How To File An Extension For Form 1120s- Best Explanation

Table of Contents

How To File An Extension For Form 1120s: Complete Overview

Here we discuss a complete procedure on “How To File An Extension For Form 1120s?”. If your business is structured as an S Corporation, you must file IRS Form 1120-S to report income, deductions, and shareholder information. But if you need more time to file your return, the IRS allows you to request an automatic 6-month extension by submitting Form 7004.

What Is the Extension for Form 1120-S? & How To File An Extension For Form 1120s?

Form 7004 is the IRS application used to request an extension of time to file various business tax forms, including Form 1120-S. This extension provides six additional months to complete and submit your tax return — but it does not extend the deadline to pay any taxes owed by shareholders.

When Is the Deadline?

For calendar-year S Corporations, the deadline to file Form 1120-S is typically:

- March 15 of the following year

- Therefore, to request an extension, Form 7004 must be filed by March 15

Once filed and accepted, the extended deadline is September 15.

Who Can File an 1120-S Extension?

Any S Corporation in good standing can file Form 7004 to request an extension for:

- Timely filing Form 1120-S

- Providing Schedule K-1s to shareholders

Keep in mind:

- This extension applies only to the filing, not to tax payment obligations passed through to shareholders.

- Shareholders may still owe personal taxes by April 15 and should estimate and pay accordingly.

Step-by-Step Process to File an Extension for Form 1120-S

Step 1: Determine If an Extension Is Needed

You should request an extension if:

- Your Form 1120-S won’t be ready by the due date (March 15 for calendar-year S Corps).

- You need more time to accurately prepare and issue Schedule K-1s to shareholders.

Note: The extension applies only to the filing deadline, not to payment of taxes owed by shareholders.

Step 2: Complete IRS Form 7004

Form 7004 is used to request an automatic 6-month extension to file Form 1120-S.

Form 7004 includes

- Part I: Check box “25” to indicate Form 1120-S

- Part II:

- Business information (name, EIN, address)

- Tax year (calendar or fiscal)

- Estimate of total income and pass-through earnings

- Amount of any payments already made

- Balance due (if applicable – rare for S Corps unless there’s built-in gains tax or excess net passive income tax)

Step 3: Estimate Tax Liability (If Applicable)

While S corporations generally do not pay federal income tax, there are exceptions, such as:

| Exception | Tax Type | Example Calculation |

| Built-In Gains Tax (BIG) | Tax on appreciated assets sold within 5 years of switching from C Corp to S Corp | 21% of gain |

| Excess Net Passive Income Tax | If passive income > 25% of gross receipts | 21% on excess |

| LIFO Recapture Tax | Due in first year of S election | Based on LIFO reserve inclusion |

For these rare scenarios, the S Corp must calculate the applicable tax and pay it with Form 7004.

Step 4: File Form 7004 by the Original Deadline

- Deadline: March 15 (calendar-year S Corps)

- Filing Options:

- E-File using IRS-approved tax software

- Mail the paper form (certified mail is recommended)

Step 5: Provide Estimated Schedule K-1s (Optional but Advisable)

If the extension delays delivery of final Schedule K-1s, you should provide estimated figures to shareholders so they can still file their personal returns or request their own extensions (Form 4868).

Tax Payment Rules for S Corporations

- S Corporations typically have no federal income tax liability, so Form 7004 often requires no payment.

- However, if one of the special taxes (like BIG or excess passive income tax) applies, the S Corp must pay by March 15, even if filing Form 7004.

Penalties for Late Filing or Non-Compliance

Failing to file IRS Form 1120-S on time or failing to meet its compliance requirements can lead to significant IRS penalties, even when the S corporation owes no federal income tax. The most common penalty is for late filing, which amounts to $220 per shareholder per month, up to a maximum of 12 months. This means that a multi-shareholder S corporation can face thousands of dollars in penalties for just a few months of delay. Additionally, the IRS imposes separate penalties for failing to furnish Schedule K-1s to shareholders on time, which is currently $290 per K-1.

