U.S. Federal Tax System – Comprehensive and In-Depth Overview

The US Federal Tax system is the primary method by which the federal government raises revenue to fund public services, infrastructure, defense, and social programs. This system is complex, multi-tiered, and governed by the Internal Revenue Code (IRC). It applies to individuals, corporations, partnerships, estates, trusts, and nonprofit entities, each of which has specific obligations under U.S. tax law.

Administered and enforced by the Internal Revenue Service (IRS), this tax framework is built on principles of equity, progressivity, and voluntary compliance, meaning taxpayers are expected to self-report and accurately pay their tax liabilities.

What Is the Federal Tax System?

At its core, the federal tax system is designed to ensure that individuals and organizations contribute a fair share of their income to support the functioning of the U.S. government. The system includes:

- Income taxes on earnings, investments, and business profits,

- Payroll taxes to fund Social Security and Medicare,

- Corporate taxes on the profits of incorporated businesses,

- Estate, gift, and excise taxes, and

- Special taxes on certain activities and entities.

All U.S. citizens, residents, and certain nonresidents with income from U.S. sources are obligated to comply with the federal tax system based on their income and financial transactions.

Federal Income Tax Return – What It Means?

A federal income tax return is a formal document filed annually with the Internal Revenue Service (IRS) that summarizes an individual’s or entity’s income, deductions, tax credits, and tax payments for a specific tax year. It serves as the IRS’s method of verifying how much tax is owed or refundable based on financial activity during the year. Its main purposes are:

- To report total income from all sources: employment, business, investments, and more.

- To claim deductions (e.g., standard, itemized, retirement contributions, health savings).

- To apply tax credits (e.g., Child Tax Credit, Earned Income Credit).

- To reconcile taxes paid throughout the year via withholding or estimated payments.

Filing for Individuals – Form 1040

For individuals, the primary federal form is Form 1040, which is used to report all types of income including:

- Wages and salaries (Form W-2)

- Interest and dividends (Forms 1099-INT, 1099-DIV)

- Business and freelance income (Schedule C)

- Rental income (Schedule E)

- Capital gains or losses (Schedule D)

- Retirement income (Form 1099-R)

- Social Security (SSA-1099)

The taxpayer’s Adjusted Gross Income (AGI) is calculated, deductions are applied, and then the Taxable Income is determined. This amount is used to calculate the federal tax liability using the IRS’s progressive tax rate brackets.

Federal Taxation for Businesses – Based on Entity Type

In the U.S., how a business is taxed federally depends primarily on its legal structure. The IRS assigns different tax treatment based on whether the business is a sole proprietorship, partnership, corporation, or LLC. Below is an in-depth look at how each type is treated under federal tax law:

1. Sole Proprietorship

Tax Classification: Disregarded Entity

- The simplest form of business ownership, typically run by one individual.

- The business and the owner are considered one and the same for legal and tax purposes — it is not treated as a distinct taxable entity.

- The business’s income and expenses are reported on Schedule C, attached to the individual’s Form 1040.

- Earnings are taxed as personal income and also subject to self-employment tax obligations.

Forms Used:

- Form 1040

- Schedule C (Profit or Loss from Business)

2. Partnership

Tax Classification: Pass-Through Entity

- Consists of multiple owners who jointly manage the business and divide profits and losses among themselves.

- The business itself does not pay income tax.

- Instead, it files Form 1065 to report overall activity.

- Each partner receives a Schedule K-1 detailing their share of income, which is then reported on their individual return.

Forms Used:

- Form 1065

- Schedule K-1

- Form 1040 (for partners individually)

3. Limited Liability Company (LLC)

Tax Classification: Varies by Election

- LLCs offer liability protection like corporations but enjoy flexible taxation.

- Default classifications:

- Single-member LLCs are classified as sole proprietorships by default for federal tax purposes and are considered disregarded entities

- Multi-member LLC: Treated as a partnership

- LLCs have the option to change their tax treatment by filing an election to be taxed as either an S corporation (via Form 2553) or a C corporation (via Form 8832):

- Form 2553 for S corp status

- Form 8832 for C corp status

Forms Used:

- The required form depends on the LLC’s tax classification—commonly Form 1040 with Schedule C, Form 1065, Form 1120, or Form 1120-S, based on the election made.

