Unlocking the Concept of Waterfall Allocations: A Clear Explanation

A waterfall allocation refers to a structured framework used to distribute profits and losses in investment partnerships, particularly those involving private equity, real estate, or hedge funds. Instead of dividing profits based on ownership stakes, this approach allocates income through structured levels or thresholds that prioritize investor contributions and performance outcomes.

How Waterfall Allocation Works?

A waterfall allocation framework operates like a tiered funnel that governs how investment returns are distributed within a partnership or fund. The “waterfall” metaphor signifies that cash flows must “fill” one level before they can flow to the next. This ensures that investors are repaid appropriately before managers receive performance-based incentives. This structure is frequently embedded in agreements for private equity, venture capital, hedge funds, and real estate investment partnerships.

Each level—or “tier”—in the waterfall structure corresponds to a specific financial obligation, such as returning initial capital, paying a preferred return, and sharing profits through carried interest. Let’s break down each step in detail:

1. Return of Capital (ROC)

Objective: Repay investors their initial investment before distributing any profits.

This is the foundational tier. Every dollar of distributed cash first goes toward reimbursing Limited Partners (LPs) for their contributed capital. No profits, interest, or incentives are considered at this point.

Example: If Investor A contributed $150,000 to a fund, they are entitled to receive the entire $150,000 back before any preferred returns or profit-sharing begins. Until this threshold is satisfied, the General Partner (GP) does not participate in distributions.

Tax Note: This amount is typically a non-taxable return of capital, reducing the investor’s basis in the partnership interest.

2. Preferred Return (Hurdle Rate)

Objective: Ensure LPs receive a minimum annual return on their invested capital before GPs are rewarded.

Often referred to as the “hurdle rate,” this tier provides an annualized return (commonly 6%–10%) on the contributed capital, compounded or simple, depending on the agreement. It compensates investors for the opportunity cost and time value of money.

Example: If the hurdle is 8% annually on a $150,000 investment, the investor should receive $12,000 per year before the GP earns any share of the profits.

Tax Note: This return is generally taxable as ordinary income or capital gain, depending on how the income is generated by the partnership.

3. Catch-Up Provision

Objective: Align the GP’s profit participation with the agreed profit-sharing structure.

After the preferred return is paid, the GP may receive a “catch-up” allocation. In this tier, 100% of the profits go to the GP until their share of the total profits reaches a predetermined percentage—often 20%.

This ensures that the GP is brought up to speed with the agreed economic split before moving into final profit-sharing.

Example: Once LPs have received their preferred return, the GP may receive the next $30,000 in profits exclusively until their cumulative earnings equal 20% of all profits distributed.

Why it matters: The catch-up provision motivates the GP to meet investor expectations and aligns their incentives with fund performance.

4. Carried Interest (Promote)

Objective: Share remaining profits between investors and managers as per a negotiated split.

At this stage, remaining profits are typically divided between the Limited Partners and General Partner, often using a standard split like 80/20 or 70/30. This tier compensates the GP for successfully managing and growing the investment and is often the most financially significant reward for the sponsor.

Example: After capital and preferred returns are paid, and the GP has caught up to their 20% share, any remaining profits—say $1,000,000—are split, with $800,000 going to LPs and $200,000 to the GP.

Tax Note: Carried interest is usually taxed at the long-term capital gains rate (20%) if the investment holding period exceeds 3 years (per IRC §1061), plus an additional 3.8% Net Investment Income Tax (NIIT) for high-income earners.

