Pass Through Entity Tax: A Smart Tax Strategy for Business Owners

A Flow-Through Entity—also known as a PassThrough Entity Tax—is a business structure where the entity itself is not taxed at the federal level. Rather than being taxed at the business level, the entity’s income, deductions, credits, and other tax-related items are transferred to the individual owners, who report them on their personal tax returns.

This model is particularly common among sole proprietorships, partnerships, LLCs, and S corporations and is favored for its tax efficiency, operational simplicity, and single layer of taxation, in contrast to traditional C corporations.

How Does Pass-Through Taxation Work?

When a business is treated as a pass-through entity for federal tax purposes:

- The business itself does not pay federal income tax.

- Instead, each owner’s share of income or loss is reported on their individual tax return.

- These amounts are typically reported using:

- Schedule K-1 (for partnerships and S corps)

- Schedule C (for sole proprietorships and single-member LLCs)

- Form W-2 (for wages paid, if applicable)

For the Owner:

- Reports the income/loss on Form 1040.

- Pays tax at individual tax rates.

- May owe self-employment tax, depending on the entity type and income characterization.

Entities That Qualify as Pass-Through

Pass-through entities are business structures where the profits, losses, and other tax attributes are not taxed at the entity level. Instead, these amounts are passed along to the individual owners or beneficiaries, who must include them in their own personal income tax filings. This structure avoids the double taxation typically associated with C corporations and provides flexibility in how income is recognized and taxed.

Here’s a detailed look at each type of entity that qualifies as a pass-through for U.S. federal tax purposes:

1. Sole Proprietorship

A sole proprietorship is the simplest and most common form of business structure in the United States. It is owned and operated by one individual and does not require formal incorporation.

- Legal Structure: No legal separation between the individual and the business.

- Tax Filing: Income and expenses are reported on Schedule C of Form 1040.

- Pass-Through Feature: All net profits are taxed once on the owner’s personal return.

- Self-Employment Tax: Sole proprietors pay both the employer and employee portion of Social Security and Medicare taxes.

- Best For: Freelancers, gig workers, consultants, and single-owner small businesses seeking simplicity.

2. Single-Member Limited Liability Company (SMLLC)

A single-member LLC offers the liability protection of a corporation while maintaining the straightforward tax treatment of a sole proprietorship.

- Legal Structure: A separate legal entity offering limited liability to the owner.

- Default Tax Treatment: Treated as a disregarded entity for federal tax purposes.

- Tax Filing: Income is reported on Schedule C (Form 1040) unless the LLC elects to be taxed as an S corporation or C corporation.

- Pass-Through Feature: Business income passes directly to the sole member and is taxed on their individual return.

- Best For: Solo entrepreneurs wanting liability protection with minimal complexity.

3. Partnership

A partnership is a business owned by two or more individuals or entities. It is governed by a partnership agreement that outlines each partner’s ownership share and responsibilities.

- Legal Structure: Separate legal entity, but not separate for tax purposes.

- Tax Filing: Files Form 1065, and each partner receives a Schedule K-1 reporting their share of income, losses, and credits.

- Owner Reporting: Partners report this income on Schedule E of Form 1040.

- Self-Employment Tax: General partners usually owe self-employment tax on their distributive share.

- Capital Accounts & Basis: Partnerships must maintain detailed records of each partner’s capital account and tax basis.

- Best For: Businesses with multiple owners looking for flexibility in profit sharing and tax reporting.

4. Multi-Member Limited Liability Company (MMLLC)

A multi-member LLC offers the same limited liability protection as a single-member LLC but is treated as a partnership by default for federal tax purposes.

- Legal Structure: Separate legal entity with flexible governance options.

- Tax Filing: Treated like a partnership, the LLC files Form 1065 and issues Schedule K-1s to members.

- Owner Reporting: Members report their share on Form 1040 + Schedule E.

- Pass-Through Feature: Income is passed proportionally (or as agreed) to each member.

- Optional Elections: May choose to be taxed as an S corporation or C corporation.

- Best For: Small businesses with more than one owner wanting liability protection and operational flexibility.

5. S Corporation

An S Corporation is a special tax status elected by a corporation or LLC that meets specific IRS criteria.

- Legal Structure: Separate legal entity incorporated at the state level.

