How Carried Interest Works- Best Step By Step Guide In 2025

Table of Contents

A Comprehensive Guide On Carried Interest

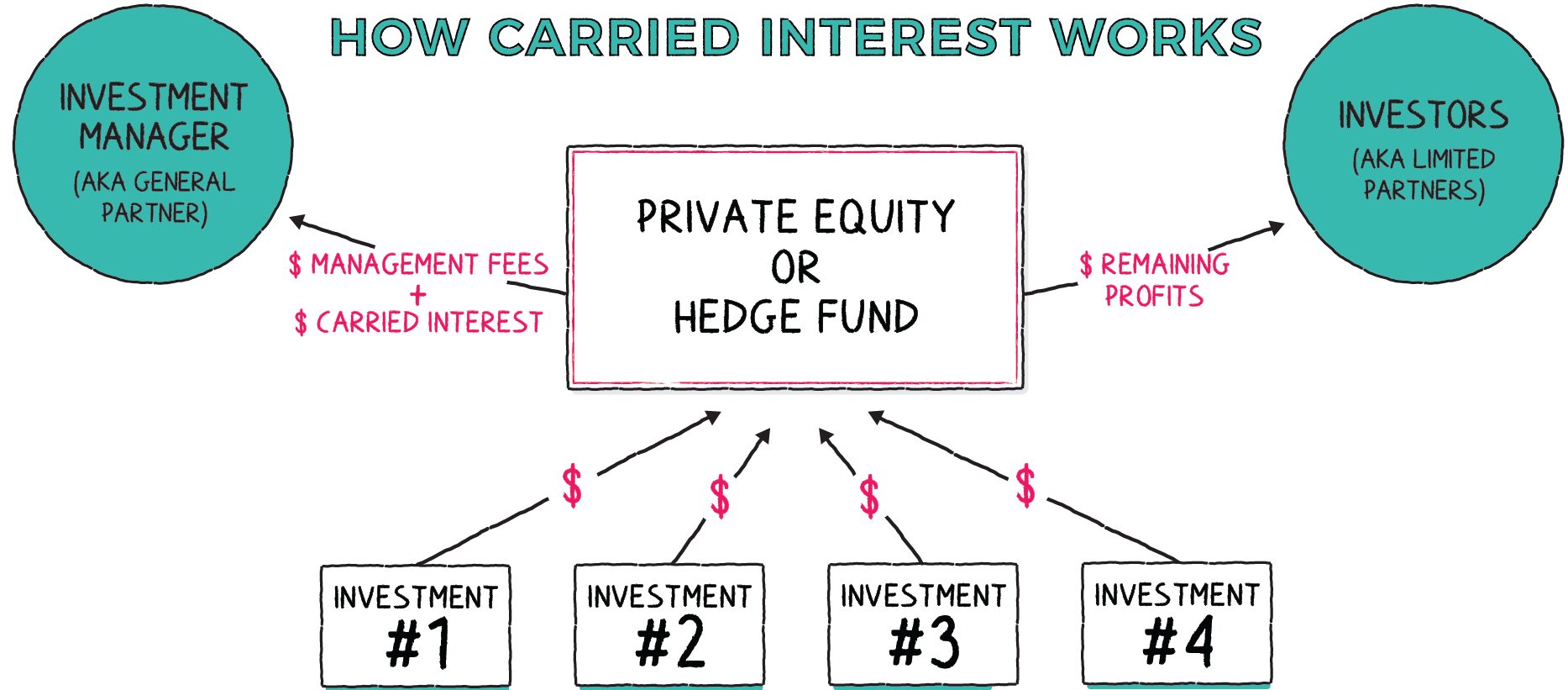

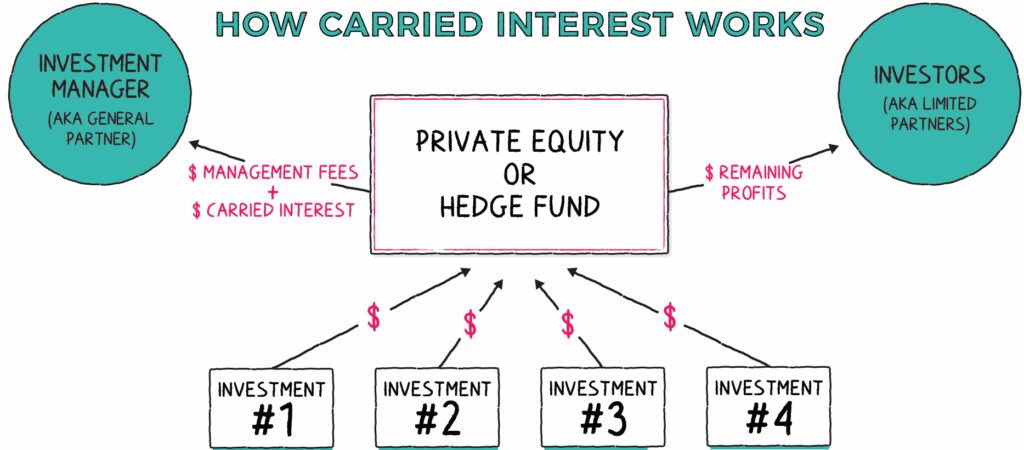

How Carried Interest Works?

Are you willing to know about, How carried interest works?, then this comprehensive guide is only for you. Carried interest (often called “carry”) is the share of profits that a General Partner (GP) or fund manager earns as compensation for managing an investment fund — typically without investing a corresponding amount of capital.

It is not a salary or management fee, but rather an incentive-based return tied to the fund’s performance.

Effect of Carried Interest on Fund Accounting

Carried interest has a unique and significant impact on the accounting structure of private equity, hedge funds, and venture capital funds. Unlike standard business expenses, carried interest is a profit reallocation, not a cost — and that distinction governs how it is reflected in a fund’s financials.

How It Works – Step-by-Step Breakdown

1. Fund Formation

- A private equity or venture capital fund is created as a limited partnership (LP).

- Investors (LPs) contribute most of the capital.

- Fund managers (GPs) contribute a small portion (often 1–5%).

2. Investment Period

- The GP uses the committed capital to invest in companies or assets.

- The goal is to grow the value of those assets over several years.

3. Hurdle Rate

- Many funds include a preferred return (usually 6–8%) that LPs must receive before the GP gets carried interest.

- This ensures LPs get a minimum return on their investment first.