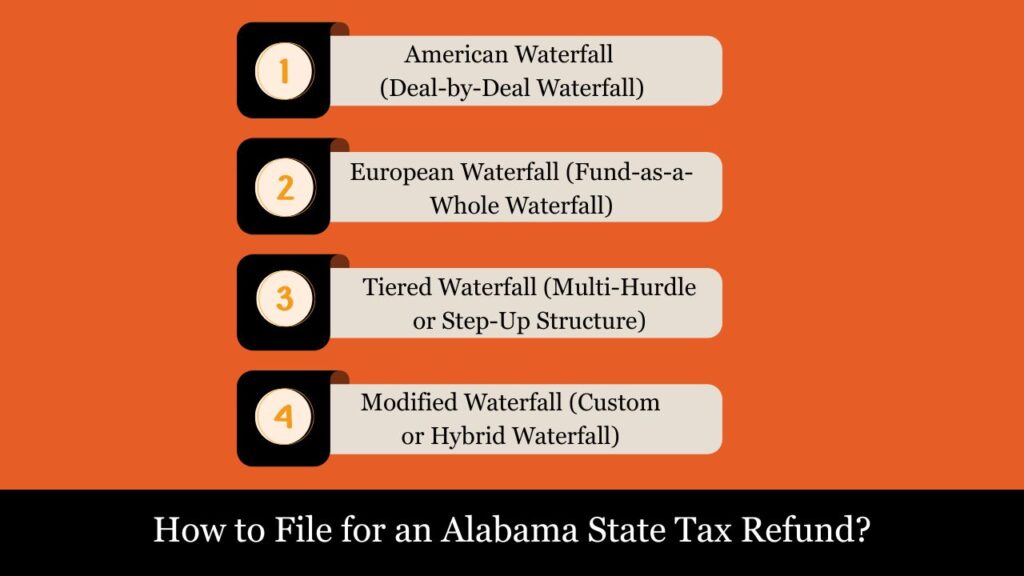

Types of Waterfall Structures – Expanded and Descriptive

Waterfall structures define how profits and cash flows from an investment are distributed between Limited Partners (LPs) and General Partners (GPs). While the basic principles are consistent—prioritizing capital recovery, preferred returns, and performance incentives—the actual structuring of waterfalls can vary significantly based on fund strategy, investor risk appetite, jurisdiction, and deal complexity.

Let’s explore the four primary types of waterfall structures in greater detail:

1. American Waterfall (Deal-by-Deal Waterfall)

Also Known As: Deal-Specific or U.S.-Style Waterfall

This model allocates profits based on the performance of each individual investment or deal, rather than the fund as a whole. Each investment “stands on its own,” meaning distributions are triggered once a specific deal meets its required benchmarks.

Key Features:

- Profits are distributed after each deal closes and becomes profitable.

- There is no pooling of gains or losses from other deals in the fund.

- LPs and GPs may receive distributions earlier, often after the first profitable exit.

Practical Use Case:

Used frequently in U.S. real estate syndications, private equity, and venture capital structures where sponsors want access to performance fees on early wins.

Pros:

- Quicker payouts for GPs—strong short-term incentive.

- Encourages deal activity—faster compensation for sponsors upon closing a profitable project.

Cons:

- Higher risk exposure for LPs, especially if early deals perform well but later ones underperform.

- No fund-level protection—successful deals may be offset by losses later without recourse.

Tax Implication:

Each deal’s outcome may require standalone tax tracking, especially for basis adjustments, capital gain categorization, and withholding if foreign partners are involved.

2. European Waterfall (Fund-as-a-Whole Waterfall)

Also Known As: Whole-of-Fund Waterfall or Euro-Style Waterfall

In contrast to the American structure, the European waterfall pools returns across all investments. No carried interest is distributed to the GP until the entire fund has returned all capital contributions and met the preferred return hurdle.

Key Features:

- All capital must be repaid to LPs across the entire fund, including their preferred return, before GPs earn carried interest.

- GPs must wait for the overall portfolio to succeed before receiving profit incentives.

Practical Use Case:

Favored in European private equity, infrastructure, and institutional funds where investor protection and long-term stability are prioritized.

Pros:

- Investor-friendly: Ensures LPs recover full capital and returns before the GP profits.

- Encourages long-term performance: Promotes a holistic, strategic fund view rather than individual deal cherry-picking.

Cons:

- Delayed GP compensation—may disincentivize short-term execution.

- Requires robust tracking and fund-wide accounting for compliance and audits.

Tax Implication:

The timing of carried interest affects taxable income recognition for the GP, often delaying it until later years in the fund life cycle. Proper tracking of basis and holding periods for §1061 purposes is critical.

3. Tiered Waterfall (Multi-Hurdle or Step-Up Structure)

This type introduces multiple performance hurdles, where the GP’s share of profits increases as the fund meets higher Internal Rate of Return (IRR) thresholds. This rewards outstanding performance by offering step-up incentives.

Key Features:

- Multiple IRR tiers tied to increasing levels of GP promote (e.g., 20%, 30%, 40%).

- Built-in incentive alignment: the better the fund performs, the more profit the GP earns.

Example Tiers:

- Tier 1: 8% IRR → 80/20 split (LP/GP)\n- Tier 2: 12% IRR → 70/30 split\n- Tier 3: 15%+ IRR → 60/40 split

Practical Use Case:

Used in venture capital, high-yield real estate, and growth equity funds where higher returns are expected and GPs are rewarded for outsized gains.

Pros:

- Strong incentive for overperformance—attracts top-tier sponsors.

- Tailored to aggressive investment strategies with high-return potential.