- Tax Filing: Files Form 1120S, and shareholders receive a Schedule K-1 for their share of income.

- Owner Reporting: Shareholders report income on Form 1040 + Schedule E.

- Pass-Through Feature: Corporate income is not taxed at the entity level; instead, it flows through to shareholders.

- Compensation Structure: Shareholders who work for the business must be paid a reasonable salary, reported on Form W-2.

- Self-Employment Tax Savings: Only the salary portion is subject to employment taxes; remaining profit is not.

- Best For: Small to mid-sized businesses with active owners looking to reduce self-employment taxes while maintaining liability protection.

6. Certain Trusts and Estates

Some trusts and estates that generate income may also be treated as pass-through entities, particularly when they distribute income to beneficiaries.

- Legal Structure: Created through legal documents like wills or trust agreements.

- Tax Filing: Trust or estate files Form 1041 to report income.

- Pass-Through Feature: If income is distributed, the beneficiary receives a Schedule K-1 and reports the income on Form 1040.

- Beneficiary Reporting: Beneficiaries pay tax on the distributed portion, while undistributed income is taxed at the trust or estate level (usually at higher rates).

- Best For: Trusts and estates with distributable income designated to beneficiaries under legal or fiduciary arrangements.

Who Does Not Qualify For Pass Through Entity Tax?

Pass-through taxation allows business income, deductions, and credits to “pass through” the business directly to the owners’ individual tax returns, avoiding corporate-level taxation. However, not all entities qualify for this treatment.

Below are common entities that do NOT qualify as pass-throughs for U.S. federal income tax purposes:

1. C Corporations

Federal Treatment: Taxed as separate entities.

Taxation: Subject to double taxation—once at the corporate level (flat 21% rate) and again at the shareholder level when dividends are distributed (typically 15%–20%).

Forms Used: File Form 1120 with the IRS.

Why They Don’t Qualify: They do not pass income to shareholders directly; profits remain within the entity unless distributed.

2. Foreign Corporations (not electing pass-through treatment)

Definition: Corporations incorporated under foreign laws.

Taxation: Subject to U.S. tax only on U.S.-source income, but not treated as pass-throughs unless they make specific elections.

Why Excluded: Not organized under U.S. laws and generally treated as separate taxable entities.

3. Publicly Traded Partnerships (PTPs) – Sometimes

Exception: Some PTPs are taxed as corporations under IRC §7704 if they are publicly traded and not engaged in qualified passive income activities.

Why Excluded: Public trading disqualifies many of them from pass-through status unless 90%+ of income is passive.

4. Trusts and Estates (in most cases)

Taxation: Taxed at the entity level; distributions may carry income to beneficiaries, but overall not treated as full pass-throughs.

Forms Used: Form 1041.

Why Excluded: Only certain trusts (e.g., grantor trusts) qualify for pass-through-like treatment.

5. Certain Investment Funds

Examples: Real Estate Investment Trusts (REITs), Regulated Investment Companies (RICs), and mutual funds.

Taxation: Often receive favorable tax treatment but are not pass-throughs in the traditional business sense.

Why Excluded: Subject to specific IRS regimes and distribution requirements.