4. S Corporation

Tax Classification: Pass-Through Corporation

- Offers liability protection like a C corp but avoids double taxation.

- ncome, deductions, and other tax items flow through directly to the shareholders’ personal tax returns.

- Required to submit Form 1120-S and distribute Schedule K-1s to each shareholder for individual tax reporting.

- Shareholders pay tax on their share of income, whether or not distributed.

- Must pay reasonable salaries to shareholder-employees, subject to payroll tax.

Forms Used:

- Form 1120-S

- Schedule K-1

- Form 1040 (shareholders)

5. C Corporation

Tax Classification: Separate Taxable Entity

- Recognized as an independent legal and taxable entity distinct from its shareholders.

- Pays corporate income tax at a flat 21% rate.

- When profits are distributed as dividends, they are taxed again at the shareholder level (double taxation).

- Suitable for larger businesses seeking outside investors or planning to go public.

Forms Used:

- Form 1120 (U.S. Corporation Income Tax Return)

- Form 1099-DIV (for shareholder dividend reporting)

- Form 1040 (for shareholders receiving dividends)

6. Nonprofit Organization (501(c)(3))

Tax Classification: Tax-Exempt Entity

- Operates for charitable, educational, or religious purposes.

- Exempt from federal income tax on income related to its exempt purpose.

- Must apply for tax-exempt status using Form 1023.

- Must file annual informational returns, typically Form 990, unless very small.

Forms Used:

- Form 990 / 990-EZ / 990-N

- Form 1023 (for initial exemption application)

7. Foreign Corporation

Tax Classification: U.S. Taxable Entity (if engaged in U.S. business)

- A company formed under foreign law but doing business or earning income in the U.S.

- Subject to U.S. tax on income effectively connected with a U.S. trade or business.

- May also face withholding taxes on U.S.-source passive income and branch profits tax.

Forms Used:

- Form 1120-F (U.S. Income Tax Return of a Foreign Corporation)

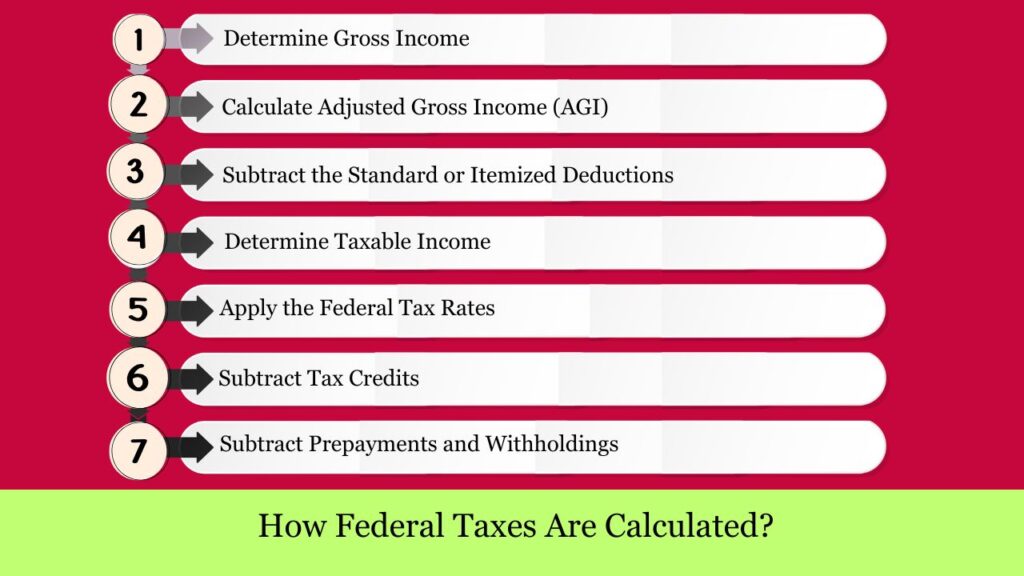

How Federal Taxes Are Calculated?

Federal tax calculation in the U.S. involves determining taxable income, applying the appropriate tax rates, and subtracting credits or prepayments to arrive at the final tax liability. The process differs for individuals and businesses but follows similar foundational steps.