Cons:

- Complex structure: Requires detailed financial modeling, IRR tracking, and investor reporting.

- Harder to administer: Performance-based splits must be recalculated across deals and timelines.

Tax Implication:

Because carried interest rates increase at each hurdle, precise tracking is required to determine how much income is taxed at favorable long-term capital gain rates.

4. Modified Waterfall (Custom or Hybrid Waterfall)

This is a flexible structure that incorporates elements of American, European, and Tiered models, often tailored for specific sponsor/LP negotiations or deal profiles. It may include time-based returns, clawback clauses, or special promote bonuses.

Key Features:

- Combines features such as:\n – Time-based preferred returns\n – IRR hurdles with flexible promote splits\n – Clawback mechanisms\n – Reinvestment thresholds or reinvestment gates\n – GP capital contributions affecting split eligibility

Practical Use Case:

Used in joint ventures, custom institutional funds, and family offices where investment dynamics or investor objectives don’t fit standard models.

Pros:

- Highly customizable: Accommodates unique deal features and strategic investor preferences.

- Balances GP and LP interests based on performance, timing, and capital dynamics.

Cons:

- Legally complex to structure and administer.\n- Difficult to model and explain—requires clear documentation to avoid disputes.

Tax Implication:

Because modified structures may not align perfectly with economic substance or proportional ownership, they must be carefully tested under IRC §704(b) to ensure Substantial Economic Effect and avoid reallocation by the IRS.

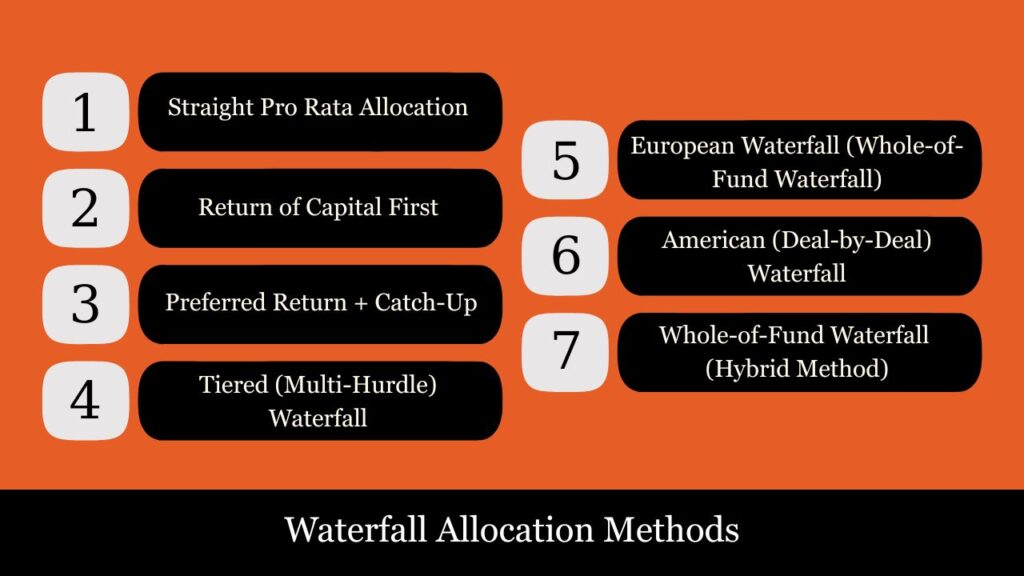

Waterfall Allocation Methods

Waterfall allocation methods define how profits and cash distributions are shared among investors and fund managers in structured investment entities like partnerships, LLCs, private equity funds, and real estate syndications. Each method reflects different priorities, risk-sharing arrangements, and economic outcomes. These methods must comply with IRS rules, especially those under IRC §704(b) and Substantial Economic Effect standards.

Below are the most commonly used waterfall allocation methods, explained in detail:

1. Straight Pro Rata Allocation

Description:

Under this simplest method, all profits and losses are allocated strictly in proportion to each investor’s ownership or capital contribution percentage—no tiers, no preferred returns, and no promotes.

Use Case:

Best suited for small partnerships, passive LLCs, or closely held investment entities where all partners share equally in risk and return.

Example:

If Partner A owns 40% and Partner B owns 60%, every dollar of profit or loss is distributed 40/60 accordingly, regardless of deal performance or time of contribution.

Tax Consideration:

Easiest to implement and report on Form 1065 and Schedule K-1. No complex tracking of performance metrics or IRR hurdles required.

