Form 8082- Best Informative Analysis

Table of Contents

What is IRS Form 8082?

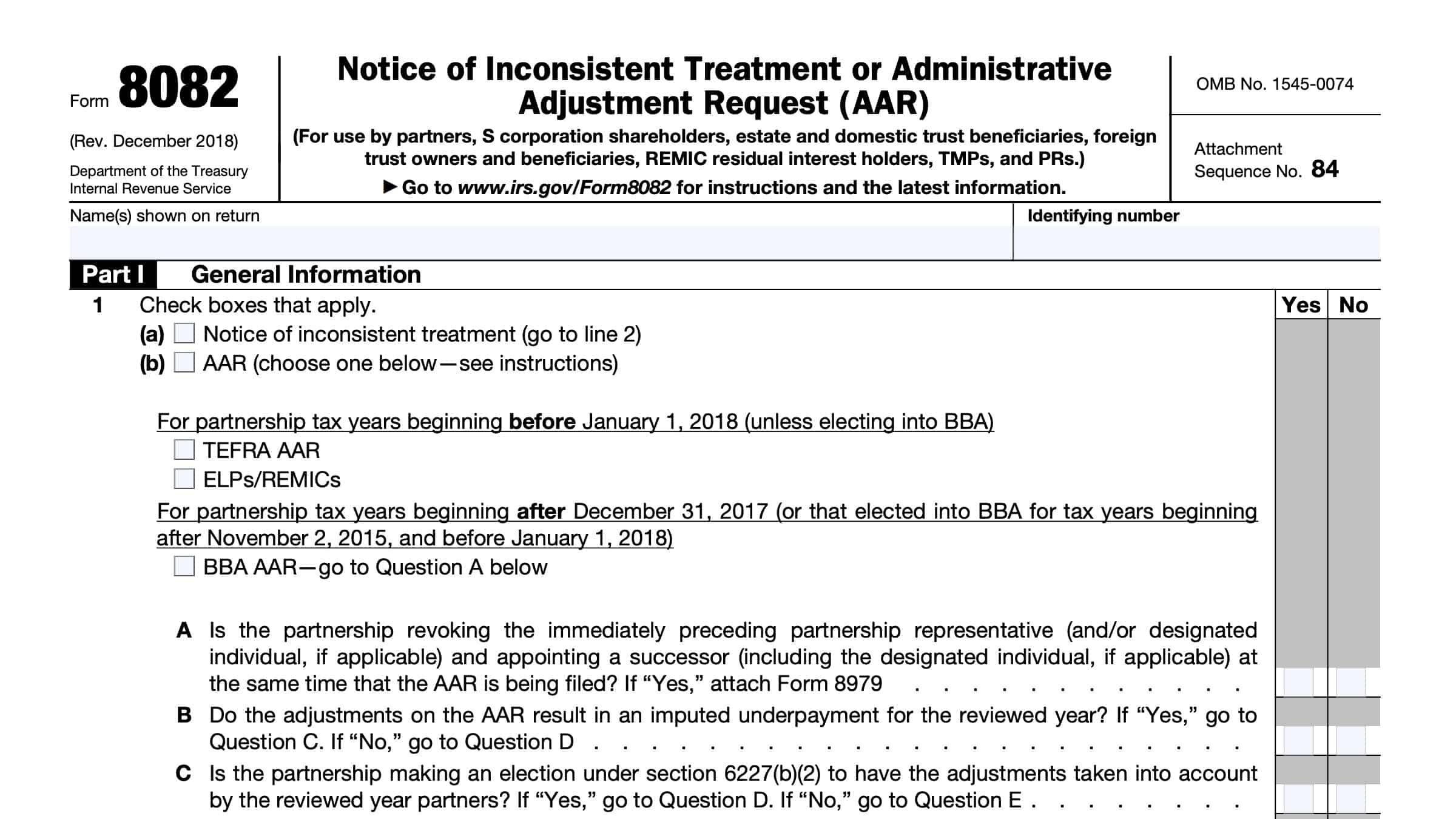

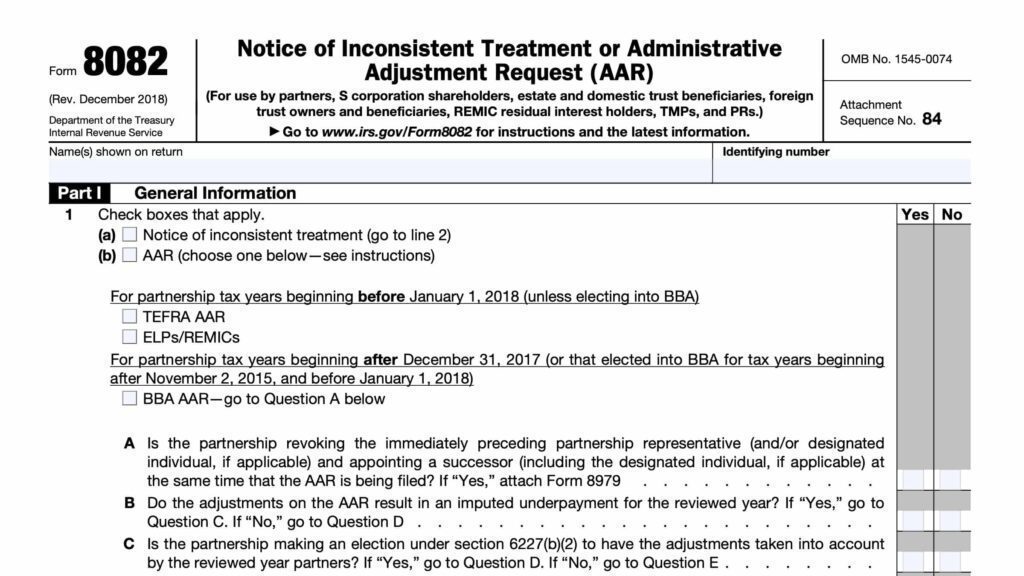

Form 8082, titled “Notice of Inconsistent Treatment or Administrative Adjustment Request (AAR)”, is an IRS form used by taxpayers, especially partners in partnerships or shareholders in S corporations, to notify the IRS and other involved parties of inconsistent treatment of partnership items on their tax returns. It is also used to make administrative adjustment requests to correct errors or discrepancies in prior tax years.

Why is Form 8082 Important?

In partnership taxation, many items flow through to individual partners’ tax returns (Schedule K-1 items). Sometimes, a taxpayer might treat an item differently than the partnership or other partners, leading to inconsistencies that the IRS may flag.

Form 8082, officially titled “Notice of Inconsistent Treatment or Administrative Adjustment Request (AAR)”, plays a crucial role in maintaining tax accuracy and compliance for partners, S corporation shareholders, and certain pass-through entities.

Here’s why it matters

1. Ensures Accurate Tax Reporting

Partners and shareholders may receive incorrect or inconsistent information on a Schedule K-1 from a partnership or S corp. Filing Form 8082 alerts the IRS that you’re reporting a different amount than what was reported to you—preventing potential audits or penalties.

2. Protects Taxpayers from IRS Adjustments

If you disagree with the information on a Schedule K-1 (such as income, deductions, or credits), and you don’t file Form 8082, the IRS may penalize you for inconsistent reporting. This form shields you from penalties as long as you notify the IRS properly.

3. Required for Partnership True Ups

Form 8082 is often used during true ups in partnerships, especially when a partner identifies discrepancies in allocations or income. It helps partners report the correct amounts based on final, accurate data rather than relying on potentially outdated or incorrect K-1 figures.

4. Supports Administrative Adjustment Requests (AARs)

For partnerships subject to the Bipartisan Budget Act (BBA) rules, Form 8082 is also used to file an Administrative Adjustment Request, enabling partnerships to correct previously filed returns without amending each partner’s individual return.

5. Maintains IRS Compliance