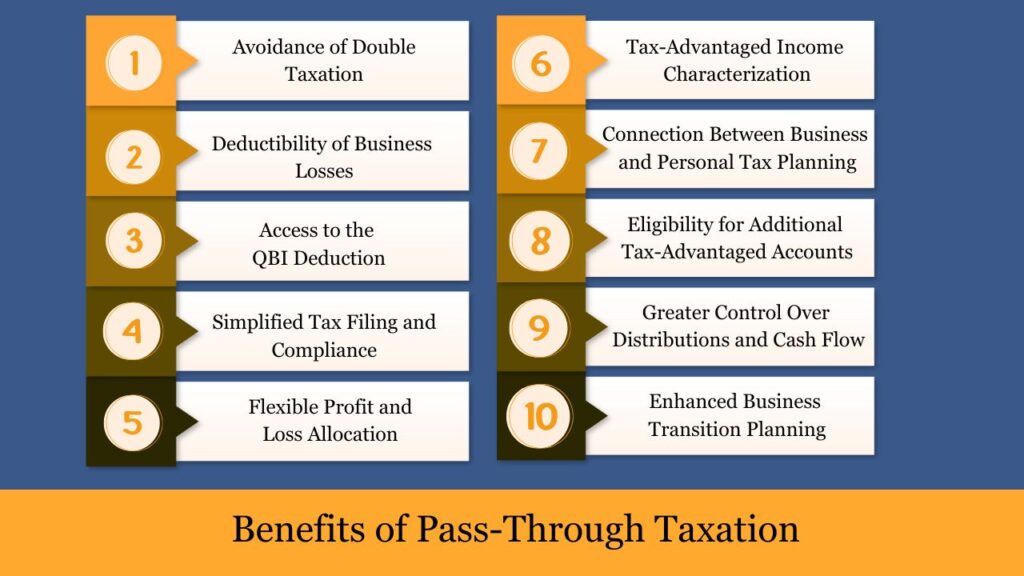

Key Benefits of Pass-Through Taxation

Pass-through taxation offers a range of financial and administrative advantages for business owners, especially those operating small to medium-sized enterprises, professional practices, or independent ventures. By allowing income to “pass through” directly to the owner’s individual tax return, these structures simplify the tax process while optimizing potential savings.

Here’s a breakdown of the core benefits:

1. Avoidance of Double Taxation

Unlike C corporations, which pay corporate income tax and then distribute after-tax profits to shareholders who pay personal tax on dividends, pass-through entities are taxed only once—at the owner level.

- How it works: The business itself is not taxed. Instead, the profits or losses pass directly to the owners’ personal returns.

- Result: This single layer of taxation helps reduce the overall tax burden and preserves more capital for reinvestment or personal use.

2. Deductibility of Business Losses

Owners of pass-through businesses can typically deduct business losses on their individual tax returns, subject to IRS limitations such as the at-risk rules and passive activity loss rules.

- Advantage: If your business operates at a loss, you may be able to offset that loss against other income sources (like wages or investment income), reducing your total tax liability.

- Example: A sole proprietor who incurs a $20,000 business loss may use that to reduce their taxable income from other employment or investments.

3. Access to the Qualified Business Income (QBI) Deduction

Under IRC Section 199A, most pass-through owners may deduct up to 20% of their qualified business income (QBI), significantly reducing taxable income.

- Eligibility: Applies to sole proprietors, partners, S corporation shareholders, and certain trusts and estates.

- Income Limits for 2024 (filed in 2025):

- Single filers: full deduction below $191,950

- Married filing jointly: full deduction below $383,900

- Impact: This deduction can save thousands of dollars annually and is not available to C corporations.

4. Simplified Tax Filing and Compliance

Pass-through entities generally face fewer administrative and regulatory burdens compared to C corporations.

- Simplified Forms: Most sole proprietors and single-member LLCs file just Schedule C along with their Form 1040.

- No Corporate Governance Required: Unlike C corporations, pass-throughs are not required to hold annual shareholder meetings, maintain corporate minutes, or follow strict bylaws.

- Lower Compliance Costs: Less need for corporate attorneys or specialized accountants.

5. Flexible Profit and Loss Allocation (Partnerships and LLCs)

Certain pass-through structures, such as partnerships and multi-member LLCs, offer flexibility in allocating income, deductions, credits, and losses among owners—even if ownership percentages differ.

- Custom Allocation: Profit and loss allocations can be tailored through a written partnership or LLC operating agreement.

- Strategic Benefit: Owners can plan tax allocations to suit their income situations, cash needs, or long-term goals.

6. Tax-Advantaged Income Characterization (S Corporations)

S corporations allow owners to split business income between W-2 wages (subject to payroll taxes) and distributions (not subject to self-employment tax).

- Impact: Reduces the total employment tax burden while still maintaining Social Security/Medicare contributions through reasonable compensation.

- Example: An S corp shareholder pays themselves a $60,000 salary and takes a $40,000 distribution—only the salary is subject to employment tax.

7. Direct Connection Between Business and Personal Tax Planning

Since all income flows directly to the owner’s personal return, pass-through entities enable more integrated and holistic tax planning.