4. Profit Realization

- After investments are exited (e.g., IPOs, acquisitions), profits are distributed:

- LPs get their invested capital back

- Then receive their preferred return

- After that, remaining profits are split, typically:

- 80% to LPs

- 20% to GP as carried interest

5. Tax Treatment

- Carried interest is taxed as a capital gain (typically 20%) if the asset was held for over 3 years (per IRC Section 1061).

- This favourable tax rate is much lower than ordinary income tax rates (which can exceed 37%).

Example of Carried Interest in Action

Let’s say a PE fund:

- Raises $100 million from investors.

- Invests in companies and earns $40 million in total profit after several years.

- LPs first get their $100 million back and a preferred return of $8 million.

- That leaves $32 million in remaining profits.

If the GP has a 20% carried interest:

- GP gets $6.4 million (20% of $32 million)

- LPs get $25.6 million (80%)

The GP pays capital gains tax on the $6.4 million (assuming the holding period is met).

Carried Interest in a Partnership Structure

Most private investment funds are structured as limited partnerships (LPs) or limited liability companies (LLCs) taxed as partnerships. In these structures:

- The General Partner (GP) manages the fund and may receive management fees and carried interest.

- The Limited Partners (LPs) are passive investors who provide most of the capital.

- The fund itself does not pay income tax — it is a pass-through entity. All income, gains, losses, and deductions “flow through” to the partners based on their ownership and profit-sharing agreements.

