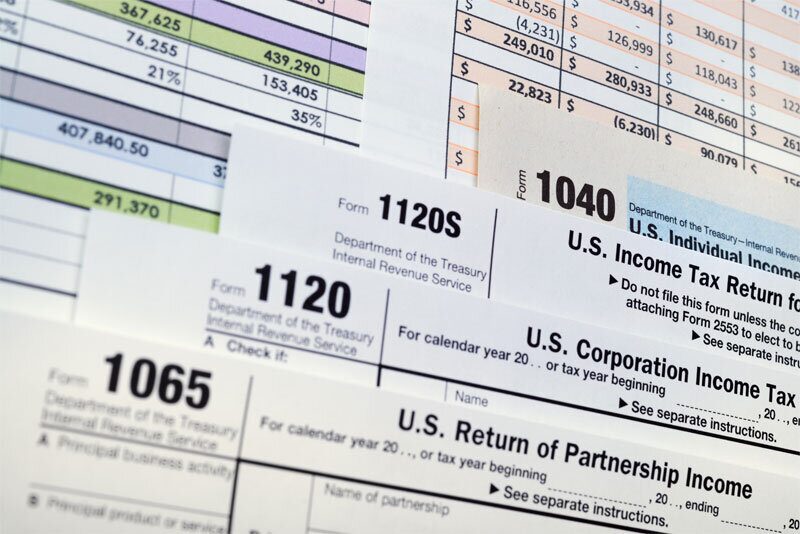

Form 1120s Instructions- Simplified Overview

Table of Contents

Key Sections Of Form 1120s (Line-by-Line Overview)

IRS Form 1120s instructions, titled U.S. Income Tax Return for an S Corporation, is the primary document S corporations must file annually to report income, deductions, tax-related data, and shareholder allocations. While S corporations are pass-through entities that typically don’t pay federal income tax, they are still required to file Form 1120-S to maintain compliance and inform the IRS and shareholders of financial activity.

Page 1: Income, Deductions, and Tax Summary

1. Identification Section (Header Area)

- Name and address of the S corporation

- Employer Identification Number (EIN)

- Date of incorporation

- Total assets

- Indicate whether the entity is a first-time filer or if it’s final return, name change, or address change

2. Line Items: Income (Lines 1a–6)

- Line 1a: Gross receipts or sales

- Line 1b: Returns and allowances

- Line 2: Cost of goods sold (linked to Schedule A)

- Line 3–6: Includes ordinary income, gains from asset sales, rental income, and other business income

These lines help determine gross profit and total income before expenses.

3. Line Items: Deductions (Lines 7–20)

Covers all deductible business expenses such as:

- Line 7: Compensation of officers

- Line 8: Salaries and wages (excluding officers)

- Line 9: Repairs and maintenance

- Line 13: Depreciation (linked to Form 4562)

- Line 17: Taxes and licenses

- Line 19: Other deductions (itemized in Statement 1 attached to the return)

This section determines ordinary business income (or loss) on Line 21.

4. Tax and Payments (Lines 22–26)

While most S corps don’t pay tax, this section reports:

- Built-in gains tax (for former C corps)

- Excess net passive income tax

- LIFO recapture tax

- Estimated tax payments and credits (if applicable)

- Balance due or overpayment

Schedule B: Other Information

Schedule B collects essential qualitative and compliance data about the S corporation:

- Accounting method (cash/accrual/other)

- Business activity code and product/service description

- Number of shareholders

- Foreign transactions and ownership

- Details about debt, losses, and business changes

- Whether the entity made any distributions or redemptions

- Information on publicly traded securities or ownership in other pass-through entities

Schedule B ensures the IRS can assess whether the entity continues to meet S corporation qualifications and monitors potential audit flags.

Schedule K: Shareholders’ Pro Rata Summary

This section reports all items of income, deductions, credits, and other tax attributes that must be passed through to shareholders and reflected on their Schedule K-1s.

Includes:

- Ordinary business income/loss

- Net rental income/loss

- Interest, dividends, and capital gains

- Section 179 expense deductions

- Foreign transactions

- Tax credits

- AMT-related items

- Other information (e.g., nondeductible expenses, distributions, loan repayments)

Schedule K is a consolidated version of what shareholders will receive individually via their Schedule K-1s.

Schedule K-1 (Form 1120-S)

Each shareholder receives an individual Schedule K-1, showing their share of the S corp’s income, deductions, credits, and other financial activity.