For Individuals (Using Form 1040)

Step 1: Determine Gross Income

Gross income comprises all earnings received in the form of money, property, services, or other compensation, unless specifically excluded by law:

- Wages and salaries (Form W-2)

- Self-employment or business income (Schedule C)

- Interest and dividends (Forms 1099-INT, 1099-DIV)

- Capital gains (Schedule D)

- Retirement income (Form 1099-R)

- Rental and royalty income

- Unemployment compensation, alimony (pre-2019 agreements), and other miscellaneous income

Step 2: Calculate Adjusted Gross Income (AGI)

Deduct eligible adjustments from your total income to calculate your Adjusted Gross Income (AGI). These deductions include:

- IRA contributions

- HSA contributions

- Student loan interest

- Educator expenses

- Self-employment tax deduction

Step 3: Subtract the Standard or Itemized Deductions

- Standard deduction (2025):

- $14,600 for single filers

- $29,200 for married couples filing jointly

- $21,900 for head of household

- OR

- Itemized deductions, such as mortgage interest, medical expenses, state and local taxes (limited by SALT cap), charitable contributions.

Step 4: Determine Taxable Income

Taxable income = Adjusted Gross Income – Deductions

Step 5: Apply the Federal Tax Rates

The U.S. uses a progressive tax system. Tax rates increase as income increases:

- For 2025, single taxpayers fall into progressive tax brackets ranging from 10% to 37%, based on their taxable income levels.

Each portion of income is taxed at a different rate — not the entire income at the highest bracket.

Step 6: Subtract Tax Credits

Credits reduce tax liability dollar-for-dollar. Common examples:

- Child Tax Credit

- Earned Income Tax Credit (EITC)

- American Opportunity Credit

- Lifetime Learning Credit

Step 7: Subtract Prepayments and Withholdings

Reduce the remaining liability by:

- Federal income tax withheld from paychecks

- Estimated tax payments made during the year

Final Step: Determine Balance Due or Refund

If your total tax payments and withholdings are more than your actual tax owed, you’ll receive a refund from the IRS.

If tax liability exceeds payments ➝ amount due

For Businesses (Entity-Specific Approach)

1. Sole Proprietorship

- Business income is reported on Schedule C with Form 1040.

- Net profit is added to personal income and taxed at individual rates.

- Subject to self-employment tax (Social Security + Medicare = 15.3%).

2. Partnership

- Files Form 1065, which is informational.

- Income “passes through” to partners via Schedule K-1.

- Each partner reports their portion of the partnership’s income on their personal tax return and is responsible for paying the associated taxes:

- Income tax at individual rates

- Self-employment tax, if applicable

3. S Corporation

- Files Form 1120-S; income passes through to shareholders via K-1s.

- Shareholders pay tax on their share of income at individual rates.

- Wages are taxed normally, but distributions are not subject to SE tax.

4. C Corporation

- Pays corporate tax directly using Form 1120.

- Flat 21% corporate tax rate on net taxable income.

- Dividends paid to shareholders are taxed again on their personal returns — this is double taxation.

5. LLC

- Tax treatment depends on structure and IRS election:

- Single-member LLC ➝ taxed like sole proprietorship

- Multi-member LLC ➝ taxed like partnership

- LLCs may choose to be taxed as an S corporation or C corporation by filing Form 2553 or Form 8832 with the IRS.

- Profit flows to owner(s) unless taxed as C corp.

Example – Individual Calculation

Let’s say Sarah, a single filer, earns:

- $60,000 salary

- $1,200 interest income

- $3,000 freelance income

She has: - $2,000 in IRA contributions

- $1,500 federal tax withheld

- Standard deduction of $14,600

Steps:

- Gross income = $64,200

- AGI = $64,200 – $2,000 = $62,200

- Taxable income = $62,200 – $14,600 = $47,600

- Tax owed (using tax tables): ~$6,400

- After $1,500 withheld: Balance due = $4,900

Key Concepts

| Term | Meaning |

| AGI | Income after above-the-line deductions |

| Taxable Income | Income after all deductions (standard or itemized) |

| Marginal Tax Rate | The highest rate that applies to your top dollar of income |

| Effective Tax Rate | Total tax paid ÷ total income — actual percentage of income paid in taxes |

| Credits vs Deductions | Tax credits lower your actual tax bill dollar-for-dollar, while deductions reduce the amount of income that is subject to tax. |

| Withholding | Income tax automatically taken from paychecks and sent to IRS |

Self-Employment and Payroll Taxes – Complete Overview

In the U.S. tax system, individuals and businesses that earn income through work must contribute to Social Security and Medicare via either self-employment tax or payroll tax, depending on whether the taxpayer is self-employed or an employee.