Form 8082 is critical for compliance under IRC Section 6222, which requires consistent treatment of partnership items between the partnership and individual partners. Filing this form avoids issues if the IRS audits the return later.

True Up Connection to Form 8082

When you’re a partner in a partnership or a shareholder in an S corporation, you receive a Schedule K-1 each year. This form reports your share of income, deductions, and credits. Sometimes, these reported amounts are based on preliminary or estimated figures—especially if the entity hasn’t finalized its books. If you later discover that the numbers are incorrect or inconsistent with your records or actual income, you’ll need to “true up” your return. That’s where Form 8082 comes in.

When a taxpayer discovers that an item from a partnership or S corporation was incorrectly reported or requires adjustment after filing their tax return, they use Form 8082 to:

How Form 8082 Facilitates a True Up

1. Identifying Inconsistencies

If your Schedule K-1 shows inaccurate figures—maybe due to late corrections, audit adjustments, or errors—you’re expected to report the correct data on your tax return. This is your true up.

2. Notifying the IRS

When you report a different amount than what’s shown on your K-1, you must file Form 8082 to notify the IRS of this inconsistent treatment. This protects you from penalties and provides transparency.

3. Administrative Adjustment Requests (AAR)

Under the Bipartisan Budget Act (BBA) rules, partnerships can file Form 8082 as part of an AAR, allowing them to correct previous errors across all partners in a consolidated way—another form of true-up at the entity level.

Example: True-Up Using Form 8082

Emily receives a Schedule K-1 showing $30,000 in income. Later, the partnership updates her share to $38,000 based on final books.

She reports $38,000 on her tax return (true-up).

She files Form 8082 to notify the IRS of the $8,000 difference.

Reason: “Final income allocation updated post-year-end.”

This keeps her compliant and avoids IRS penalties.

Who Should File Form 8082?

Form 8082 should be filed by:

1. Partners in a Partnership

If you’re a partner and your Schedule K-1 includes incorrect or inconsistent items (e.g., income, deductions, credits), and you report a different amount on your tax return, you must file Form 8082.

2. Shareholders in an S Corporation

If you’re an S corp shareholder and you treat an item differently than what’s reported on your Schedule K-1, you are also required to file Form 8082.