Key components include:

- Shareholder’s percentage of ownership

- Allocated ordinary income/loss

- Capital gains, rental income, and portfolio income

- Shareholder-level adjustments

- Distributions received

- Loan balances (if applicable)

K-1s must be sent to shareholders by the filing deadline (March 15 or extended date) so they can accurately file personal tax returns.

Schedule L: Balance Sheet per Books

This schedule shows the corporation’s financial position at the beginning and end of the tax year, based on its books and records:

- Assets: Cash, receivables, inventory, equipment, etc.

- Liabilities: Payables, loans, and other obligations

- Equity: Capital stock, retained earnings, and shareholder contributions

Schedule L helps reconcile the company’s book income to taxable income and is required if total receipts or assets exceed $250,000.

Schedule M-1: Reconciliation of Income (Loss) per Books With Income (Loss) per Return

This section explains the differences between financial statement income and taxable income.

Examples of reconciling items:

- Depreciation differences (book vs tax)

- Non-deductible expenses (e.g., fines, penalties)

- Income not recorded on books but included on tax return

Ensures transparency and accuracy in taxable income computation.

Schedule M-2: Analysis of Accumulated Adjustments Account (AAA) and Retained Earnings

This schedule tracks:

- Additions to retained earnings (net income)

- Distributions to shareholders

- Other adjustments to capital accounts

The AAA account is a tax-based account used to determine taxable vs. non-taxable distributions to shareholders.

Summary

Form 1120-S is not just a single-page filing — it’s a multi-part financial and compliance report designed to track and allocate an S corporation’s economic activity accurately. From income and expenses to shareholder allocations and book-tax reconciliations, each section plays a crucial role in ensuring compliance, transparency, and accuracy under IRS tax rules.

| Section | Purpose |

| Income | Reports gross receipts/sales, cost of goods sold, and total income |

| Deductions | Includes salaries, rent, depreciation, taxes, and other business expenses |

| Tax and Payments | Shows tax due (if applicable), credits, and estimated tax payments |

| Schedule B | General information and shareholder details |

| Schedule K | Summarizes items to be reported on each shareholder’s return |

| Schedule K-1 | Issued to each shareholder for their share of income/loss/deductions |

| Schedule L, M-1, M-2 | Balance sheet, reconciliation of income per books vs return, retained earnings |

How to Calculate Corporate Tax Using Form 1120-S/Form 1120s instructions: A Detailed Descriptive Analysis

Form 1120-S is the tax return used by S corporations to report their income, deductions, and credits. Unlike C corporations (which pay corporate income tax), S corporations are pass-through entities, meaning the corporation itself generally does not pay federal income tax. Instead, the income or losses “pass through” to shareholders, who report them on their individual tax returns.

However, there are specific scenarios where an S corporation may owe tax at the corporate level. Understanding how to calculate these taxes using Form 1120-S is essential for compliance.

Step 1: Calculate Total Income and Deductions

The starting point for the tax calculation is = Total income – Deductions.

- Income sources reported on Form 1120-S include:

- Gross receipts or sales (less returns and allowances)

- Interest income

- Dividend income

- Capital gains

- Rental income

- Other ordinary business income

- Deductible expenses may include:

- Cost of goods sold (COGS)

- Salaries and wages

- Repairs and maintenance

- Depreciation and amortization

- Interest expense

- Taxes and licenses

- Other ordinary business expenses

The corporation subtracts deductions from total income to arrive at net ordinary business income (loss), reported on Line 21 of Form 1120-S.

Step 2: Identify Built-In Gains Tax (If Applicable)

S corporations that converted from C corporations may be subject to the built-in gains (BIG) tax on certain appreciated assets sold within the recognition period (usually 5 years).

- The BIG tax is computed on Form 1120-S Schedule D and Schedule I.

- It is a corporate-level tax and must be reported and paid by the S corporation.

- The rate is generally the highest corporate tax rate (currently 21%).

Step 3: Calculate Excess Net Passive Income Tax (If Applicable)

If an S corporation has accumulated earnings and profits from prior C corporation years and has excess net passive income over 25% of gross receipts, it may owe a tax on that excess.

- This tax is calculated on Schedule K, Line 18 of Form 1120-S.

- The tax rate is the highest corporate tax rate (21%).

Step 4: Determine Other Taxes and Payments

Form 1120-S also accounts for:

- LIFO recapture tax (if applicable)

- Built-in gains tax

- Tax on excess net passive income

- Other taxes such as on certain environmental taxes or recapture amounts

These amounts are totaled on Schedule J, Line 2.

