US Tax Classification: An Expert Verified Guide

In the U.S., how your business is taxed depends on its legal structure. Whether you’re operating as a sole proprietor, LLC, partnership, or corporation, your tax classification determines what forms you file, how profits are taxed, and your personal liability. Understanding IRS classifications is essential for compliance and optimal tax planning

Overview Table: US Tax Classification By Entity Types & Their Tax Treatments

| Business Entity | Tax Classification | Typical IRS Forms |

| Sole Proprietorship | Disregarded Entity | Form 1040 + Schedule C |

| Partnership | Pass-through Entity | Form 1065 + Schedule K-1s |

| Single-Member LLC (SMLLC) | Disregarded Entity (Default) | Form 1040 + Schedule C |

| Multi-Member LLC (MMLLC) | Partnership (Default); S or C Corp (Elective) | Form 1065, 1120S, or 1120 |

| LLC (Custom Election) | Depends on IRS election (S Corp or C Corp) | Form 8832 or 2553 + relevant tax return |

| S Corporation (S Corp) | Pass-through Corporation | Form 1120S + Schedule K-1s |

| C Corporation (C Corp) | Separate Taxable Entity (Double Taxation) | Form 1120 |

| Nonprofit (501(c)(3)) | Tax-Exempt Entity | Form 990, 990-EZ, or 990-N |

| Foreign Corporation | U.S. Taxable Entity (if engaged in U.S. trade/business) | Form 1120-F |

1. Sole Proprietorship

Business Structure:

A sole proprietorship represents the simplest structure for owning and operating a business. It is not legally distinct from the individual who owns it. The owner is personally responsible for all business profits and debts.

Tax Classification:

- Disregarded entity by the IRS — the business is ignored for tax purposes.

- All income and expenses are reported directly on the owner’s Form 1040.

IRS Filing Requirements:

- Form 1040 (U.S. Individual Income Tax Return)

- Schedule C (Profit or Loss from Business)

- Subject to self-employment tax via Schedule SE

Ideal For:

Freelancers, solo consultants, independent contractors, or early-stage entrepreneurs seeking simplicity.

2. Partnership

Business Structure:

A partnership involves two or more individuals joining forces to run a business collaboratively. It is unincorporated and has no legal separation from its owners, although the business itself can have a federal tax identity.

Tax Classification:

- Classified as a pass-through structure, it doesn’t pay taxes at the business level.

- Each partner reports their share of profit or loss on their individual return.

IRS Filing Requirements:

- Form 1065 (U.S. Return of Partnership Income)

- Schedule K-1 issued to each partner for inclusion on their personal Form 1040

- Income may be subject to self-employment tax

Ideal For:

Business ventures with multiple owners who want flexibility, shared management, and pass-through taxation.

3. Single-Member LLC (SMLLC)

Business Structure:

A single-member LLC offers personal liability protection while allowing for simplified tax reporting.

Tax Classification:

- By default, it is not treated as a separate entity for tax purposes unless a formal election is filed.

- Taxed like a sole proprietorship.

IRS Filing Requirements:

- Form 1040 + Schedule C

- The owner can submit Form 8832 to be taxed as a C Corporation or Form 2553 to choose S Corporation status.

Ideal For:

Entrepreneurs wanting liability protection without changing how they file taxes.

4. Multi-Member LLC (MMLLC)

Business Structure:

A multi-member LLC is an LLC with two or more owners (called members). It offers liability protection and allows owners to choose how they want the business to be taxed.

Tax Classification:

- Default: Partnership

- Optional: S Corporation or C Corporation (via Form 2553 or 8832)

IRS Filing Requirements:

- Default: Form 1065 + Schedule K-1s

- Elective: Form 1120 (C Corp) or Form 1120S (S Corp)

Ideal For:

Founders who want legal protection, shared ownership, and flexibility in choosing tax treatment.

5. LLC (General Classification)

Business Structure:

An LLC offers a hybrid model: personal liability protection like a corporation, and flexible taxation options like a partnership or sole proprietorship.