How Carried Interest Flows in Fund Accounting

Carried interest doesn’t appear as a typical expense or income item in fund accounting. Instead, it functions as a reallocation of partnership profits from the Limited Partners (LPs) to the General Partner (GP), based on the fund’s performance. Carried interest operates as an internal profit reallocation, rather than a line-item expense. Here’s how it affects a fund’s books:

1. Profit Recognition

The fund recognizes total net income from its investments after deducting operating expenses (management fees, legal, audit, etc.).

2. Hurdle Rate Application

Many funds include a preferred return (usually 6–8%) that LPs must receive before the GP gets carried interest. This ensures LPs get a minimum return on their investment first. Before carried interest is allocated, many fund agreements require a preferred return (e.g., 8%) be distributed to LPs.

Let’s assume:

- LPs contributed $100 million.

- Preferred return (hurdle): 8% = $8 million.

This $8 million is distributed to LPs before the GP can earn any carried interest.

3. Carried Interest Allocation

Once the LPs receive their preferred return: Remaining profits are split (typically 80/20) between LPs and GP. The 20% to GP is carried intrerest, allocated directly as a capital account increase (not a fee).

Suppose $42 million remains after the hurdle return:

- GP receives 20% of $42 million = $8.4 million (carried interest)

- LPs receive 80% of $42 million = $33.6 million

Important: This is an allocation, not a payment. It is not shown as an expense but rather as a change in the profit-sharing ratio.

4. Return of Capital & Preferred Return

Before any carried interest is allocated:

- LPs are returned their contributed capital.

- Then, they often receive a preferred return (e.g., 8%).

Only after these thresholds are met can carry be calculated.

5. Fund-Level Profit Calculated

The fund aggregates all:

- Gains and losses

- Management fees

- Fund expenses

to determine net profits available for distribution.

Example

Total gain: $50 million

Less fees/expenses: $5 million

Net distributable profit: $45 million

How This Appears in Financial Statements

1. Income Statement

Carried interest does not appear as an expense. The net income remains unchanged — it is allocated among the partners.

2. Capital Accounts

The GP’s capital account increases by the amount of carried interest allocated.

- LPs’ capital accounts increase by their allocated share of net income.

- GP’s capital account increases by the carried interest allocation.

This is shown as:

Partner Capital Accounts

————————-

LP Capital Accounts: +$33.6M

GP Capital Account: +$8.4M (carried interest)

3. Schedule K-1 Reporting

- LPs receive a Schedule K-1 showing their share of net income (excluding the carry given to the GP).

- The GP receives a Schedule K-1 reflecting their carried interest allocation — often as long-term capital gain (if holding requirements are met).

Tax vs GAAP Accounting for Carried Interest

Carried interest represents a complex area where tax and financial accounting rules diverge significantly. Understanding these differences is essential for fund managers, investors, accountants, and tax professionals.

1. Nature and Recognition

GAAP Accounting

Carried interest is treated as a partner’s profit allocation under equity method accounting for partnerships or similar investment entities. It is not recorded as an expense but rather as an increase in the General Partner’s capital account reflecting their share of profits.

GAAP recognizes carried interest only when the fund earns profits, matching the performance and investment value over time.

The fund’s financial statements show carried interest as part of net income allocation, but it does not reduce fund net income.

Tax Accounting

The IRS treats carried interest as a share of capital gains or qualified income allocated to the General Partner, taxable at the partner level.

The GP reports this income on their tax return, often at preferential capital gains rates if the holding period and other requirements are met.

For tax purposes, carried interest is not deductible by the fund (unlike management fees or other expenses).

2. Timing of Recognition

GAAP

Income and carried interest are recognized based on fair value changes and realized gains/losses during the reporting period.

Carried interest accrual follows the investment performance and the fund’s financial results, including unrealized gains when fair value measurements are allowed.

GAAP can recognize estimated carried interest periodically, even before actual distributions occur, reflecting accrual accounting principles.