Step 5: Calculate Total Tax Liability

The total tax liability on Form 1120-S is usually limited to the corporate-level taxes mentioned above since most income is passed through to shareholders.

- Most S corporations pay no federal income tax at the entity level.

- Instead, shareholders pay tax on their shares of income, reported on Schedule K-1.

- Corporate-level tax (if any) is reported on Schedule J, Line 3.

Step 6: Shareholder Income Allocation (Pass-Through)

Though not a direct part of tax calculation on Form 1120-S, the net income or loss flows through to shareholders via Schedule K-1.

- Each shareholder reports their share of income, deductions, credits, and other items on their individual returns (Form 1040).

- This pass-through mechanism avoids double taxation typical of C corporations.

Summary:

| Step | Description |

| 1. Calculate Net Ordinary Income | Income minus deductions to find taxable income |

| 2. Apply Built-In Gains Tax (if any) | Tax on appreciation from prior C corp status |

| 3. Apply Excess Passive Income Tax (if any) | Tax on passive income exceeding limits |

| 4. Add Other Applicable Taxes | Environmental, LIFO recapture, etc. |

| 5. Total Tax Liability | Usually limited to corporate-level taxes |

| 6. Pass-Through to Shareholders | Income/loss reported individually via Schedule K-1 |

Key Takeaways

- Most S corporations do not pay federal income tax at the entity level.

- Corporate tax is limited to special cases (built-in gains, excess passive income).

- Understanding these exceptions is crucial to accurate Form 1120-S preparation and compliance.

- Shareholders report their shares of income on their personal returns and pay taxes accordingly.

Example: Tax Calculation for an S Corporation Using Form 1120-S

Scenario:

- ABC S Corp had the following financials for the tax year:

- Gross Receipts: $500,000

- Cost of Goods Sold (COGS): $200,000

- Operating Expenses (salaries, rent, utilities, etc.): $150,000

- Interest Income: $5,000

- Built-In Gain from prior C corp asset sale: $30,000

- Excess Net Passive Income: $10,000

- Number of shareholders: 5

Step 1: Calculate Ordinary Business Income

Gross Receipts – COGS − Operating Expenses = Ordinary Business Income

$500,000 − $200,000 − $150,000 = $150,000

Step 2: Calculate Taxable Income at the Corporate Level

Since ordinary business income passes through to shareholders and is not taxed at the corporate level, focus on corporate-level taxes:

- Built-In Gains Tax:

ABC S Corp must pay 21% tax on the $30,000 built-in gain.

30,000 × 21% = $6,30030,000

- Excess Net Passive Income Tax:

ABC S Corp must pay 21% tax on the $10,000 excess net passive income.

10,000×21%=$2,100

Step 3: Total Corporate – Level Tax Liability

6,300+2,100=$8,400

Step 4: Shareholders’ Taxable Income

The $150,000 ordinary business income is passed through to shareholders.

Each shareholder’s share (assuming equal ownership) is:

150,000 / 5 = $30,000

Each shareholder reports $30,000 on their individual tax return and pays tax at their personal income tax rates.

Summary:

| Item | Amount | Tax Rate | Tax Due |

| Built-In Gains | $30,000 | 21% | $6,300 |

| Excess Net Passive Income | $10,000 | 21% | $2,100 |

| Total Corporate Tax Liability | $8,400 | ||

| Ordinary Business Income (Pass-Through) | $150,000 | Taxed on shareholder level | N/A |

Key takeaway

Most of the S corporation’s income flows through to shareholders, who pay taxes individually. The corporation itself only pays tax on specific items like built-in gains or excess passive income at a flat 21% rate.

Understanding the Tax Rate for Form 1120-S: Complete Explanation

Form 1120-S is used by S corporations to report income, deductions, credits, and taxes to the IRS. A fundamental question often asked is: What tax rate applies to an S corporation?

The answer is more nuanced than for C corporations because S corporations are primarily pass-through entities for tax purposes. Let’s dive deep into how tax rates work for Form 1120-S filers.

1. Pass-Through Taxation: No Corporate Income Tax Rate

- S corporations generally do NOT pay federal income tax at the corporate level.

- Instead, the corporation’s income, deductions, credits, and losses “pass through” directly to shareholders.

- Shareholders report their share of these items on their individual tax returns (Form 1040), where it is taxed at their individual income tax rates, which vary by income level and filing status.