Pros:

- Simple to administer

- Ideal for equal-risk partnerships

- IRS-friendly due to economic symmetry

Cons:

- No incentive mechanism for active managers

- Does not reward performance or risk-taking

2. Return of Capital First

Description:

This method ensures that investors recover 100% of their initial capital contributions before any profits are distributed. It is a foundational principle in most waterfall models, designed to protect investor principal.

Use Case:

Common in real estate, venture capital, and debt funds that prioritize capital preservation or involve higher risk profiles.

Key Note:

No profit is recognized until the initial investment is returned in full.

Tax Consideration:

Return of capital is non-taxable until the investor’s basis is reduced to zero. Thereafter, future distributions are taxed as capital gains.

Pros:

- Strong investor protection

- Encourages capital commitment

Cons:

- Delays GP participation

- Not attractive for early-stage sponsors

3. Preferred Return + Catch-Up

Description:

In this method, profits are distributed in three or four distinct tiers:

- Return of Capital to LPs

- Preferred Return (e.g., 8% annually)

- Catch-Up provision, typically 100% of profits to GPs until parity

- Carried Interest or Promote (e.g., 80/20 LP/GP split)

Use Case:

Common in private equity funds and syndicated real estate deals, where LPs want downside protection and GPs want upside incentive.

Example:

After an LP receives their 8% annual return, the GP receives 100% of the next distributions until they’ve caught up to 20% of cumulative profits.

Tax Consideration:

- Preferred return is taxed as ordinary income or capital gains depending on fund activity

- Carried interest is usually long-term capital gain (20%) if holding period >3 years under §1061

Pros:

- Balances LP protection with GP motivation

- Standard in many sophisticated partnerships

Cons:

- Requires careful modeling

- Complex Schedule K-1 allocations

4. Tiered (Multi-Hurdle) Waterfall

Description:

This model introduces multiple performance tiers where profit-sharing ratios change depending on the fund’s achieved Internal Rate of Return (IRR). GPs earn progressively more of the profits as fund performance improves.

Use Case:

Ideal for venture capital and aggressive growth funds seeking to incentivize extraordinary performance.

Example Tiers:

- Tier 1: 8% IRR → 80/20 split (LP/GP)

- Tier 2: 12% IRR → 70/30 split

- Tier 3: 15% IRR or higher → 60/40 split

Tax Consideration:

Each promote tier needs separate tracking for capital gain treatment. The GP must meet the 3-year holding requirement under §1061 to qualify for long-term capital gains on each carried interest tier.

Pros:

- Powerful performance incentives for GPs

- Encourages long-term strategic planning

Cons:

- Highly complex modeling and legal drafting

- Difficult to administer and audit

5. European Waterfall (Whole-of-Fund Waterfall)

Description:

Under this structure, all fund investments are aggregated, and the GP only receives carried interest after:

- The LPs have been fully repaid their capital across all deals, and

- The preferred return hurdle has been met fund-wide

Use Case:

Widely used in European private equity funds, infrastructure funds, and institutional-grade funds.

Investor Benefit:

Avoids premature GP payouts if early deals perform well and later deals lose money.

Tax Consideration:

Delays income realization for the GP. Requires fund-wide basis tracking and waterfall simulation for IRS compliance.

Pros:

- Strong investor protection

- Aligns long-term fund performance with rewards

Cons:

- GP’s compensation delayed significantly

- Requires robust accounting infrastructure

6. American (Deal-by-Deal) Waterfall

Description:

Profits are distributed per investment, not on a fund-wide basis. Once a deal hits its hurdle, the GP earns their share without waiting for the entire fund to perform.

Use Case:

Standard in U.S. real estate, private equity syndications, and deal-specific joint ventures.

Caution:

Can disadvantage LPs if early deals succeed but later deals lose money.

Tax Consideration:

Can create inconsistencies in carried interest recognition and GP basis across deals. Requires granular tracking of each investment’s lifecycle.

Pros:

- GP gets paid sooner

- Easier to evaluate individual deal performance

Cons:

- Less investor protection

- More susceptible to misalignment of long-term fund returns

7. Whole-of-Fund Waterfall (Hybrid Method)

Description:

Combines the European and American models, allowing GPs to receive some carried interest as milestones are reached across groups of deals, while still protecting LPs from losses.

Use Case:

Used in institutional funds where partial returns and mid-term payouts are negotiated.

Benefit:

Balances early incentives with fund-wide accountability.

Tax Consideration:

More complex tax allocations but allows phased GP recognition of income under §704(b) and §1061.