If an S corporation owes certain special taxes—such as the built-in gains tax or excess net passive income tax—failing to pay these by the original due date (typically March 15 for calendar-year filers) can result in interest charges and additional late payment penalties. Moreover, failing to timely file Form 7004 for an extension invalidates the extension request, resulting in the return being considered late. These penalties highlight the importance of timely and accurate compliance with all 1120-S filing obligations.

| Type of Non-Compliance | Penalty |

| Late Filing of Form 1120-S | $220 per shareholder per month, up to 12 months |

| Late or Missing Schedule K-1s | $290 per K-1 not timely filed with IRS (2025 rate) |

| Underpayment of Tax | Interest + penalties if S Corp fails to pay applicable taxes on time |

| Failure to File Form 7004 by Deadline | Loss of extension; all filing is considered late |

Example Penalty

If a 3-member S Corp files 3 months late without an extension:

3 shareholders×3 months×$220=$1,980

Compliance Best Practices

- File Form 7004 on Time: Ensure submission by March 15 to avoid automatic penalties.

- Document Estimated Income: Keep internal documentation for pass-through earnings used to estimate Schedule K-1s.

- Communicate With Shareholders: Let them know about the extension and their own tax obligations.

- Avoid Underpayment: If special taxes apply, estimate and pay with Form 7004.

- Confirm Receipt: Always get confirmation of electronic filing or use certified mail for paper submissions.

Extension Timeline Summary

| Action | Date (Calendar Year) |

| Form 1120-S Original Deadline | March 15, 2025 |

| Form 7004 Due Date | March 15, 2025 |

| Extended Filing Deadline | September 15, 2025 |

| Shareholder Tax Payment Due | April 15, 2025 |

Example of Extension Filing

Business Info:

- S Corporation: Sunrise Digital LLC

- Tax Year: Jan 1 – Dec 31, 2024

- Filing Deadline: March 15, 2025

Steps:

- Estimate business income and pass-through earnings

- File Form 7004 electronically or by mail by March 15, 2025

- Provide shareholders with estimated Schedule K-1 figures if necessary

- File full Form 1120-S by September 15, 2025

Important Notes:

- No tax is paid at the S corporation level, but shareholders are responsible for taxes on their share of income.

- Failure to file Form 7004 on time results in late-filing penalties: typically $220 per shareholder per month, up to 12 months.

- Shareholders should still pay estimated taxes by April 15, even if the K-1 is not finalized.

Bottom Line

Filing a Form 1120-S extension via Form 7004 is a straightforward way to gain more time to complete an accurate tax return and distribute K-1s. However, it’s critical to file by the original deadline and ensure that shareholders are informed of their tax responsibilities to avoid penalties. This extension is a helpful tool, but it should be used wisely and in coordination with both tax professionals and shareholders.

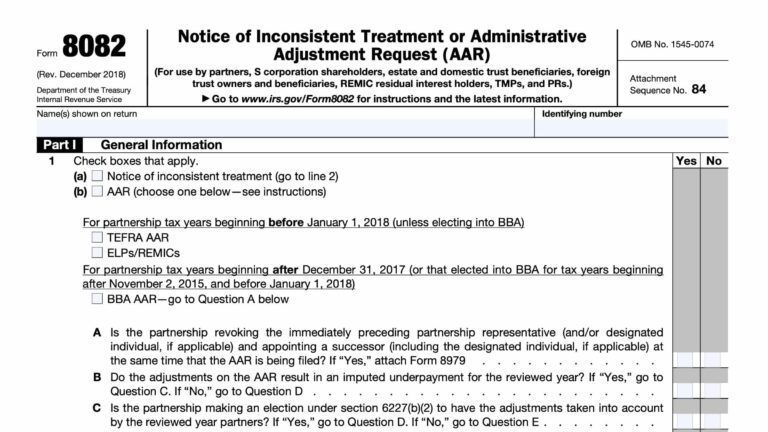

Form 1120 v/s 1120s: What Sets Them Apart

Form 1120 and Form 1120-S are both U.S. corporate income tax returns, but they cater to different entity types and reflect vastly different tax treatments. Form 1120 is used by C corporations, which are taxed as separate entities and are subject to the flat corporate tax rate of 21% on their profits. These corporations may also face double taxation, where earnings are taxed at the corporate level and again at the shareholder level when distributed as dividends.