- Owners can:

- Coordinate estimated tax payments across income streams

- Maximize retirement plan contributions

- Utilize income timing strategies to manage tax brackets

8. Eligibility for Additional Tax-Advantaged Accounts

Pass-through owners may qualify to contribute to tax-advantaged accounts such as:

- SEP IRAs or Solo 401(k)s

- Health Savings Accounts (HSAs)

- Qualified business expense deductions

These contributions can lower taxable income and build long-term savings in a tax-deferred or tax-free manner.

9. Greater Control Over Distributions and Cash Flow

Unlike C corporations, which often require formal board approval for dividend distributions, pass-through owners typically have more flexibility to draw cash from the business without triggering corporate-level tax consequences.

- Owners can choose:

- When to withdraw profits

- How to reinvest in the business

- Whether to retain earnings without double taxation

10. Enhanced Business Transition Planning

Pass-through structures often make it easier to transition or transfer ownership, particularly in family businesses or small partnerships.

- Tax attributes like basis, capital accounts, and carried losses transfer directly to the new owner.

- Estate and gift tax planning can be more efficient when using ownership interests in partnerships or S corporations.

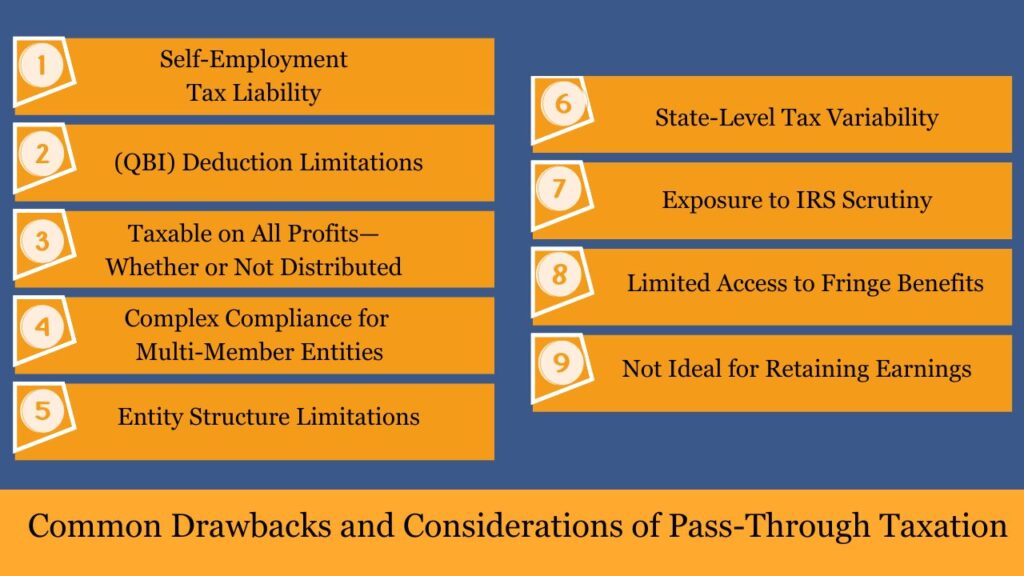

Common Drawbacks and Considerations of Pass-Through Taxation

While pass-through taxation offers numerous benefits, it also comes with complexities, compliance burdens, and limitations that business owners must carefully consider. These drawbacks may influence entity choice, tax strategy, and long-term business planning.

Below are the most important considerations when operating as a pass-through entity:

1. Self-Employment Tax Liability

Owners of pass-through businesses—especially sole proprietors, partners, and members of LLCs—are generally subject to self-employment tax.

- Applies to: Net business income from sole proprietorships, partnerships, and LLCs (unless taxed as an S corp).

- Tax Rate: Currently 15.3% (12.4% for Social Security + 2.9% for Medicare) on net self-employment income.

- Impact: Unlike employees who split payroll taxes with employers, pass-through owners pay both portions themselves.

- Exception: S corporation shareholders may reduce self-employment tax by taking part of their income as distributions (not subject to SE tax).

Example: A sole proprietor earning $100,000 in net profit would pay approx. $15,300 in self-employment tax—on top of income tax.

2. Qualified Business Income (QBI) Deduction Limitations

Although the Section 199A QBI deduction provides a generous tax break, it comes with eligibility rules, phase-outs, and limitations, especially for high earners.