Pros:

- Fair and flexible

- Blends early and long-term incentive alignment

Cons:

- Not standardized—requires careful drafting and partner education

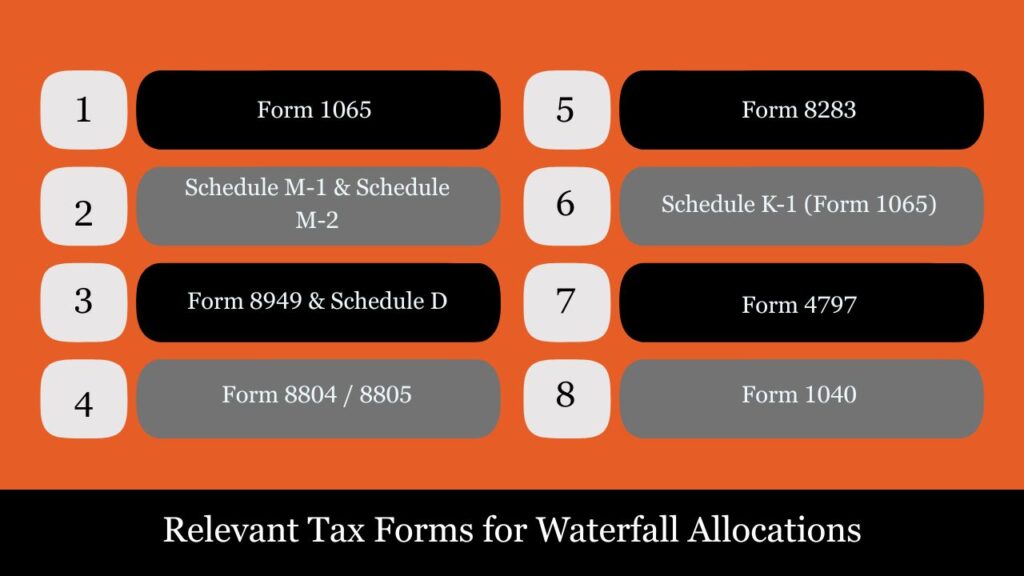

Relevant Tax Forms for Waterfall Allocations

Waterfall allocations influence how profits and losses are distributed among partners and must be accurately reported to the IRS. The following tax forms are commonly used to ensure proper compliance:

1. Form 1065 – U.S. Return of Partnership Income

Purpose:

Reports the partnership’s total income, deductions, gains, and losses.

Relevance to Waterfall Allocation:

- Captures the overall financial activity and reflects how profit/losses are divided based on the waterfall structure.

- Schedule K within Form 1065 summarizes how income and deductions are allocated to each partner.

- Any deviation from ownership percentages (due to preferred returns, catch-ups, or promotes) must be reflected in line with Substantial Economic Effect rules under IRC §704(b).

Compliance Tip: The waterfall allocation method must match the operating or partnership agreement and be clearly documented in the capital account statements.

2. Schedule K-1 (Form 1065) – Partner’s Share of Income, Deductions, Credits

Purpose:

Shows each partner’s allocated share of the partnership’s taxable activity.

Waterfall Allocation Impact:

- Each partner’s income, deduction, and distribution items are customized according to waterfall tiers.

- Special items like preferred returns and carried interest are included under ordinary income or capital gains, as applicable.

- The capital account analysis should reflect any priority payouts, return of capital, and residual profit allocations.

Key Lines Affected:

- Line 1: Ordinary income

- Line 9a/b: Capital gains

- Line 19A/B: Distributions

- Line 20: Other information, including IRC §704(b) disclosures and Section 199A details

3. Schedule M-1 & Schedule M-2 – Reconciliation of Income and Capital Accounts

Purpose:

- M-1: Reconciles book income with taxable income.

- M-2: Tracks changes in each partner’s capital account.

Relevance to Waterfall Allocations:

- Book-to-tax timing differences often arise when cash distributions don’t match taxable allocations (e.g., preferred return paid in a later year).

- M-2 ensures capital accounts adjust correctly after return of capital, catch-ups, and carried interest are distributed.

Important for:

Maintaining accurate capital account balances required for Substantial Economic Effect compliance under IRC §704(b).

4. Form 8949 & Schedule D – Sales and Capital Gains

Purpose:

Reports gains and losses from asset sales.

When Used:

- If the partnership liquidates assets (e.g., sells a real estate property or business), resulting capital gains or losses must be allocated per the waterfall tiers.

- Individual partners will also use Form 8949 and Schedule D when reporting their distributed capital gains on their Form 1040.

Example:

LPs receive capital gains from a property sale — these must be broken down by short-term vs. long-term and reported accordingly.