What Are Payroll Taxes?

Payroll taxes are federal taxes employers withhold from their employees’ wages and remit to the IRS, along with the employer’s matching contributions.

Payroll Tax Components:

| Tax Type | Employee Pays | Employer Pays | Total Rate |

| Social Security | 6.2% | 6.2% | 12.4% |

| Medicare | 1.45% | 1.45% | 2.9% |

| Total (FICA) | 7.65% | 7.65% | 15.3% |

- Applies to wages up to $168,600 (2025 limit) for Social Security; Medicare has no wage limit.

- High-income earners pay an additional 0.9% Medicare surtax above:

- $200,000 (single)

- $250,000 (married filing jointly)

Employer Responsibilities:

- Withhold employee portion from paychecks

- Match the amounts and submit all payroll taxes to the IRS (via Form 941 quarterly)

What Is Self-Employment Tax?

Self-employed individuals — including freelancers, gig workers, independent contractors, and sole proprietors — must pay both portions (employer and employee) of Social Security and Medicare taxes.

Self-Employment Tax Rate:

- 12.4% Social Security

- 2.9% Medicare

- Total: 15.3%

Additionally, individuals with income exceeding certain thresholds are subject to an extra 0.9% Medicare tax on wages and self-employment income.

Who Pays Self-Employment Tax?

- Sole proprietors (reported on Schedule C)

- Partners in partnerships

- LLC members (unless they elect corporate treatment)

- S corp shareholders only pay SE tax on wages, not on distributions

Filing Requirements:

- File using Schedule SE (Form 1040) to calculate SE tax

- You can claim 50% of your self-employment tax as an above-the-line deduction on your individual tax return.

Key Differences: Payroll vs. Self-Employment Tax

| Aspect | Payroll Tax | Self-Employment Tax |

| Who Pays | Employees & Employers | Self-employed individuals |

| Tax Rate | 7.65% (each) | 15.3% total |

| Reporting Form | Form 941 (employers), Form W-2 (employees) | Schedule SE with Form 1040 |

| Deductibility | Employer may deduct their share | 50% deductible by taxpayer (above-the-line) |

| Medicare Surtax | Applies above income thresholds | Also applies above same thresholds |

Estimated Tax Payments for Self-Employed Individuals

Because no employer is withholding taxes, self-employed individuals must:

- Estimate and pay quarterly taxes using Form 1040-ES

- Include both income tax and SE tax in those estimates

- Avoid penalties by paying enough each quarter or 90% of total liability

Example – Calculating SE Tax

If Rachel, a freelance graphic designer, earns $80,000 in net self-employment income:

- SE tax = $80,000 × 15.3% = $12,240

- She can deduct $6,120 (50%) when calculating AGI on Form 1040

- She must also account for income tax separately

Strategies to Reduce Self-Employment Tax

- S Corporation election: Pay yourself a reasonable salary (subject to payroll tax) and take remaining profit as a distribution (not subject to SE tax).

- Maximize deductions: Business expenses lower net income, reducing SE tax.

- Health insurance & retirement contributions: Deductible items that reduce taxable income and SE tax burden.

IRS Tax Filing Deadlines (2025) – Complete Overview

Filing your federal taxes on time is not only a legal obligation — it’s essential to avoid costly penalties, interest, and loss of certain tax benefits. The Internal Revenue Service (IRS) sets specific annual deadlines based on your taxpayer classification, business entity type, and income situation.

Below is a comprehensive breakdown of the key IRS filing and payment deadlines for the 2024 tax year (filed in 2025), covering individuals, businesses, payroll taxes, and tax-exempt organizations.

1. Individual Taxpayer Deadlines – Form 1040

April 15, 2025 – Standard Filing Deadline

- Due for: All individual taxpayers

- Forms:

- Form 1040 (Individual Income Tax Return)

- Attachments: Schedules A, B, C, D, SE, etc.

- Final day to:

- Pay remaining 2024 taxes

- Make contributions to traditional IRAs and HSAs for 2024

- Applies to: Employees, retirees, gig workers, freelancers

October 15, 2025 – Extended Filing Deadline

- File Form 4868 by April 15 to get a 6-month extension

- Important: Extension only delays filing, not payment

- Taxes not paid by April 15 may accrue interest and late payment penalties until settled.