Tax Classification:

- Can be taxed as:

- Sole proprietorship (single-member)

- Partnership (multi-member)

- C Corporation (via Form 8832)

- S Corporation (via Form 2553)

IRS Filing Requirements:

Varies based on election:

- 1040 + Schedule C (Sole proprietorship)

- 1065 + K-1s (Partnership)

- 1120S (S Corp)

- 1120 (C Corp)

Ideal For:

Startups and small-to-midsize businesses looking for customizable tax structures with liability protection.

6. S Corporation (S Corp)

Business Structure:

An S Corporation is a corporation that elects pass-through taxation status, allowing income and losses to be reported on the owners’ personal tax returns.

Tax Classification:

- Pass-through corporation — avoids double taxation

- Owners receive income via salary (W-2) and distributions

IRS Filing Requirements:

- Form 1120S

- Schedule K-1 to each shareholder

- Form 2553 required to elect S Corp status

Note:

- Only U.S. citizens/residents may be shareholders

- Limit of 100 shareholders

- Must pay reasonable compensation to shareholder-employees

Ideal For:

Established businesses with consistent profit, aiming to reduce self-employment taxes while retaining pass-through benefits.

7. C Corporation (C Corp)

Business Structure:

A C Corporation is a separate legal and taxable entity from its owners. It can issue shares, attract investors, and raise capital more easily than other structures.

Tax Classification:

- Separate taxable entity — subject to double taxation

- Corporation pays tax on profits; shareholders pay tax again on dividends

IRS Filing Requirements:

- Form 1120 (U.S. Corporate Income Tax Return)

Tax Rate:

- Flat federal corporate rate of 21% (as of 2025)

Ideal For:

Businesses planning to grow large, issue stock, or attract venture capital or institutional investors.

8. Nonprofit Organization (501(c)(3))

Business Structure:

A nonprofit organization exists to serve public or charitable purposes, not to generate profit for private individuals.

Tax Classification:

- Recognized as tax-exempt under Section 501(c)(3)

- Cannot benefit private interests or shareholders

IRS Filing Requirements:

- Apply for status using Form 1023

- Annually file Form 990, 990-EZ, or 990-N

- Donations may be tax-deductible to contributors

Ideal For:

Charities, religious groups, educational institutions, and public benefit organizations.

9. Foreign Corporation

Business Structure:

A foreign corporation refers to a company formed under the laws of a country other than the United States. but conducting business within the U.S. or deriving U.S.-source income.

Tax Classification:

- Taxed in the U.S. on income effectively connected with U.S. trade/business

- Also subject to withholding tax on U.S.-source passive income

IRS Filing Requirements:

- Form 1120-F

- Could be subject to branch profits tax and intricate reporting rules when involved with U.S.-based affiliates or partnerships

Ideal For:

Global companies with U.S. customers, operations, or physical presence.

Important IRS Forms by Entity Type

Understanding which IRS form to file is crucial for business owners. The form you file depends on your entity structure, tax classification, and whether you’re taxable, pass-through, or exempt. Here’s a structured list of key IRS forms by business type:

Form 1040 – U.S. Individual Income Tax Return

- Used By: Individuals, Sole Proprietors, and Single-Member LLCs (default status)

- Purpose: Reports personal income, deductions, and credits.

- Why It Matters: It’s the foundational tax form for individuals and sole business owners. Business earnings are reported directly on the individual’s tax return using Schedule C.

Schedule C – Profit or Loss from Business

- Used By: Sole Proprietors and Single-Member LLCs

- Purpose: Reports business income, expenses, and net profit/loss.

- Why It Matters: This form integrates with Form 1040 and determines the net earnings from self-employment that may be subject to SE tax.

Form 1065 – U.S. Return of Partnership Income

- Used By: Partnerships and Multi-Member LLCs (default classification)

- Purpose: Used to disclose the partnership’s earnings, expenses, and other financial results to the IRS.

- Why It Matters: Though the partnership itself doesn’t pay tax, this informational return is essential for issuing Schedule K-1 to partners.

Schedule K-1 (Form 1065 or 1120S)

- Used By: Partners in a partnership or shareholders in an S Corporation

- Purpose: Shows each owner’s share of business income, losses, deductions, and credits.

- Why It Matters: Individuals must report this income on their Form 1040. It’s critical for pass-through entities to distribute K-1s accurately.

