11,150 | 24% |

| $11,151–$15,200 | 35% |

| Over $15,200 | 37% |

Tax Filing

- Use Form 990-T to report UBTI and calculate UBIT

- Retirement accounts (like IRAs) must file separately from the owner

- Accompany with Schedule A and supporting schedules (if applicable)

Additional Considerations

- Net Operating Losses (NOLs) from previous years can offset UBTI

- Income from controlled foreign corporations and PFICs may also be treated as UBTI

- Check K-1 Box 20, Code V for partnership investments – it indicates UBTI

Summary

- UBTI = Gross Unrelated Business Income – Directly Connected Expenses – $1,000 deduction

- UBTI includes active business income and debt-financed income

- Reported on Form 990-T

- Taxed at trust income tax rates

- Planning is essential to reduce or avoid UBIT exposure

What is Excluded from Unrelated Business Taxable Income (UBTI)?

While UBTI refers to income earned from non-exempt business activities by tax-exempt organizations or retirement accounts (like IRAs), the IRS excludes several types of income from this definition. These exclusions are critical for nonprofits and Self-Directed IRAs to maintain their tax-exempt advantage.

Common Exclusions from UBTI

Here are the main categories of income excluded from UBTI under the Internal Revenue Code (IRC §512–514):

1. Dividends

- Income from shares of stock in corporations

- Treated as passive investment income

- Always excluded unless tied to debt-financed instruments

Example: A nonprofit earning dividends from a public company does not pay UBIT.

2. Interest

- Interest from bonds, savings, certificates of deposit, and loans

- Passive income unless connected to a business loan or controlled entity

Example: Bank interest from a checking account or loan interest income is exempt.

3. Capital Gains

- Gains from the sale of property, stocks, or other investments

- Long-term or short-term capital gains are excluded from UBTI

Exception: If the property is inventory in a business activity, the gain may be taxable.

4. Rental Income (from Real Property)

- Rent from real estate (not personal property) is excluded

- Property must not be financed with debt or involve substantial services

Passive rental income from unleveraged property is safe

But debt-financed property triggers Unrelated Debt-Financed Income (UDFI)

5. Royalty Income

- Payments for the use of intangible assets, like patents, copyrights, or trademarks

- Royalty income is excluded unless it involves significant services or personal effort

Example: A nonprofit licensing its name earns royalties exempt from UBTI.

6. Certain Research Income

- Qualified scientific research conducted for governmental or public interest

- Exempt from UBTI under IRC §512(b)(9)

7. Volunteer Labor

- Income from activities substantially carried out by volunteers is excluded

- Protects nonprofits that rely heavily on volunteer work

Example: Church bake sale operated entirely by volunteers

8. Convenience of Members or Students

- Income from services or facilities provided for the convenience of members

- Often applies to university bookstores, cafeterias, or dormitories

Example: A campus coffee shop serving only students may be exempt

9. Donations, Contributions, and Gifts

- Contributions with no expectation of goods or services

- These are not business receipts and are excluded from UBTI

Summary Table – What’s Excluded from UBTI

| Type of Income | UBTI? | Notes |

| Dividends | No | Passive investment income |

| Interest | No | Except from debt-financed or controlled for-profit entities |

| Capital Gains | No | Except from inventory or dealer property |

| Real Estate Rent (no debt) | No | Must avoid debt financing and substantial services |

| Royalties | No | Purely passive; avoid service-based licensing |

| Volunteer-Run Business | No | Labor must be mostly volunteer |

| Member Convenience Services | No | For students, members, or patients of exempt institutions |

| Research for Public Use | No | Scientific research for governments or the public |

| Donations and Gifts | No | Not earned through business activity |

Notes

- Even passive income can become UBTI if tied to debt financing (UDFI).

- Always evaluate if services, debt, or control affect the income’s exempt status.

- Form 990-T is used only if the organization earns taxable UBTI.

Where Do You Report UBTI?

If a tax-exempt organization (such as a nonprofit, charity, or educational institution) or a retirement account (such as a Self-Directed IRA or Solo 401(k)) earns income from unrelated business activities, that income is subject to Unrelated Business Income Tax (UBIT) and must be reported to the IRS.

