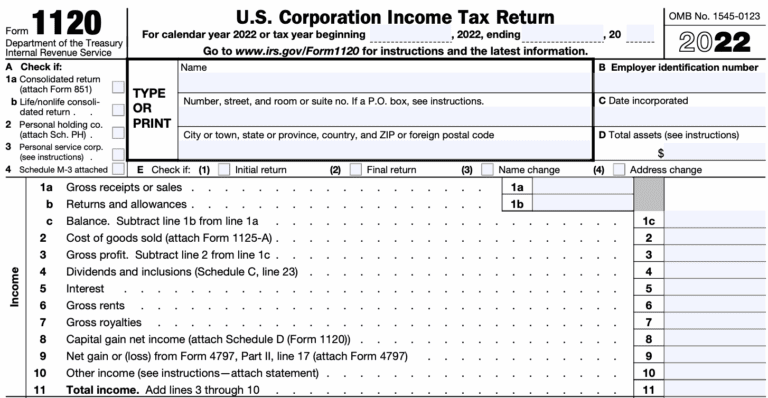

How To File Extension For Form 1120? Best Detailed Overview

Table of Contents

How To File Extension For Form 1120-Step By Step Guide

Here is a step by step guide on “How To File Extension For Form 1120”.

Step 1: Get the Right Form

Download IRS Form 7004, titled “Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns.”

You can also file Form 7004 electronically via IRS-authorized e-file providers.

Step 2: Complete the Header Section

Include:

- Corporation’s full legal name

- EIN (not SSN)

- Business address

- Type of return: For C corporations, select Form 1120 (Box 1, Code 12).

Make sure the tax year matches your accounting year (e.g., calendar year ending Dec 31).

Step 3: Estimate Your Total Tax Liability

In Part II of Form 7004, you must provide:

- Line 5: Tentative total tax liability for the tax year.

- Line 6: Total payments and credits already made.

- Line 7: Balance due (if any). You should pay this amount with your extension request.

Even though the IRS gives you time to file your return, you must still pay the full tax amount due by the original due date to avoid penalties and interest.

Step 4: File Form 7004 by the Due Date

For calendar-year C corporations, Form 7004 must be filed on or before April 15 (or the 15th day of the 4th month after the close of your fiscal year).

You can file:

- Electronically (E-File): Through IRS-approved software or your CPA/tax advisor

- By Mail: Send to the appropriate IRS address based on your state (check Form 7004 instructions)

E-filing is preferred: It’s faster, more accurate, and provides confirmation of receipt.

How to Make a Payment With 1120 Extension

You can pay the balance due using:

- IRS Direct Pay (ACH transfer from a checking/savings account)

- Electronic Federal Tax Payment System (EFTPS)

- Wire transfer

- Credit/Debit card (via IRS-approved payment processors)

Use Form 7004-V as a payment voucher if mailing a check or money order.

How to Calculate Corporate Tax for Form 1120 When Filing an Extension

Filing an extension using Form 7004 gives corporations extra time (usually 6 months) to file the full Form 1120 tax return, but it does not extend the time to pay any taxes owed. Therefore, it’s crucial to estimate your tax liability accurately and pay it by the original deadline to avoid penalties and interest.

Step-by-Step Process to Calculate Tax Before Filing an Extension

1. Estimate Taxable Income

- Use your financial statements (income statement, balance sheet, etc.) for the tax year.

- Calculate gross income (sales, services, dividends, interest).

- Subtract allowable deductions such as:

- Cost of goods sold (COGS)

- Operating expenses

- Depreciation and amortization

- Charitable contributions (subject to limits)

- Employee salaries and benefits

- Interest expenses (within IRC limits)

2. Calculate Taxable Income

- Adjust gross income by deductions to arrive at taxable income.

- Account for net operating losses (NOLs) carried forward or back.

- Factor in any special tax credits (R&D credits, foreign tax credits).

3. Apply the Corporate Tax Rate

- The current flat federal corporate tax rate is 21% (as of 2018 Tax Cuts and Jobs Act).

Estimated Tax Liability = Taxable Income × 21%

For example, if taxable income is $500,000:

500,000 × 0.21 = 105,000

4. Include Estimated Tax Payments Already Made

- Subtract any quarterly estimated tax payments your corporation has already made during the tax year.

5. Determine Amount Due With Extension

- If you owe additional tax, this amount should be paid by the original filing deadline (typically April 15 for calendar-year corporations).

- Failure to pay can result in late payment penalties and interest, even if you file Form 7004 for an extension.