Form 1120 – U.S. Corporation Income Tax Return

- Applicable To: Traditional C Corporations and LLCs that opt for C Corporation tax treatment

- Purpose: Reports income, gains, deductions, and taxes owed by corporations.

- Why It Matters: C Corps pay corporate tax directly on this form, separate from owners. Dividends paid to shareholders are taxed again.

Form 1120S – Income Tax Return for an S Corporation

- Used By: S Corporations and LLCs that elect S Corp status

- Purpose: Reports income and deductions, passes income through to shareholders.

- Why It Matters: Prevents double taxation by allowing profits to pass through to shareholders, who report them individually.

Form 2553 – Election by a Small Business Corporation

- Used By: Corporations or LLCs electing to be taxed as an S Corporation

- Purpose: Officially elects S Corporation status for federal tax purposes.

- Why It Matters: Must be timely filed to gain or maintain S Corp pass-through taxation benefits.

Form 8832 – Entity Classification Election

- Used By: LLCs (both single- and multi-member) and other eligible entities

- Purpose: Allows businesses to elect their tax classification (e.g., C Corporation).

- Why It Matters: Key for choosing between default and elective tax treatment. It’s how an LLC can become taxed as a C Corp or revert to default.

Form 990 – Return of Organization Exempt from Income Tax

- Used By: Nonprofit organizations (e.g., 501(c)(3))

- Purpose: Provides annual financial disclosure for tax-exempt entities.

- Why It Matters: Maintains nonprofit tax-exempt status and ensures transparency. Versions include:

- 990-N (postcard filing for gross receipts ≤ $50,000)

- 990-EZ (simplified form for receipts < $200,000)

- Full 990 (required for larger nonprofits)

Form 1120-F – U.S. Income Tax Return of a Foreign Corporation

- Used By: Foreign corporations engaged in U.S. trade or business

- Purpose: Reports U.S.-source income effectively connected to a U.S. business.

- Why It Matters: Ensures compliance with U.S. taxation on foreign entities operating domestically, including branch profit taxes.

Key Tax Concepts for U.S. Business Entities

Understanding these fundamental tax concepts is essential for making informed decisions about your business structure, tax obligations, and potential savings. Each term plays a critical role in how income is taxed and reported.

Pass-Through Taxation

Definition:

Pass-through taxation allows business earnings to bypass entity-level taxation and be reported directly by the owners. Instead, profits or losses “pass through” directly to the individual owners or members, who report it on their personal tax returns.

Applies to:

- Sole Proprietorships

- Partnerships

- S Corporations

- Most LLCs (unless they elect corporate taxation)

Why It Matters:

This method avoids double taxation. Only the owners pay income tax, which can result in significant tax savings, especially when combined with the Qualified Business Income (QBI) deduction.

Example:

If an LLC earns $100,000 in profit, the business does not pay income tax. Instead, the owner includes that $100,000 on their Form 1040 and pays taxes at their individual rate.

Double Taxation

Definition:

Double taxation occurs when the same income is taxed twice—once at the corporate level, and again at the shareholder level when distributed as dividends.

Applies to:

- C Corporations

Why It Matters:

This can increase the overall tax burden for business owners, as profits are first taxed under the corporate tax rate (21%), and then shareholders pay additional tax on dividends received.

Example:

A C Corp earns $200,000. The company pays 21% corporate tax ($42,000). If the remaining $158,000 is distributed to shareholders, they pay personal tax on those dividends.

Disregarded Entity

Definition:

A disregarded entity is a business that is legally separate from its owner, but ignored for federal tax purposes. The IRS treats the business and the owner as the same taxpayer.

Applies to:

- Single-Member LLCs (default treatment)

Why It Matters:

No separate business return is required. The owner reports all income and expenses on their personal tax return using Schedule C. Despite this simplicity, it still provides liability protection.

Example:

A freelancer operates as a single-member LLC. The IRS treats them as a sole proprietor for tax purposes, even though they’re legally shielded from business liabilities.

K-1 Form (Schedule K-1)

Definition:

Form K-1 is used to report each partner’s or shareholder’s share of income, deductions, and credits from a pass-through entity.