- Income Thresholds for 2024 (filed in 2025):

- Single: Phase-out starts at $191,950

- Married filing jointly: Phase-out starts at $383,900

- Limitations Apply To:

- Specified Service Trades or Businesses (SSTBs)—including law, consulting, health, financial services, and more.

- Taxpayers above income limits who fail W-2 wage and property tests.

Result: High-income professionals may receive a reduced or eliminated QBI deduction, impacting overall tax efficiency.

3. Taxable on All Profits—Whether or Not Distributed

One of the key characteristics of pass-through taxation is that owners are taxed on their share of income, regardless of actual cash distributions.

- Applies To: Partnerships, S corporations, and multi-member LLCs.

- Impact: Owners may owe tax on “phantom income”—profit reported for tax purposes but not received in cash.

- Cash Flow Concern: This can lead to liquidity issues if the business retains profits for reinvestment but the owner still has to pay tax personally.

Example: A partner allocated $80,000 in profit (but receives no distribution) must still report and pay tax on the full amount.

4. Complex Compliance for Multi-Member Entities

Entities like partnerships and S corporations involve more complex recordkeeping and tax reporting than sole proprietorships or single-member LLCs.

- Key Requirements Include:

- Issuing Schedule K-1s to each owner annually

- Tracking owner basis (investment in the business)

- Maintaining accurate capital accounts

- Complying with partnership agreements or S corp rules

- Filing Forms:

- Partnerships: Form 1065

- S Corporations: Form 1120S

- Impact: Mistakes in K-1s, distributions, or basis calculations may result in IRS penalties or audit risks.

5. Entity Structure Limitations

While pass-through entities provide flexibility, each type has inherent restrictions that can impact growth or operations:

- S Corporations:

- Must limit shareholders to 100 U.S. persons

- Cannot issue multiple classes of stock

- Restrictions on foreign ownership

- Partnerships and LLCs:

- May face difficulties raising capital from outside investors

- Often lack the perceived credibility of a traditional corporation

- Sole Proprietorships:

- Offer no liability protection

- Not separate from the owner for legal purposes

6. State-Level Tax Variability

State tax treatment of pass-through entities can differ widely from federal rules.

- Some states:

- Do not conform to the QBI deduction

- Impose franchise taxes or entity-level fees

- Require composite returns for nonresident owners

- Examples:

- California imposes an LLC fee based on gross receipts.

- New York imposes the Metropolitan Transportation Business Tax (MTA tax) on partnerships in NYC.

Result: State-level pass-through taxation may reduce or offset federal-level benefits.

7. Exposure to IRS Scrutiny

Pass-through entities—especially those claiming the QBI deduction or classifying income to avoid self-employment tax—may face increased audit risk.

- Red Flags Include:

- Unreasonably low salaries in S corporations

- Discrepancies in K-1 reporting

- Misclassification of passive vs. active participation

- Impact: Errors or aggressive tax positions may lead to audits, penalties, or reclassification by the IRS.

8. Limited Access to Fringe Benefits

Owners of pass-through entities (especially S corporations) may not qualify for certain tax-free fringe benefits that are commonly available to C corporation employees.

- Not fully deductible for owners/shareholders:

- Health insurance premiums (for >2% S corp shareholders)

- Group-term life insurance

- Cafeteria plans

- C Corporation Advantage: C corps can fully deduct these costs and offer more robust employee benefits tax-free.

9. Not Ideal for Retaining Earnings

Because profits are passed through and taxed at the owner level, pass-through entities are not well suited for long-term profit retention.

- Impact: Owners pay tax on earnings even if those profits are kept in the business rather than distributed.

- Contrast with C Corps: C corporations can retain earnings without triggering personal-level tax until dividends are paid.