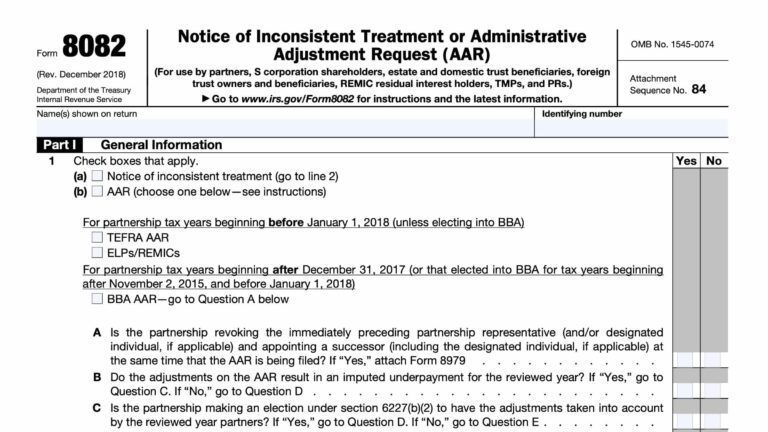

IRS Form to Report UBTI: Form 990-T

- Form Name: Exempt Organization Business Income Tax Return

- Used By:

- Nonprofit organizations

- Tax-exempt trusts

- IRAs and qualified retirement accounts with UBTI

Key Sections of Form 990-T

| Section | What to Report |

| Part I | Total gross unrelated business income and deductions |

| Part II | Calculation of UBTI (after $1,000 deduction) |

| Part III | Tax computation using trust tax rates |

| Schedule A | Required if multiple unrelated businesses are conducted |

| Schedule M | Report UBTI from controlled entities or partnerships |

IRA owners: If your Self-Directed IRA receives a K-1 showing UBTI (Box 20, Code V), you must file Form 990-T on behalf of your IRA, not personally.

When UBTI Must Be Reported

- More than $1,000 in gross UBTI annually triggers filing requirements

- Due 4.5 months after the end of the tax year (usually May 15 for calendar-year entities)

- File separately from Form 990 or other individual returns

Where to File

- Electronically via IRS-authorized e-file providers

- For IRAs or custodians filing on behalf of retirement accounts, the return should be filed using the IRA’s name and EIN, not the individual taxpayer’s SSN

Payment of UBIT

- UBTI is taxed at trust tax rates, which can range from 10% to 37%

- Estimated tax payments (Form 990-W) may be required if UBIT is expected to exceed $500

Summary

| Requirement | Details |

| Form | Form 990-T |

| Filed By | Nonprofits, trusts, IRAs with UBTI |

| Threshold | Gross UBTI over $1,000 |

| Tax Rates | Trust income tax brackets (up to 37%) |

| Deadline | 4.5 months after year-end (May 15 for calendar year) |

| Filed Under | IRA/Trust EIN, not personal SSN |

Unrelated Business Taxable Income (UBTI) on a Partnership K-1

When a tax-exempt entity or a Self-Directed IRA invests in a partnership or LLC taxed as a partnership, it receives an IRS Schedule K-1 (Form 1065) at year-end. If that entity receives income from a business activity unrelated to its tax-exempt purpose, it may trigger Unrelated Business Taxable Income (UBTI).

Where UBTI Appears on Schedule K-1 (Form 1065)

Look for UBTI in the following section of the K-1:

- Box 20, Code V – Unrelated Business Taxable Income (UBTI)

Code V includes information the tax-exempt partner needs to compute UBTI. This may include:

- Partnership’s gross income from unrelated business activities

- Allocated expenses

- Any debt-financed income (which creates Unrelated Debt-Financed Income (UDFI))

Common Triggers of UBTI from Partnerships

| Trigger | Explanation |

| Active business income | If the partnership earns income from operations like manufacturing or services |

| Debt-financed property | Generates UDFI; commonly from leveraged real estate or margin trading |

| Operating LLCs or franchises | Income is considered “business activity,” not passive investment |

Special Note for Self-Directed IRAs

If an IRA owns a portion of a partnership and receives a K-1 with UBTI:

- The IRA must file Form 990-T

- The return is filed under the IRA’s EIN, not the individual’s SSN

- If gross UBTI exceeds $1,000, UBIT tax applies at trust tax rates (up to 37%)

How to Report UBTI from a K-1

- Review K-1 Box 20 (Code V) for UBTI or UDFI amounts

- Confirm if total gross UBTI exceeds $1,000

- File IRS Form 990-T

- Attach a copy of the K-1 to the return

- Pay UBIT using IRS trust tax rates

- May need to file Form 990-W for estimated tax payments

Summary Table

| K-1 Box | Description |

| Box 20, Code V | UBTI information for tax-exempt partners |

| Schedule K & M-1 | May include relevant financial details |

| Additional footnotes | Often explain the nature of UBTI/UDFI income |

Notes

- Request UBTI disclosures before investing in partnerships

- Use a tax advisor familiar with UBTI and retirement account rules

- Consider UBTI blockers (like C-corp blockers) for large investments

Conclusion

Even passive investors (like IRAs or nonprofits) can owe tax if the underlying activity of the partnership is active business income. Carefully reading Box 20, Code V of the K-1 is essential to identify potential tax liability and remain compliant.