Applies to:

- Partnerships (Form 1065)

- S Corporations (Form 1120S)

- Trusts and Estates (Form 1041)

Why It Matters:

Each recipient uses their K-1 to report their share of the entity’s income on their individual tax return (Form 1040). It ensures that taxes are properly calculated and attributed.

Example:

A partner in a law firm receives a K-1 showing $50,000 in profit share. They must report this amount on their personal return, even if they didn’t actually receive a cash distribution.

Choosing the Right Tax Classification for Your Business

Selecting the right tax classification is one of the most important financial decisions you’ll make when starting or restructuring a business in the United States. The IRS assigns default classifications based on the business entity type, but many businesses have the flexibility to elect a different tax treatment to suit their financial goals, ownership structure, or compliance needs.

Why Tax Classification Matters?

Your tax classification directly impacts:

- How your income is taxed (corporate vs. individual level)

- Which IRS forms you need to file

- Eligibility for certain tax deductions (like the QBI deduction)

- Liability exposure and self-employment tax

- The ability to attract investors or issue stock

Default IRS Classifications by Entity Type

| Entity Type | Default Tax Treatment | IRS Forms |

| Sole Proprietorship | Disregarded Entity | Form 1040 + Schedule C |

| Single-Member LLC | Disregarded Entity | Form 1040 + Schedule C |

| Multi-Member LLC | Partnership | Form 1065 + K-1s to members |

| Corporation (Inc.) | C Corporation | Form 1120 |

Optional Elections for Tax Classification

Some businesses are eligible to elect a different tax classification using the following IRS forms:

| Form | Purpose | Eligible Entities |

| Form 8832 | Entity Classification Election (e.g., C Corp status) | LLCs (single- or multi-member) |

| Form 2553 | S Corporation Election | Corporations & eligible LLCs |

Notes:

- To be effective for the current tax year, Form 2553 is typically due within 2 months and 15 days after the start of that year.

- Entities electing S Corp status must meet eligibility rules (e.g., max 100 shareholders, all must be U.S. persons, only one class of stock).

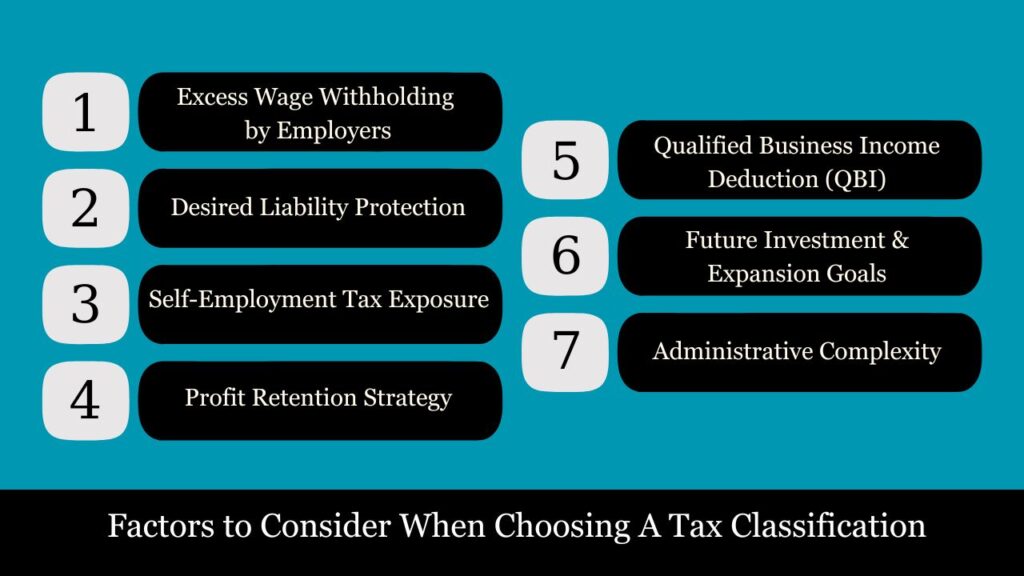

Factors to Consider When Choosing A Tax Classification

- Number of Owners / Members

- Single owner: may benefit from pass-through taxation (sole prop/SM LLC)