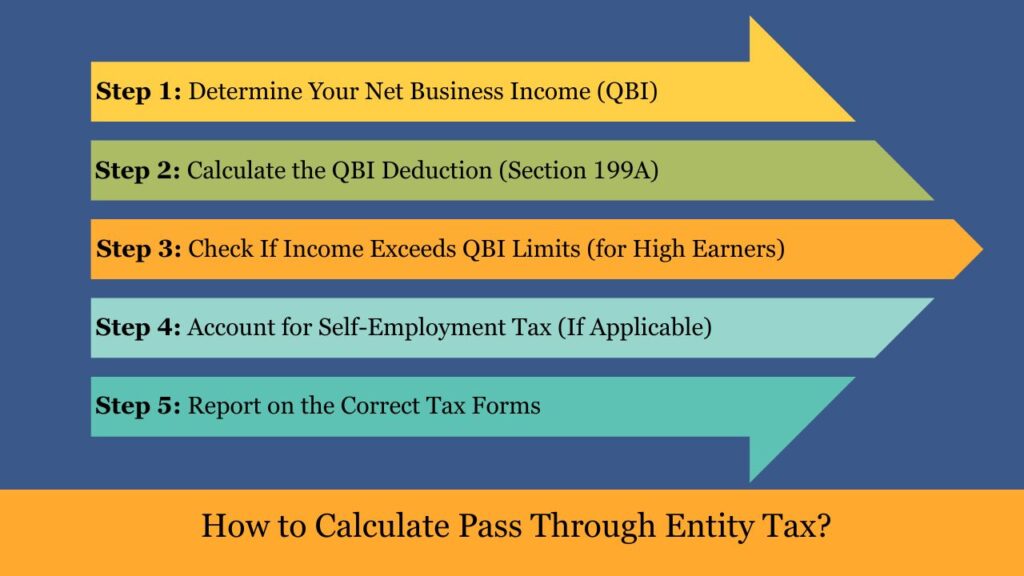

How to Calculate Pass Through Entity Tax?

Pass-through taxation requires owners to report business income, losses, deductions, and credits on their individual tax returns (typically Form 1040). The key steps to calculate total tax liability for pass-through income include:

Step 1: Determine Your Net Business Income (QBI)

This is your business’s profit after deducting all ordinary and necessary business expenses.

- For sole proprietors or single-member LLCs:

Use Schedule C (Form 1040) to calculate:

NetProfit=Gross Income – Business Expenses

- For partnerships or S corporations:

You’ll receive a Schedule K-1, showing your share of:- Ordinary business income (Box 1)

- Guaranteed payments (Box 4)

- Deductions (Boxes 12–13)

Note: QBI excludes:

- Wages and guaranteed payments to partners

- Capital gains/losses

- Dividend or interest income not related to the business

Step 2: Calculate the QBI Deduction (Section 199A)

Most pass-through business owners can deduct up to 20% of their Qualified Business Income, subject to limitations.

Basic Formula (for taxpayers below the income threshold):

If your overall taxable income falls beneath the threshold where the QBI deduction begins to phase out:

- Single: $191,950

- Married filing jointly: $383,900

Then your deduction is simple:

QBIDeduction=20% × QBI

Example:

- Net business income (QBI): $100,000

- Filing status: Single

- Taxable income (before QBI deduction): $150,000

QBI Deduction = 20% × $100,000 = $20,000

Your taxable income is reduced to:

$150,000 –$20,000 =$130,000

Step 3: Check If Income Exceeds QBI Limits (for High Earners)

If your taxable income exceeds the thresholds, you’ll need to apply wage and property tests, especially if you’re in a non-SSTB (non-service business):

W-2 Wage / Property Test:

The amount you can claim for the QBI deduction is capped at the lower of the two calculated limits:

- 20% of QBI

OR - The greater of:

- 50% of W-2 wages paid by the business

OR

- 25% of W-2 wages + 2.5% of the unadjusted basis of qualified property

- 50% of W-2 wages paid by the business

Example:

- QBI = $200,000

- W-2 wages paid = $60,000

- No qualified property

20% of QBI = $40,000

50% of W-2 wages = $30,000

So, deduction = $30,000

Step 4: Account for Self-Employment Tax (If Applicable)

Self-employment tax applies to active income from:

- Sole proprietors

- General partners

- Members of LLCs (unless treated as S corp shareholders)

Self-Employment Tax Rate (2024–2025):

- 15.3% total

- 12.4% Social Security tax, applied to earnings up to the $168,600 limit for 2024

- 2.9% for Medicare (no wage limit)

- Additional 0.9% Medicare surtax for high earners

Self-Employment Tax Calculation:

Use Schedule SE (Form 1040).