3. Partnerships Making an Administrative Adjustment Request (AAR)

Under the Bipartisan Budget Act (BBA) rules, partnerships (not individual partners) must file Form 8082 to correct previously filed information across the entire partnership.

When and Where to File Form 8082?

When to File Form 8082

- At the same time you file your federal income tax return (e.g., Form 1040, 1065, or 1120S), not separately.

- It must be included on or before the due date of your return, including extensions.

Important: Do not file Form 8082 after your return is filed. It must be attached with the original or amended return.

Where to File Form 8082

- If you are an individual (Form 1040 filer):

Attach Form 8082 to your tax return and file it with the IRS where your return is normally filed. - If you are a partnership or S corporation:

Include Form 8082 with your Form 1065 (partnership) or Form 1120S (S corp) and file it with the appropriate IRS service centre.

Paper or E-file

- You can e-file Form 8082 with your return using approved tax software.

- If you file a paper return, just staple Form 8082 to your tax return documents.

File Form 8082 with your original or amended return, on or before the due date, and send it to the same IRS address or e-file service center used for that return.

How to Prepare Form 8082: Step-by-Step Guidelines

IRS Form 8082, titled “Notice of Inconsistent Treatment or Administrative Adjustment Request (AAR),” is used when you report a different amount on your tax return than what’s shown on a Schedule K-1 or when partnerships file an AAR under the Bipartisan Budget Act (BBA).

Below is a full guide to filling out Form 8082:

Part I – Notice of Inconsistent Treatment

- Line 1: Identify the partnership or S corporation by name and EIN (Employer Identification Number).

- Line 2: Specify the tax year of the entity related to the inconsistency.

- Line 3: Describe the item(s) treated inconsistently (e.g., income, deduction, credit).

- Line 4: Explain the difference between the treatment on your return and the entity’s return or Schedule K-1.

Part II – Administrative Adjustment Request

- Line 5: Indicate if you are making an administrative adjustment request.

- Line 6: Describe the adjustment being requested, including the amounts and tax years affected.

- Line 7: Provide any additional explanation or supporting information to justify the adjustment.

Part III – Administrative Adjustment Request (AAR)

Only complete if the entity itself is making a correction (usually partnerships under the BBA rules).

- This part is used to correct prior-year information without amending every partner’s return.

- Provide affected item(s), corrected values, and explanations.

- Ensure your entity is eligible to file AARs (generally for BBA partnerships).

Attachments Required

- Attach a copy of the Schedule K-1 in question.

- If applicable, attach supporting documents (e.g., financial statements, corrected allocations, final tax reporting).

Example: Using Form 8082 for a True Up

Imagine you filed your individual tax return reporting your share of partnership income based on the Schedule K-1 received. Later, the partnership issues an amended K-1 showing additional income you had not reported. To true up your tax return, you would file Form 8082 with your amended return, notifying the IRS of the inconsistency and requesting adjustment to your reported income.

Summary

Form 8082 is a key IRS form for addressing inconsistencies and making true-ups related to partnership and S corporation items on individual tax returns. It enables taxpayers to proactively disclose and correct discrepancies, helping ensure compliance and accurate tax reporting. Understanding how and when to use Form 8082 is essential for partners and shareholders who want to manage their tax obligations effectively and avoid penalties.

FAQs on IRS Form 8082

1. What is IRS Form 8082?

Form 8082 is the IRS form used to report a difference (inconsistent treatment) between the information you received on a Schedule K-1 and what you are actually reporting on your tax return. It’s also used by partnerships to file an Administrative Adjustment Request (AAR) under the BBA rules.

2. Who needs to file Form 8082?

- Partners in a partnership

- S corporation shareholders

- Partnerships filing an AAR under the BBA audit regime

Anyone who treats a K-1 item differently than reported should file this form.

3. When is Form 8082 required?

When you receive a K-1 with incorrect information and choose to report a different amount (i.e., a true-up), Form 8082 must be filed with your tax return to avoid IRS penalties.

4. What is inconsistent treatment?

This happens when your tax return reflects a different amount than what’s shown on the K-1. For example, if your K-1 says $20,000 income, but you report $25,000 due to updated financials, that’s an inconsistent treatment.

5. Can Form 8082 be e-filed?

Yes. Form 8082 can be e-filed as part of your tax return using most IRS-authorized tax software platforms.

6. What if I don’t file Form 8082 when required?

Failing to file when required may result in IRS penalties, audit red flags, and possible disallowance of your adjusted treatment.

7. Does Form 8082 correct a K-1?

No. Form 8082 does not correct the K-1. It simply notifies the IRS that you are treating the K-1 information differently on your return.

8. Is Form 8082 only for errors?

Not always. It’s used for any discrepancy—whether caused by late updates, errors, or revised allocations—not just mistakes.

9. What is an Administrative Adjustment Request (AAR)?

An AAR allows BBA partnerships to adjust previously reported information without issuing amended K-1s. The partnership files Form 8082 to report those adjustments.

10. Where do I file Form 8082?

You must attach Form 8082 to your original or amended tax return and file it with the same IRS service center where you send your return.