Private Equity VS Venture Capital- Best Comparison In 2025

Table of Contents

Detailed Comparison On Private Equity vs Venture Capital

Overview

When it comes to alternative investments, Private Equity (PE) and Venture Capital (VC) are two of the most popular options—but they serve very different purposes and types of companies. Understanding core differences among Private Equity vs Venture Capital is crucial for investors, entrepreneurs, and financial professionals alike.

While both Private Equity and Venture Capital involve investing in private companies, they differ significantly in investment stage, target companies, risk profile, investment size, and involvement. Understanding these distinctions is essential for investors, entrepreneurs, and finance professionals.

Comparison Guide: Private Equity Vs Venture Capital

1. Definition

Private Equity

Private Equity involves investing in mature, established companies that are usually profitable or near profitability. PE firms typically acquire a controlling stake or buy out companies entirely. The goal is to improve operational efficiency, restructure finances, or help expand the business, then exit after 5 to 10 years with substantial returns.

Venture Capital

A Hedge Fund is a pooled investment vehicle that invests primarily in liquid, market-traded securities and derivatives. It aims to produce high returns regardless of market direction, often using leverage, short-selling, arbitrage, and complex strategies. Hedge funds are flexible in asset allocation and are actively managed with a focus on absolute returns.

2. Investment Stage

Private Equity

PE firms typically invest in mature companies that are established, profitable or near profitability, and may require capital for expansion, restructuring, or ownership buyouts. PE investments often happen during later stages of a company’s lifecycle.

Venture Capital

VC focuses on early-stage startups and high-growth companies, often in technology, biotech, or innovative sectors. These companies may be pre-revenue or in early revenue phases but have significant growth potential.

3. Target Companies

Private Equity

Targets companies with stable cash flows, solid business models, and proven market presence. These businesses are often undervalued or underperforming and need operational improvements, strategic guidance, or financial restructuring.

Private Equity

Invests in startups with disruptive ideas, innovative products, or scalable business models, but with higher uncertainty and risk due to lack of track record or market validation.

4. Investment Size and Structure

Private Equity

Deals are usually very large, often hundreds of millions to billions of dollars. PE investments often involve buyouts, where the PE firm acquires a controlling interest or entire ownership of the company.

Venture Capital

Investment rounds are smaller, ranging from a few hundred thousand dollars to tens of millions. VC typically takes a minority equity stake and participates in multiple funding rounds (Seed, Series A, B, C…).

5. Risk and Return Profile

Private Equity

Generally lower risk compared to VC due to investing in established firms, but still carries operational and market risks. Returns tend to be more stable but require patience over 5 to 10 years.

Venture Capital

Higher risk, with many startups failing. However, successful investments can generate exponential returns, making VC attractive for investors with a higher risk tolerance and a long-term horizon.

6. Investor Involvement

Private Equity

Private Equity firms are actively involved in managing companies. They often appoint board members, implement operational improvements, optimize costs, and drive strategic changes to boost profitability before exit.

Venture Capital

VCs provide guidance, mentorship, and networking support but usually do not manage day-to-day operations. Their role is more of a strategic advisor, helping startups scale.

7. Exit Strategies

Private Equity

Exits typically occur through selling the company to another firm, conducting an initial public offering (IPO), or recapitalization after several years of value enhancement.

Venture Capital

VCs exit by selling shares during IPOs, acquisitions by larger companies, or secondary sales. Since startups are smaller and less mature, exit timelines can vary widely.

8. Examples

Private Equity

Firms like Blackstone, KKR, and The Carlyle Group focus on leveraged buyouts and growth equity in established companies.

Venture Capital

Firms like Sequoia Capital, Andreessen Horowitz, and Accel invest in early-stage companies like Airbnb, Uber, and Dropbox.

Summary Table

| Aspect | Private Equity | Venture Capital |

| Investment Stage | Mature, established companies | Early-stage startups |

| Company Profile | Stable cash flow, profitable | High growth potential, risky |

| Investment Size | Large (millions to billions) | Smaller (thousands to millions) |

| Equity Stake | Majority or controlling | Minority |

| Risk Level | Moderate | High |

| Investor Role | Active management | Advisory, mentoring |

| Typical Exit | Sale, IPO, recapitalization | IPO, acquisition |

| Return Horizon | 5-10 years | 7-10+ years |

Why Choose Private Equity or Venture Capital?

- Private Equity suits investors or firms looking for stable investments with operational control and moderate risk. It’s ideal for companies ready for scaling, restructuring, or ownership transitions.

- Venture Capital appeals to those willing to accept higher risk for the chance of exceptional growth, supporting disruptive innovations and early market entrants.

Conclusion

Both Private Equity and Venture Capital play vital roles in the business and investment ecosystem. PE is about transforming established businesses, while VC is about nurturing startups with breakthrough ideas. Choosing between them depends on your risk tolerance, investment horizon, and interest in company involvement.

FAQs on Private Equity vs Venture Capital

1. What is the main difference between private equity and venture capital?

Private equity invests in mature companies with stable cash flows, often taking controlling stakes, while venture capital focuses on early-stage startups with high growth potential and typically takes minority stakes.

2. Which investment is riskier: private equity or venture capital?

Venture capital is generally riskier because it targets startups with unproven business models, whereas private equity invests in established companies with more predictable cash flows.

3. How long do private equity and venture capital investments usually last?

Private equity investments typically last 5 to 10 years, while venture capital investments can take 7 to 10 years or more to realize returns.

4. Can individual investors invest in private equity or venture capital?

Both usually require accredited investor status due to high minimum investments and risk, but some funds and platforms offer access to smaller investors.

5. How do private equity firms create value compared to venture capitalists?

Private equity firms actively manage and restructure companies to improve profitability, whereas venture capitalists provide funding, mentorship, and strategic guidance to help startups grow.

6. What types of companies do private equity and venture capital invest in?

Private equity targets mature, profitable businesses needing growth or restructuring; venture capital invests in startups and early-stage companies with innovative ideas.

7. What are the typical exit strategies for private equity and venture capital?

Both exit through IPOs or acquisitions, but private equity may also use recapitalizations or sales to other firms.

8. How do investment sizes differ between private equity and venture capital?

Private equity deals often involve hundreds of millions or billions, while venture capital rounds range from thousands to tens of millions.

9. Is private equity suitable for startup founders looking for funding?

Usually, startups seek venture capital rather than private equity since PE focuses on mature companies.

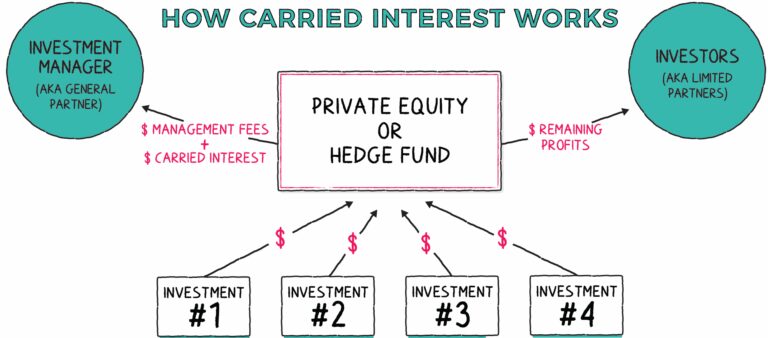

10. What fees are associated with private equity vs venture capital funds?

Both typically charge management fees around 2% and performance fees around 20%, but the timing of fees can differ based on investment exits.