Tax

Carried interest income is recognized only when the underlying gain is realized (e.g., asset sale or disposition).

The timing follows realization principles—no income recognition for unrealized gains.

Tax rules apply Section 1061, requiring a 3-year holding period for the income to qualify as long-term capital gain for carried interest.

3. Measurement and Valuation

GAAP

Carried interest valuation depends on the fair value of investments and estimated future profits.

Fund accountants use valuation models and performance hurdles to estimate carried interest accruals and record adjustments as values change.

Complex valuation assumptions impact carried interest amounts recognized in financial statements.

Tax

Carried interest is measured based on actual taxable gains realized and the profit-sharing agreement percentages.

The calculation excludes unrealized gains or fair value adjustments.

Tax calculations are more straightforward, following realized gain/loss figures.

4. Presentation in Financial Statements

GAAP

Carried interest is shown as allocations of net income between LPs and GPs within the equity section (partners’ capital accounts).

It does not appear as an expense or separately on the income statement but is part of net income attribution.

Disclosures explain the profit-sharing and carried interest policies.

Tax

Carried interest is reported on the GP’s individual or corporate tax return, often via Schedule K-1 from the partnership.

It is reported as capital gain income or qualified income subject to special tax rules.

There is no presentation on fund financial statements from a tax perspective, only partner-level reporting.

5. Impact on Fund Economics

GAAP

Carried interest affects the allocation of profits and capital accounts but does not reduce reported net income available to all partners.

It impacts fund NAV, carried interest accruals, and investor returns but is largely a non-cash accounting allocation until distributions occur.

Tax

Carried interest results in taxable income for the GP, creating a tax liability often deferred until gain realization.

The fund itself cannot deduct carried interest, so it doesn’t reduce the fund’s taxable income.

Summary Table: Tax vs GAAP Accounting for Carried Interest

| Aspect | GAAP Accounting | Tax Accounting |

| Recognition | Based on accrual & fair value changes | Based on realized gains |

| Timing | Recognized periodically, including unrealized gains | Recognized only at realization |

| Measurement | Fair value & estimated profits | Actual realized taxable gain |

| Presentation | Allocation of net income, capital accounts | Reported on partner’s tax return (Schedule K-1) |

| Deductibility | Not an expense, no deduction | Not deductible by fund |

| Tax Rate | N/A | Preferential capital gains (subject to holding period) |

The key distinction is that GAAP focuses on economic performance and fair value, recognizing carried interest accruals as profits emerge, while tax accounting strictly follows realization principles with preferential capital gains treatment subject to specific IRS rules.

Fund managers must carefully coordinate their financial and tax reporting to ensure compliance and optimize fund economics.

Summary: Key Accounting Effects of Carried Interest

Carried interest primarily affects fund accounting through the reallocation of profits between Limited Partners (LPs) and the General Partner (GP), rather than being treated as a conventional expense. Under GAAP, carried interest is recorded as an increase in the GP’s capital account and a corresponding decrease in the LPs’ capital accounts, reflecting the GP’s share of the fund’s profits after preferred returns and hurdle rates are met.

This treatment ensures that carried interest does not reduce the fund’s reported net income but rather reallocates the existing profits. The timing of recognition often follows accrual principles, with estimates made based on unrealized gains, while tax accounting recognizes carried interest income only upon realization of gains.

Furthermore, carried interest impacts financial disclosures by requiring clear reporting of profit-sharing arrangements and capital account changes. Overall, carried interest aligns the GP’s economic interest with fund performance while maintaining transparent and consistent accounting that differentiates it from ordinary expenses.

Conclusion

Carried interest affects fund accounting not by reducing income but by changing how income is distributed among partners. It strengthens the capital base of the GP and reduces the share of profits available to LPs — without affecting the fund’s net operating income. This unique accounting treatment is at the heart of the tax efficiency and incentive power of carried interest, and it’s a key reason why it continues to attract both attention and controversy in financial, legal, and policy circles.