What is Unrelated Business Taxable Income (UBTI) for Tax-Exempt Organizations?

Unrelated Business Taxable Income (UBTI) refers to net income derived from a trade or business that is regularly carried on by a tax-exempt organization but is not substantially related to its exempt purpose.

This income is subject to Unrelated Business Income Tax (UBIT), ensuring that nonprofits don’t gain unfair tax advantages when competing with for-profit businesses.

UBTI and Investment Partnerships

If a nonprofit invests in a partnership or LLC that engages in unrelated business, Schedule K-1 (Form 1065) may report UBTI in Box 20, Code V. This income must be included on Form 990-T.

UBTI ensures that tax-exempt organizations remain mission-focused and don’t unfairly compete in the commercial sector. Any business activity that doesn’t align with your core exempt purpose may be subject to UBIT and filing requirements under Form 990-T.

What is Self-Rental?

Self-rental occurs when a tax-exempt entity or a retirement account (e.g., Self-Directed IRA) owns a property and rents it to a related or controlled business, typically one in which the same individual or entity has a substantial interest.

Can self-rental be unrelated business taxable income ?

Yes, self-rental income can be considered Unrelated Business Taxable Income (UBTI) under certain conditions—especially for tax-exempt organizations or retirement accounts (like IRAs) that rent property to a business they control or are involved in.

Rental Income Exceptions (Generally Excluded from UBTI)

Typically, passive rental income is excluded from UBTI if:

- It’s real property (not personal property)

- No services are provided

- It’s not debt-financed

- The lessee is not a related business

However, when self-rental is to a related party, the IRS may reclassify this otherwise passive income as active business income, which is subject to UBTI.

Reporting Requirements

If self-rental results in UBTI:

- Form 990-T must be filed (if UBTI > $1,000)

- Income and expenses must be reported accurately

- If through a partnership, UBTI may appear on Schedule K-1, Box 20, Code V

Self-Rental and IRAs: High-Risk Zone

For retirement accounts (e.g., Self-Directed IRAs or Solo 401(k)s):

- Self-rental to a business owned by you or a family member may result in a prohibited transaction

- Can lead to disqualification of the entire IRA, triggering full taxation and penalties

Conclusion

Self-rental income can be UBTI if it involves a trade or business, services, or related parties. While rental income is generally excluded from UBTI, IRS rules are strict on self-dealing and abuse through related-party transactions. Always assess intent, structure, and relationship before entering such arrangements.

Frequently Asked Questions (FAQs) on Unrelated Business Taxable Income (UBTI)

1. What is UBTI (Unrelated Business Taxable Income)?

UBTI refers to income from a regularly carried on trade or business that is not substantially related to a tax-exempt organization’s mission. If such income exceeds $1,000, it may be subject to the Unrelated Business Income Tax (UBIT).

2. What triggers UBTI for nonprofits or charities?

Common UBTI triggers include:

- Operating a business like a bookstore or café

- Selling advertising space (online or in print)

- Renting property with services (e.g., furnished or cleaned spaces)

- Investing in partnerships engaged in business operations

3. Do all rental activities generate UBTI?

Not always. Rental income from real property is generally exempt from UBTI unless:

- The rent includes personal property or services

- It’s from a debt-financed property

- It’s a self-rental to a controlled or related entity

4. How is UBTI reported to the IRS?

Tax-exempt organizations must report UBTI on Form 990-T if gross UBTI exceeds $1,000 during the year. Estimated taxes may be required using Form 990-W.

5. Can IRAs or retirement accounts have UBTI?

Yes. Self-Directed IRAs and Solo 401(k)s may incur UBTI if they:

- Invest in active businesses

- Use leverage (debt-financed real estate = UDFI)

- Participate in partnerships (via K-1s with Box 20, Code V)

6. What is Unrelated Debt-Financed Income (UDFI)?

UDFI is a subset of UBTI generated when a tax-exempt entity earns income from debt-financed property. It typically affects IRAs investing in leveraged real estate or margin trading.

7. What is excluded from UBTI?

UBTI does not include:

- Donations, gifts, and grants

- Interest, dividends, and capital gains

- Qualified sponsorship payments

- Royalties and most real estate rental income

8. What are the tax rates for UBTI?

UBTI is taxed at trust tax rates, which can be as high as 37% for retirement accounts. For nonprofits, rates vary depending on income level and entity structure.

9. Can UBTI jeopardize tax-exempt status?

Yes. If an organization relies too heavily on unrelated business activities, or fails to report UBTI, it may risk losing its exempt status under IRS scrutiny.

10. How can I avoid or reduce UBTI?

To minimize UBTI risk:

- Limit unrelated business activities

- Use blocker corporations for investments

- Avoid self-rental or related-party transactions

- Consult a tax professional before investing or launching revenue-generating operations