6. File Form 7004 and Pay Estimated Tax

- File Form 7004 by the original due date to get an extension on the filing deadline.

- Submit your estimated tax payment electronically via EFTPS, IRS Direct Pay, or by check.

Important Notes:

- Form 7004 does not grant an extension to pay taxes—only to file the return.

- Interest and penalties on late payments begin accruing from the original tax due date.

- Overestimating your tax can result in excess payment but will be refunded or credited in your final return.

Summary Table:

| Step | Action | Notes |

| 1. Estimate taxable income | Use financial statements | Include all income and deductions |

| 2. Calculate taxable income | Adjust for losses & credits | Apply NOLs, tax credits, etc. |

| 3. Apply 21% corporate tax | Calculate estimated tax liability | Flat rate since 2018 |

| 4. Subtract estimated payments | Reduce tax due | Account for prior payments |

| 5. Pay estimated tax | Pay by original due date | To avoid penalties & interest |

| 6. File Form 7004 | File by original due date | Gets 6-month filing extension |

Consequences of Not Filing or Paying IRS Form 1120/1120-S on Time

Failing to file or pay your corporate taxes on time can result in serious financial penalties, interest charges, and legal risks. The IRS treats corporations—both C corporations (Form 1120) and S corporations (Form 1120-S)—as responsible entities that must adhere strictly to tax deadlines.

Here’s a breakdown of what can happen if you miss your tax deadlines:

1. Late Filing Penalty (Form 1120)

For C corporations filing Form 1120, the IRS imposes a late filing penalty if the return is not submitted by the due date, including extensions.

- Penalty Amount: 5% of the unpaid tax per month or part of a month, up to a maximum of 25%.

- If the return is over 60 days late, the minimum penalty is the lesser of:

- The tax due, or

- $485 (for returns due in 2024 and beyond; adjusted for inflation)

Important: Even if you owe no tax, you may still be penalized for failing to file.

2. Late Filing Penalty (Form 1120-S)

For S corporations filing Form 1120-S, the penalty is calculated per shareholder.

- Penalty Amount: $245 per shareholder per month, up to 12 months

- Applies if the return is:

- Filed late

- Filed inaccurately

- Missing required schedules (like Schedule K-1)

This penalty is particularly harsh for S corps with many shareholders, where the total fine can be significant even if no taxes are owed.

3. Failure to Pay Penalty

If your corporation does not pay its full tax liability by the due date (generally April 15 for calendar-year corporations), the IRS assesses a failure-to-pay penalty.

- Penalty Rate: 0.5% of unpaid taxes per month, up to a maximum of 25%

- This penalty continues to accrue until the tax is paid in full

Tip: Even if you can’t file on time, paying your estimated taxes by the due date can reduce or eliminate this penalty.

4. Interest on Unpaid Taxes

In addition to penalties, the IRS charges interest on any unpaid tax from the original due date until the tax is paid in full.

- The interest rate is typically the federal short-term rate + 3%

- Interest compounds daily

This means even a small unpaid balance can snowball into a large liability over time if left unaddressed.

5. Loss of Good Standing or Business Licenses

Failure to file corporate taxes may result in:

- Revocation of your corporation’s good standing with your state

- Ineligibility to renew business licenses

- Denial of business loans or government contracts

- Negative impact on your corporate credit profile

6. Increased Audit Risk

The IRS may flag businesses that:

- Fail to file consistently

- Underreport income or overstate deductions

- Do not submit required Schedules (e.g., K-1s)

Late or non-filing increases the risk of a comprehensive IRS audit, which can result in adjustments, penalties, and years of scrutiny.

7. Criminal Charges in Severe Cases

While rare, willful failure to file or pay taxes—especially if fraud is involved—can result in:

- Criminal prosecution

- Fines up to $25,000 for corporations

- Potential imprisonment of responsible individuals under IRC §7201, §7203

These consequences apply if there is a pattern of evasion or intentional misconduct.

Summary Table: Consequences at a Glance

| Action Missed | Penalty | Maximum Penalty | Other Consequences |

| Late Filing (1120) | 5% per month | 25% | $485 minimum if >60 days late |

| Late Filing (1120-S) | $245/shareholder/month | 12 months | Even if no tax owed |

| Late Payment | 0.5% per month | 25% | Interest continues until paid |

| Unpaid Tax Interest | Daily compounding | No limit | Based on federal rate + 3% |

| Repeated Non-Compliance | — | — | Audit risk, revoked licenses, legal action |

Summary

Missing your IRS Form 1120 or 1120-S filing or payment deadlines can be extremely costly—even if your corporation isn’t profitable. Penalties are steep, interest is unavoidable, and your legal and financial standing can be jeopardized.