In contrast, Form 1120-S is filed by S corporations, which are pass-through entities. This means the corporation itself typically does not pay income taxes; instead, profits and losses are passed through to shareholders, who report them on their individual tax returns. This structure avoids double taxation and is often favored by small businesses and closely held companies.

Another key distinction lies in the compliance and shareholder structure. S corps are limited to 100 shareholders, must be U.S. citizens or residents, and can only issue one class of stock. Meanwhile, C corps face no such restrictions, making them more suitable for larger businesses or those seeking investment from foreign or institutional shareholders.

In short, Form 1120 is about entity-level taxation, while Form 1120-S supports pass-through taxation, each aligned with unique strategic, financial, and compliance considerations.

Summary Table

| Feature | Form 1120 (C Corp) | Form 1120-S (S Corp) |

| Entity Type | C Corporation (taxable entity) | S Corporation (pass-through entity) |

| Original Filing Deadline | April 15 (calendar year) | March 15 (calendar year) |

| Extended Filing Deadline | October 15 | September 15 |

| Tax Due With Extension | Tax must be paid by April 15 | No entity-level tax due (except in rare cases) |

| Impact on Owners | Corporation pays federal tax | Shareholders pay tax on passed-through income |

| Penalties | Late filing or underpayment triggers IRS penalties | Penalties for each late Schedule K-1 per shareholder |

Example Comparison

| Example | C Corp (Form 1120) | S Corp (Form 1120-S) |

| Files Form 7004 on | April 10 | March 10 |

| Extension granted to | October 15 | September 15 |

| Tax Due | Must pay estimated corporate tax by April 15 | No entity tax, but shareholders must pay taxes by April 15 |

FAQs – Form 1120-S Late Filing & Compliance

1. What happens if I file Form 1120-S late?

If you file Form 1120-S after the due date (typically March 15 for calendar-year corporations) without a valid extension, the IRS imposes a penalty of $220 per shareholder per month, up to 12 months—even if no tax is due.

2. Is there a penalty if the S corporation owes no taxes?

Yes. S corporations are still subject to late filing penalties even if they don’t owe federal income tax, due to the requirement to report and furnish Schedule K-1s.

3. What if I forget to file an extension using Form 7004?

Failing to file Form 7004 by the original deadline (March 15) invalidates the extension, and your Form 1120-S will be treated as late, triggering penalties.

4. What is the penalty for not providing Schedule K-1s to shareholders?

The penalty is $290 per K-1 for failing to furnish Schedule K-1s on time (2025 amount), which can be assessed in addition to the filing penalty.

5. How long is the extension period for Form 1120-S?

The IRS grants an automatic 6-month extension when Form 7004 is properly filed by the original due date. For calendar-year S corporations, that moves the deadline from March 15 to September 15.

6. Do shareholders get penalized if the S corporation files late?

Shareholders are not penalized directly by the IRS, but delays in K-1 delivery may affect their ability to file personal tax returns, possibly requiring their own extensions (Form 4868).

7. Can late filing penalties be waived?

In some cases, the IRS may waive penalties for reasonable cause, such as natural disasters, serious illness, or circumstances beyond control. However, first-time abatement is generally not available for Form 1120-S.

8. Does e-filing Form 1120-S reduce the risk of late penalties?

Yes. E-filing is faster, timestamped, and more reliable. It reduces the risk of mailing delays and offers immediate confirmation of submission.

9. Are penalties assessed per return or per shareholder?

Penalties are assessed per shareholder for each month the return is late, making the total penalty grow quickly for corporations with multiple shareholders.

10. Can I still file if the deadline has passed?

Yes, but the return will be considered late. You should file as soon as possible to reduce monthly penalty accruals and consider requesting penalty relief if applicable.