5. Form 8804 / 8805 – Withholding for Foreign Partners (IRC §1446)

Purpose:

Reports and withholds U.S. income tax on Effectively Connected Income (ECI) earned by foreign partners.

Relevance to Waterfall:

- If a foreign partner receives waterfall-based distributions (especially profit share or promote), U.S. tax must be withheld.

- Form 8804 reports the total tax withheld; Form 8805 is issued to each foreign partner.

Tip:

Even if the foreign partner has not yet received distributions, allocation alone may trigger withholding obligations.

6. Form 8283 – Non-Cash Contributions

Purpose:

Used when partners contribute property or assets (not cash) to a partnership.

Relevance:

- Affects the beginning capital account.

- Impacts how profit tiers in the waterfall apply, especially if contributions are valued above or below fair market value (FMV).

Important For:

Initial basis setup in tiered distributions.

7. Form 4797 – Sale of Business Property

Purpose:

Reports gains and losses from the sale of real property or depreciable business assets.

When Used in Waterfall Context:

- Asset-heavy funds (like real estate partnerships) often use Form 4797 when disposing of depreciable or Section 1250/1245 property.

- Waterfall distributions resulting from such sales are passed through to partners via Schedule K-1.

8. Form 1040 – Individual Tax Return (Partner Level)

Purpose:

Used by partners to report personal income.

Relevance:

- Waterfall-structured distributions (ordinary income, capital gains, return of capital) must be reported correctly by each partner.

- Typically supported by:

- Schedule E (for partnership income)

- Form 8949/Schedule D (for gains/losses)

- Form 8990 (if applicable under IRC §163(j) limits)

How To Calculate Waterfall Allocation?

To calculate waterfall allocations, you follow a structured process that distributes profits (and potentially losses) through predefined tiers. These tiers are usually outlined in the partnership or fund agreement and may include:

- Return of Capital

- Preferred Return (Hurdle Rate)

- Catch-Up

- Carried Interest (Promote)

Below is a step-by-step guide with a detailed example:

Step 1: Identify Key Inputs

Before calculating, gather the following:

- Total capital contributed by each partner (LP and GP)

- Total distributable cash (e.g., from asset sale or net profits)

- Preferred return rate (e.g., 8%)

- Catch-up terms (e.g., 100% to GP until it equals 20% of profits)

- Final profit split (e.g., 80/20 between LP and GP)

Step 2: Return of Capital

Goal: Return all contributed capital to Limited Partners (LPs) first.

Formula:

Return = Capital Contribution of LPs

Example:

- LPs contributed: $1,000,000

- GP contributed: $0 (common in many fund setups)

- Distributable Cash: $2,000,000

LPs receive back their $1,000,000 first.

Remaining Cash: $1,000,000

Step 3: Preferred Return (Hurdle Rate)

Goal: Pay LPs their annual preferred return before GPs receive anything.

Formula (Simple):

PreferredReturn=LP Capital x Hurdle Rate x Years

Example:

- Hurdle Rate: 8% per year

- Investment held for 2 years

- $1,000,000 x 8% x 2 = $160,000 to LPs

LPs receive $160,000

Remaining Cash: $840,000

Step 4: GP Catch-Up Tier

Goal: GP receives 100% of the next profits until the GP’s share equals its agreed promote (e.g., 20%).

Formula:

Catch-UpAmount=(PreferredReturn/(LP%/GP%))-PreferredReturn

Example:

- Total profit so far = $1,000,000

- LP already received $1,160,000

- To make GP = 20% of total profit, GP needs:

$1,000,000 x 20% = $200,000

GP has $0 so far → needs $200,000 to “catch up”

GP receives $200,000

Remaining Cash: $640,000

Step 5: Carried Interest (Remaining Profit Split)

Goal: Split remaining profits based on agreed ratio (commonly 80/20).

Formula:

Remaining Profit × LP % = LP'sShare

Remaining Profit × GP % = GP'sShare

Example:

- Remaining Cash: $640,000

- Split: 80/20

LP receives: $640,000 × 80% = $512,000

GP receives: $640,000 × 20% = $128,000

Notes on Variations

- Tiered Waterfalls may apply different splits at different IRRs (e.g., 80/20 below 12%, 70/30 above).

- European Waterfalls don’t allow GP carry until all deals/fund-level capital and preferred returns are repaid.

- Clawbacks may apply if early GP profits are too high relative to final fund performance.