2. Quarterly Estimated Tax Payments – Form 1040-ES

Required if you earn income without withholding (self-employment, rental income, investments, etc.)

| Quarter | Income Period | Payment Due Date |

| Q1 | Jan 1 – Mar 31 | April 15, 2025 |

| Q2 | Apr 1 – May 31 | June 17, 2025 |

| Q3 | Jun 1 – Aug 31 | Sept 16, 2025 |

| Q4 | Sep 1 – Dec 31 | Jan 15, 2026 |

If you submit your complete Form 1040 and pay the full tax due by January 31, 2026, the fourth estimated tax payment is no longer required.

3. Partnerships – Form 1065

March 17, 2025

- Applies to: Partnerships and multi-member LLCs (default)

- Due:

- Form 1065

- Schedule K-1 for each partner

- Extension:

- To receive a 6-month extension, submit Form 7004; the extended due date will be September 15, 2025.

4. S Corporations – Form 1120-S

March 17, 2025

- Applies to: S Corporations and LLCs electing S Corp status

- Due:

- Form 1120-S

- Schedule K-1s to shareholders

- Extension:

- File Form 7004 for new deadline: Sept 15, 2025

5. C Corporations – Form 1120

April 15, 2025 (calendar-year corporations)

- Due:

- Form 1120

- If fiscal-year corporation: Return is due the 15th day of the 4th month after year-end

- Extension:

- Form 7004 provides a 6-month extension (to Oct 15, 2025)

6. Trusts and Estates – Form 1041

April 15, 2025

- Relevant for fiduciaries managing trusts or estates that generate taxable income.

- Due:

- Form 1041

- Extension:

- Form 7004 allows a 5½-month extension (to Sept 30, 2025)

7. Tax-Exempt Organizations – Form 990

May 15, 2025

- Applies to: 501(c)(3) and other nonprofit orgs with year-end December 31, 2024

- Due:

- Form 990, 990-EZ, or 990-N (based on size)

- Extension:

- Form 8868 provides a 6-month extension (to Nov 15, 2025)

8. Payroll Tax Returns – Form 941

Employers must file quarterly returns for employment taxes (Social Security, Medicare, income tax):

| Quarter | Period Covered | Form 941 Due Date |

| Q1 | Jan – Mar | April 30, 2025 |

| Q2 | Apr – Jun | July 31, 2025 |

| Q3 | Jul – Sep | Oct 31, 2025 |

| Q4 | Oct – Dec | Jan 31, 2026 |

In addition, employers are required to submit federal tax deposits on a monthly or semiweekly basis, depending on their deposit schedule.

9. Key IRS Extension Forms & Deadlines

| Form | Used For | Extension Length | Deadline to File |

| Form 4868 | Individual (Form 1040) | 6 months | April 15, 2025 |

| Form 7004 | Business returns (1065, 1120) | 5½ to 6 months | March/April 2025 |

| Form 8868 | Tax-exempt organizations | 6 months | May 15, 2025 |

IRS Late Filing & Payment Penalties

| Issue | Penalty |

| Late Filing | 5% per month of unpaid tax (up to 25%) |

| Late Payment | 0.5% per month of tax owed (up to 25%) |

| Late K-1 Distribution (1065/1120-S) | $290 per K-1/month (max 12 months) |

| Penalties for not filing a partnership or S corporation return | $220 per partner or shareholder for each month the return is late, up to a maximum of 12 months. |

Key Principles of the U.S. Federal Tax System

The U.S. federal tax system is built on foundational principles that guide how income is taxed, revenue is collected, and fairness is maintained across the economic spectrum. These principles ensure that taxation aligns with national priorities, economic growth, and equity.

1. Ability to Pay (Progressive Taxation)

The U.S. income tax system follows the “ability to pay” principle, which means those who earn more pay a higher percentage in taxes.

- Federal income tax follows a progressive structure, meaning individual tax rates increase with income—ranging from 10% to 37%.

- As income increases, so does the marginal tax rate applied to each additional dollar earned.

- Deductions and credits help tailor the burden based on individual circumstances.

Purpose: To ensure fairness by taxing citizens based on their financial capacity.