You only pay SE tax on 92.35% of net business income:

SEIncome=Net Profit ×92.35%

SETax=SE Income ×15.3%

Example:

- Net business income: $100,000

- SE income: $100,000 × 92.35% = $92,350

- SE tax = $92,350 × 15.3% = $14,127.55

You’re allowed to claim a deduction for 50% of your self-employment tax—about $7,064—on your Form 1040.

Step 5: Report on the Correct Tax Forms

| Form | Purpose |

| Schedule C | Reports profit/loss for sole proprietors/LLCs |

| Schedule SE | Calculates self-employment tax |

| Form 1040 | Your main individual tax return |

| Schedule E | Reports income from partnerships or S corps |

| Schedule K-1 | Provides your share of pass-through income |

| Form 8995/8995-A | Calculates QBI deduction |

Summary: Sample Calculation

Let’s say you’re a single-member LLC owner in 2024 with the following:

| Item | Amount |

| Net Business Income (QBI) | $100,000 |

| SE Taxable Income (92.35%) | $92,350 |

| SE Tax (15.3%) | $14,127.55 |

| Deduction for SE Tax (50%) | $7,063.78 |

| QBI Deduction (20% of QBI) | $20,000 |

| Adjusted Taxable Income = | $100,000 – $20,000 – $7,063.78 = $72,936.22 |

This is the taxable amount you report on Form 1040 (excluding other deductions/credits).

Pass-Through Entities vs. C Corporations

| Feature | Pass-Through Entity | C Corporation |

| Taxation Level | Income taxed at the owner level | Taxed at entity level (21%) + again on dividends |

| QBI Deduction | Eligible (up to 20%) | Not eligible |

| Governance | Fewer formalities required | Must follow strict corporate governance |

| Profit Retention | Taxed to owner whether distributed or not | Can retain earnings without owner tax |

| Best Suited For | Freelancers, small businesses, professionals | Startups, large corporations, investors |

Pass Through Entity- Single Member LLC Calculator

If you are a Single Member LLC and want to calculate your estimated taxable income, then here it is. You only need to enter your net business income (QBI) in dollars to generate the final estimated taxable income. It’s free & super easy, You must give it a try.

Note: This Calculator is only for Single Member LLC

Conclusion

Pass-through entities offer business owners the benefit of simplified taxation, operational flexibility, and the opportunity to claim the QBI deduction, potentially saving thousands of dollars each year. However, choosing the right entity type, managing income levels, and complying with IRS requirements are essential to maximize these tax advantages.

For professionals, freelancers, and small businesses, a pass-through structure may be ideal—while larger, investment-backed enterprises might benefit more from the corporate structure.

Frequently Asked Questions (FAQs)

What is a pass-through entity?

A business that doesn’t pay corporate tax—income flows to owners’ personal tax returns.

Which businesses qualify?

Sole proprietorships, partnerships, LLCs, S corps, and certain trusts/estates.

Do pass-throughs pay federal income tax?

No. The business doesn’t pay income tax directly—owners are taxed on their portion of the earnings through their personal returns.

What forms are used?

-Sole props: Schedule C

-Partnerships: Form 1065 + K-1

-S Corps: Form 1120S + K-1

-Personal: Form 1040

What’s the QBI deduction?

A tax break of up to 20% of qualified business income (QBI) for pass-through owners.

Who qualifies for QBI deduction?

Those with eligible business income under:

-$191,950 (Single)

-$383,900 (MFJ)

Do I pay self-employment tax?

Yes, if you’re a sole proprietor, partner, or LLC member (not S corp shareholder on distributions).

What’s a Schedule K-1?

A form showing your share of income from a pass-through, used on your personal return.

Taxed if I didn’t get paid?

Yes—you pay tax on allocated profits even without cash distributions.

Can I deduct business losses?

Yes, but subject to IRS limits (at-risk, passive loss, excess loss rules).

Mr. Nadeem Patel is an MBA graduate with a specialization in market research, bringing a sharp analytical mindset and strong research skills to the field of taxation and finance. Known for his efficiency and attention to detail, he has successfully published research work in the United States, reflecting his commitment to data accuracy and insightful analysis. Mr. Patel contributes well-researched, reader-friendly content that bridges market insights with U.S. tax-related topics, helping users make informed financial decisions.