Tax Treatment and Rates in Waterfall Allocations

Waterfall allocations affect how different types of income are taxed at the partner level. Depending on the nature of the distribution (return of capital, preferred return, carried interest, capital gains, etc.), the applicable tax treatment and rates can vary significantly.

1. Ordinary Income

Definition:

Income that does not qualify as capital gains or return of capital. Includes fees, interest, rent, and operating income.

Common Sources in Waterfall Allocations:

- Preferred return (if treated as guaranteed payment or operating income)

- Catch-up payments to GP (in some structures)

- Management or acquisition fees

Tax Rate:

- Taxed at individual ordinary income tax rates (2025 brackets):

- 10%, 12%, 22%, 24%, 32%, 35%, or 37%

- Subject to Self-Employment Tax (if from active trade or services)

Example:

A general partner receiving a $200,000 catch-up payment may pay tax at up to 37% if treated as ordinary income.

2. Capital Gains

A. Short-Term Capital Gains

Definition:

Profit from sale of assets held one year or less.

Tax Treatment:

- Taxed as ordinary income (up to 37%)

B. Long-Term Capital Gains

Definition:

Profit from sale of capital assets held more than one year.

Typical Sources:

- Profit from sale of real estate or securities distributed via waterfall

- Carried interest (if held >3 years per IRC §1061)

Tax Rate (2025):

- 0%, 15%, or 20% depending on taxable income thresholds:

- 0%: Up to ~$47,025 (single) or ~$94,050 (married)

- 15%: Up to ~$518,900 (single) or ~$583,750 (married)

- 20%: Above these thresholds

Example:

A partner receiving $100,000 of long-term gains from waterfall distributions will likely pay 15% or 20%, based on total income.

3. Carried Interest (Promote)

Definition:

The share of profits received by the general partner (GP) as an incentive after LPs receive their preferred return.

Tax Treatment:

- Generally taxed as long-term capital gain (20%), if held for >3 years

- Governed by IRC §1061 — introduced via the Tax Cuts and Jobs Act (TCJA)

- Holding period must exceed 3 years for carried interest to qualify for LTCG rates

If < 3 years holding period:

- Recharacterized as short-term capital gain, taxed at up to 37%

Additional Tax:

- May also be subject to the Net Investment Income Tax (NIIT) of 3.8%, if income exceeds:

- $200,000 (single)

- $250,000 (married filing jointly)

Compliance Note:

Carried interest allocations must be reported on Schedule K-1, with Form 1061 and Form 8949/Schedule D attached if applicable.

4. Return of Capital (ROC)

Definition:

Distribution of an investor’s original capital contribution — not considered income until the full basis is recovered.

Tax Treatment:

- Non-taxable to the extent of the partner’s basis

- Reduces the partner’s adjusted basis in the partnership

If basis reaches zero:

- Any further distributions are treated as capital gains

Example:

If a partner has a $100,000 basis and receives a $60,000 return of capital, no tax is due. Basis drops to $40,000. Further ROC exceeding $40,000 becomes taxable gain.

Legal and IRS Compliance Considerations in Waterfall Allocations

Waterfall allocations, while common in private equity, real estate, and investment partnerships, must follow strict legal and tax guidelines to ensure IRS compliance. Missteps in structuring or reporting waterfall tiers can result in audit risks, penalties, or recharacterization of income.

1. Must Align with the Partnership or Operating Agreement

Waterfall allocation rules must be clearly defined in the written agreement among partners, typically within:

- Partnership Agreement (for LPs/GPs)

- Operating Agreement (for LLCs)

- Joint Venture Agreements (for co-investment structures)

Why This Matters:

- The IRS will look at the governing documents to verify that income allocations match what’s reported on tax forms (e.g., Form 1065, Schedule K-1).

- If allocations do not reflect economic reality, the IRS may reallocate income/losses according to ownership percentages, voiding the waterfall.

Tip: Every tier (e.g., preferred return, catch-up, promote) should be defined in writing with numeric thresholds, percentages, and timing of distributions.

2. Must Satisfy the “Substantial Economic Effect” Test (IRC §704(b))

To be respected for tax purposes, waterfall allocations must meet the IRS’s Substantial Economic Effect (SEE) standard. This requires:

A. Capital Account Maintenance

- Each partner’s capital account must be adjusted annually for:

- Contributions

- Allocated income/losses

- Distributions

- Changes in capital must mirror the economics of the deal (i.e., how money is actually flowing).

B. Liquidation According to Capital Accounts

- Upon liquidation, remaining assets must be distributed based on capital account balances—not arbitrary formulas.