Filing for an extension (Form 7004) and paying at least your estimated tax on time is the best way to stay compliant, avoid penalties, and protect your business from escalating tax trouble.

Quick Filing & Payment Calendar for IRS Forms 1120

Form 1120 For C Corporations

| Action | Deadline (Calendar-Year C Corp) | Notes |

| File Form 1120 | April 15 | If fiscal year ends Dec 31 |

| Pay Corporate Taxes Due | April 15 | Payment is due regardless of extension |

| File for Extension (Form 7004) | April 15 | Grants automatic 6-month extension to October 15 |

| Extended Filing Deadline | October 15 | File return by this date if extension was approved |

| Q1 Estimated Tax Payment | April 15 | First corporate estimated tax installment |

| Q2 Estimated Tax Payment | June 15 | Second installment |

| Q3 Estimated Tax Payment | September 15 | Third installment |

| Q4 Estimated Tax Payment | December 15 | Final installment |

Filing Form 7004 to Extend Form 1120 (C Corporation)

Corporation Details:

- Name: Apex Innovations Inc.

- EIN: 12-3456789

- Tax Year: Calendar Year (Jan 1, 2024 – Dec 31, 2024)

- Original Filing Deadline: April 15, 2025

- Form to Extend: Form 1120

- Estimated Taxable Income: $400,000

- Estimated Payments Made in 2024: $50,000

Step-by-Step Breakdown:

Step 1: Estimate Taxable Income

Apex Innovations Inc. used internal accounting to estimate that their taxable income for 2024 is $400,000.

Step 2: Apply Corporate Tax Rate

The current federal corporate tax rate is 21%:

$400,000×0.21=$84,000

Estimated Tax Liability: $84,000

Step 3: Subtract Prior Payments

Apex Innovations already made $50,000 in estimated tax payments throughout 2024:

$84,000−$50,000=$34,000

Balance Due With Extension: $34,000

Step 4: Complete Form 7004

- Part I: Check Box 01 for Form 1120

- Part II:

- EIN: 12-3456789

- Business Name: Apex Innovations Inc.

- Address: 123 Growth Blvd, Austin, TX

- Line 2: 01/01/2024 to 12/31/2024

- Line 6: $84,000 (total estimated tax)

- Line 7: $50,000 (estimated tax paid)

- Line 8: $34,000 (amount due with extension)

Step 5: Submit Payment

Apex Innovations pays $34,000 to the IRS by April 15, 2025, using:

- EFTPS (Electronic Federal Tax Payment System)

Step 6: File Form 7004

- Filed electronically using tax software or with a CPA

- IRS does not issue confirmation, but filing on time ensures a 6-month extension

- New deadline to file Form 1120: October 15, 2025

Summary Recap

| Step | Item | Amount |

| Estimated Taxable Income | — | $400,000 |

| Estimated Tax Owed (21%) | — | $84,000 |

| Estimated Payments Made | — | $50,000 |

| Balance Due with Form 7004 | — | $34,000 |

| Deadline to Pay | — | April 15, 2025 |

| Extended Filing Due Date | — | October 15, 2025 |

Conclusion: Be Proactive, Not Reactive

Filing an extension is a smart move for C corporations that want to avoid rushed, error-prone filings. But remember: an extension to file is not an extension to pay. Be proactive — file Form 7004 on time, estimate and pay your tax liability, and use the extended time wisely to prepare a complete and compliant Form 1120 return.

Frequently Asked Questions (FAQs)

Q1: Can I file Form 7004 after the original due date?

No. It must be filed on or before the due date of the original return (e.g., April 15 for calendar-year corporations).

Q2: Does the IRS charge for filing Form 7004?

No. There is no fee, though you may incur costs if using professional tax software or advisors.

Q3: How do I know if my extension was accepted?

If you e-file Form 7004, you’ll receive a confirmation. If mailing, there is no direct acknowledgment unless the IRS contacts you.

Q4: Can penalties be waived if I missed the deadline?

Yes, in rare cases. Reasonable cause and good-faith efforts must be documented when requesting a penalty abatement.

Q5: Do S corporations also use Form 7004?

Yes, S corporations filing Form 1120-S use Form 7004 as well, but the original due date for them is typically March 15, not April 15.