- Multiple owners: partnership, S corp, or C corp structure might be better

- Desired Liability Protection

- Corporations and LLCs offer limited liability; sole proprietorships do not

- Self-Employment Tax Exposure

- S Corps allow owner-employees to split income between salary (SE tax applies) and distributions (no SE tax)

- Profit Retention Strategy

- C corporations are allowed to keep profits within the business, which can support expansion or future investment

- Qualified Business Income Deduction (QBI)

- Available for pass-through entities, but not for C Corps

- Future Investment & Expansion Goals

- C corporations are generally more appealing to venture capitalists and better suited for public offerings

- Administrative Complexity

- S Corps and C Corps require more formalities (payroll, corporate minutes, etc.) compared to LLCs or sole proprietors

Examples

- A solo freelance consultant might stick with a Single-Member LLC taxed as a sole proprietorship for simplicity and low costs.

- A growing tech startup seeking investors might opt for a C Corporation to issue stock and reinvest earnings.

- A small family-owned business with steady profits may elect S Corporation status to minimize self-employment tax.

Final Tips Before Choosing The Right Tax Classification

- Consult a tax professional or CPA to weigh pros and cons based on your revenue, payroll needs, and long-term business goals.

- Review IRS publications or use tax planning software to model the effects of each structure.

- Remember: Some elections are irreversible for a set period, so plan carefully.

Conclusion: Understanding U.S. Tax Classifications

The U.S. tax system recognizes that different business structures serve different operational, legal, and financial needs—which is why tax classifications vary based on how your business is formed and how it functions.

Each entity type—whether a sole proprietorship, partnership, LLC, S corporation, C corporation, nonprofit, or foreign corporation—comes with its own set of filing obligations, liability implications, and tax treatment:

- Sole proprietorships and single-member LLCs enjoy simplicity but may face higher self-employment tax.

- Partnerships and multi-member LLCs offer flexible ownership and pass-through taxation but require shared responsibility and compliance with K-1 reporting.

- S corporations avoid double taxation and allow owners to split income into salary and distributions but come with strict eligibility rules and compensation requirements.

- C corporations provide opportunities for expansion and easier capital raising, but face double taxation and greater regulatory burdens.

- Nonprofits benefit from tax-exempt status but must operate exclusively for qualified purposes and meet annual disclosure obligations.

- Foreign corporations engaging in U.S. trade are taxed on effectively connected income and must follow special reporting rules.

Key Insight: Your business’s tax classification directly affects how income is reported, how much tax is owed, and what IRS forms must be filed. Selecting the right classification early on helps ensure legal compliance, optimize tax savings, and align with your long-term strategy.

Frequently Asked Questions (FAQs)

What is a pass-through entity?

A business where income is taxed at the owner level, not the entity. Examples: sole proprietorship, partnership, S corp, LLC.

Do LLCs pay federal income tax?

By default, no. Income passes through to members. But LLCs can elect C corp or S corp status.

What are the key distinctions between an S corporation and a C corporation ?

S corps pass income to shareholders (no double tax). C corps pay tax at the corporate level and on dividends (double tax).

What IRS form does a sole proprietor file?

Form 1040 with Schedule C.

Is it possible for a single-member LLC to elect corporate tax treatment?

Yes, by filing Form 8832 (C corp) or Form 2553 (S corp).

What is Form 1065 used for?

It’s the partnership tax return. Income is reported via Schedule K-1 to partners.

Do nonprofits file tax returns?

Yes, they file informational returns like Form 990.

What is double taxation?

Taxing the same income at the corporate and individual level, common in C corps.

What is a disregarded entity?

A business ignored for tax purposes—income is reported on the owner’s return. Example: single-member LLC.

Do foreign companies pay U.S. taxes?

Yes, if they earn U.S.-source income or are engaged in U.S. trade/business. They file Form 1120-F.

Mr. Nadeem Patel is an MBA graduate with a specialization in market research, bringing a sharp analytical mindset and strong research skills to the field of taxation and finance. Known for his efficiency and attention to detail, he has successfully published research work in the United States, reflecting his commitment to data accuracy and insightful analysis. Mr. Patel contributes well-researched, reader-friendly content that bridges market insights with U.S. tax-related topics, helping users make informed financial decisions.