C. Deficit Restoration Obligation (DRO) or Qualified Income Offset (QIO)

- If a partner’s capital account becomes negative:

- They must restore the deficit upon liquidation (DRO), or

- The agreement must include a QIO to reallocate losses to other partners.

Example: If the waterfall gives the GP a 20% promote, this must also reflect in their capital account balance and liquidation value.

3. Carried Interest Must Meet Holding Period Rules (IRC §1061)

Waterfall allocations often include carried interest (or promote) to GPs. Under IRC §1061:

- Carried interest is only eligible for long-term capital gains treatment if the underlying asset is held for more than 3 years.

- If held for 3 years or less, it is recharacterized as short-term gain, taxed at ordinary rates.

Key Compliance Step:

- Track holding periods meticulously across portfolio assets.

- Partners must attach Form 1061 and Form 8949 when reporting gains related to carried interest.

4. Capital Account Tracking Must Be Accurate and Consistent

Proper capital account maintenance is central to validating a waterfall allocation. Key tracking elements:

- Beginning capital balances

- Capital contributions

- Preferred returns or guaranteed payments

- Carried interest or promote allocations

- Distributions, both return of capital and profits

- Book-tax differences (reconciled via Schedule M-1 and M-2)

IRS Focus Area: Discrepancies between reported K-1 allocations and capital account activity often trigger audits or partnership adjustments under the centralized audit regime (BBA rules).

5. IRS Form Compliance and Supporting Documentation

Waterfall allocations touch several critical IRS forms and reporting mechanisms. Ensure:

| Requirement | Compliance Measure |

| Allocations match partnership agreement | Review terms annually; reflect changes in Form 1065 and K-1 |

| Book vs. tax income reconciled | File Schedule M-1 and M-2 properly |

| Accurate reporting of promote/carry | Use Form 8949, Schedule D, and Form 1061 as needed |

| Withholding for foreign partners | File Form 8804/8805 for IRC §1446 ECI allocations |

| Substantial Economic Effect | Ensure capital accounts are properly maintained |

6. Clawback Provisions

A clawback clause ensures that if a GP is overpaid (e.g., early profit distributions exceed final economic entitlement), excess amounts are returned to LPs.

Legal Best Practice:

- Include detailed clawback terms in the operating agreement.

- Track cumulative distributions and performance metrics annually.

Example: If early deals yield high promote, but later deals underperform, clawbacks ensure the GP only retains the intended percentage over the fund’s life.

7. Partnership Audit Rules (BBA Rules)

Under the Bipartisan Budget Act of 2015 (BBA):

- The IRS can audit partnerships and assess tax at the partnership level, unless an election out is made.

- Improper or inconsistent waterfall allocations may result in entity-level tax adjustments.

Tip: Maintain clear documentation of all waterfall tiers, income allocations, and supporting calculations to avoid adverse adjustments.

Best Practices for Legal and IRS Compliance

| Action | Why It Matters |

| Draft detailed waterfall terms | Prevents disputes and supports tax reporting |

| Use robust accounting software | Ensures capital accounts and allocations are tracked correctly |

| Perform annual compliance reviews | Keeps partnership aligned with tax law and economic terms |

| Maintain documentation for audits | Reduces IRS scrutiny and improves defendability |

Conclusion

Waterfall allocations are strategic frameworks used in partnerships to distribute profits based on performance and priority tiers. While they reward capital and incentivize managers, they require careful legal structuring and strict IRS compliance, especially with capital accounts, IRC §704(b), and carried interest rules under §1061. Proper documentation and tax reporting are essential to ensure accuracy, fairness, and audit protection.

Frequently Asked Questions (FAQs)

What is a waterfall allocation?

A tier-based profit distribution model.

Why is it called a “waterfall”?

Profits cascade from tier to tier like water.

What tiers are typically involved?

Return of capital, preferred return, catch-up, carried interest.

Difference between American vs. European waterfall?

American: deal-by-deal. European: fund-wide.

What tax forms apply?

Forms 1065, K-1, 8949, Schedule D, and others.

Are waterfall structures required by law?

Forms 1065, K-1, 8949, Schedule D, and others.

Can waterfalls include losses?

Yes, though not typical; they must follow IRS rules and partnership agreements.

Mr. Nadeem Patel is an MBA graduate with a specialization in market research, bringing a sharp analytical mindset and strong research skills to the field of taxation and finance. Known for his efficiency and attention to detail, he has successfully published research work in the United States, reflecting his commitment to data accuracy and insightful analysis. Mr. Patel contributes well-researched, reader-friendly content that bridges market insights with U.S. tax-related topics, helping users make informed financial decisions.