2. Voluntary Compliance and Self-Reporting

The federal tax system relies on voluntary compliance, meaning taxpayers are responsible for:

- Accurately calculating their income and deductions.

- Filing their returns honestly and on time.

- Paying any tax due, or claiming a refund if overpaid.

While compliance is expected, the IRS conducts audits and uses data-matching to ensure honesty.

3. Pay-As-You-Go System

The IRS collects taxes gradually over the course of the year through withholding and estimated payments, instead of waiting for a single payment at year.

- Employees have taxes withheld from paychecks via Form W-4.

- Self-employed individuals make quarterly estimated tax payments using Form 1040-ES.

- This system provides steady funding for government operations.

Ensures consistent revenue flow to the federal government.

4. Equity and Fairness

The tax system aims to balance fairness between different income groups.

- Horizontal equity: People with the same income should pay the same amount of tax.

- Vertical equity: Those with higher incomes should pay more than those with lower incomes.

- Multiple tax credits—such as the Child Tax Credit and Earned Income Tax Credit—are designed to support working families and reduce income inequality.

The goal is to reduce economic disparity through tax policy.

5. Simplicity and Transparency (In Principle)

While the U.S. tax code is complex, a guiding principle is that taxpayers should:

- Understand how their tax is calculated.

- Know what they owe and why.

- Access forms and guidance easily via the IRS.

IRS publications and e-filing platforms aim to improve clarity and reduce taxpayer confusion.

6. Neutrality and Economic Efficiency

The tax system is designed to minimize interference in personal and business decisions.

- Taxes should not discourage work, saving, or investment unnecessarily.

- Incentives (like retirement contributions and business credits) are used to stimulate specific economic activities.

Tax neutrality helps foster long-term economic growth.

7. Revenue Sufficiency

Federal taxes must generate enough income to fund:

- National defense

- Social Security and Medicare

- Infrastructure and education

- Federal agencies and public programs

The balance between tax revenue and government spending is a major policy consideration.

8. Enforceability and Legal Accountability

The IRS enforces tax laws and can impose:

- Interest and penalties for late filing or payment

- Criminal charges for fraud or willful evasion

- Audits and collections for unpaid taxes

This ensures taxpayer compliance and strengthens system integrity.

Conclusion

The U.S. federal tax framework is a complex yet structured system that helps fund essential government programs. From individual taxpayers to large corporations, each entity has distinct filing obligations governed by IRS rules. With individual tax rates ranging from 10% to 37% and corporate tax fixed at 21%, accurate and timely filing is critical to remain compliant and avoid penalties. Maximizing deductions and credits, choosing the correct tax forms, and utilizing extensions when appropriate can enhance compliance and support smarter tax planning.

Frequently Asked Questions (FAQs)

Is the U.S. tax system voluntary?

Yes, it relies on voluntary compliance—you’re expected to file accurately and pay taxes owed without IRS intervention.

Why are taxes withheld from paychecks?

The U.S. follows a pay-as-you-go system, collecting taxes throughout the year to fund government operations steadily.

What does “progressive tax” mean?

It refers to increasing tax rates as income rises. As your income increases, you may be subject to higher marginal tax rates under the progressive tax system.

Are all taxpayers treated equally?

Yes and no. The system is designed for horizontal and vertical equity—equal treatment for equals, and more tax for higher earners.

Can the IRS audit me?

Yes. The IRS checks compliance through audits and data matching, especially if returns raise red flags.

What happens if I don’t file or pay taxes on time?

Penalties, interest, and possible legal action. Filing late can result in a 5% monthly penalty on unpaid taxes.

Why is tax neutrality important?

Neutrality ensures taxes don’t unfairly influence your financial choices—like whether to invest or save.

Are federal taxes enough to fund everything?

The system is designed for revenue sufficiency, but deficits can occur if spending exceeds tax revenue.

Is the U.S. tax system simple?

In theory, yes. In practice, it’s complex—but the IRS provides tools, forms, and guidance to help navigate it.

Mr. Nadeem Patel is an MBA graduate with a specialization in market research, bringing a sharp analytical mindset and strong research skills to the field of taxation and finance. Known for his efficiency and attention to detail, he has successfully published research work in the United States, reflecting his commitment to data accuracy and insightful analysis. Mr. Patel contributes well-researched, reader-friendly content that bridges market insights with U.S. tax-related topics, helping users make informed financial decisions.