- This structure avoids double taxation, a hallmark of C corporations.

2. Individual Shareholder Tax Rates

- Shareholders pay tax on their share of the S corporation’s taxable income at their marginal income tax rates, which range from 10% up to 37% as of 2025.

- This rate depends on:

- Total taxable income of the shareholder

- Filing status (single, married filing jointly, etc.)

- Applicable deductions and credits

- Additionally, shareholders may owe state and local taxes on pass-through income, depending on their residence.

3. Corporate-Level Taxes That May Apply

While the S corporation itself typically pays no income tax, there are exceptions where the corporation must pay tax at the entity level. These are specific corporate-level taxes imposed by the IRS, calculated and reported on Form 1120-S:

a) Built-In Gains (BIG) Tax

- Applies if the S corporation was previously a C corporation and sells certain appreciated assets within a recognition period (typically 5 years).

- Tax is imposed on the built-in gain at the flat corporate tax rate of 21%.

- Calculated on Schedule D and Schedule I of Form 1120-S.

b) Excess Net Passive Income Tax

- If the S corporation has accumulated earnings and profits from when it was a C corporation and passive investment income exceeds 25% of gross receipts, the corporation pays a tax on that excess.

- This tax is also at the flat corporate tax rate of 21%.

- Reported on Schedule K, Line 18.

c) LIFO Recapture Tax

- Applies if the corporation changed inventory accounting methods from LIFO (Last-In, First-Out).

- Taxed at the corporate rate of 21%.

4. Summary of Applicable Tax Rates

| Situation | Tax Rate | Notes |

| Pass-through income taxed to shareholders | Individual tax rates (10%-37%) | Based on shareholder’s income bracket |

| Built-In Gains (corporate-level tax) | 21% (flat corporate rate) | Applies to prior C corp assets sold |

| Excess Net Passive Income Tax | 21% (flat corporate rate) | Applies if passive income thresholds exceeded |

| LIFO Recapture Tax | 21% | If inventory accounting changed |

5. State and Local Taxes

- In addition to federal taxes, shareholders may owe state income taxes on pass-through income.

- Some states also impose entity-level taxes or fees on S corporations.

- State tax rates and rules vary widely, so local guidance is essential.

6. Qualified Business Income (QBI) Deduction Impact

- Shareholders may be eligible for the Qualified Business Income (QBI) deduction under IRC Section 199A, which can reduce taxable income from the S corporation by up to 20%.

- This deduction is claimed on the shareholder’s individual return and affects the effective tax rate on pass-through income.

Key Takeaways

- S corporations themselves generally pay no federal income tax at the entity level.

- Shareholders pay tax at their individual income tax rates on income passed through from the S corp.

- Certain corporate-level taxes (built-in gains, passive income tax) are imposed at the flat 21% corporate tax rate.

- State taxes and special deductions (like QBI) impact the overall tax liability.

E-Filing and Payment Options for IRS Form 1120-S – Complete Guide

Filing Form 1120-S, the U.S. Income Tax Return for an S Corporation, accurately and on time is critical for compliance with IRS regulations. With technological advancements, the IRS offers electronic filing (e-filing) and various payment options designed to make the process smoother and more efficient for businesses.

This guide provides a complete overview of how to e-file Form 1120-S and the different methods available for making tax payments.

1. What is E-Filing for Form 1120-S?

E-filing is the process of submitting Form 1120-S electronically via IRS-approved software or through authorized tax professionals.

Benefits of E-Filing:

- Faster processing and confirmation of receipt

- Reduced errors due to built-in validation checks

- Convenient and secure submission from any location

- Quicker refunds, if applicable

- Automatic extension requests if filed by the deadline with Form 7004

2. Who Must E-File Form 1120-S?

- The IRS mandates electronic filing for all S corporations with 250 or more shareholders.

- Smaller corporations are encouraged but not required to e-file.

- Many tax professionals and payroll services file electronically for their clients regardless of size.

3. How to E-File Form 1120-S

Step-by-Step Process:

- Choose IRS-Approved Software:

Use IRS-authorized e-file software providers, which range from simple tax preparation programs to full-service tax platforms. - Prepare the Return:

Enter all necessary financial data, including income, deductions, credits, shareholder information, and Schedule K-1 details. - Review and Validate:

Use the software’s error-checking tools to ensure all fields are correctly filled. - Submit Electronically:

Transmit the completed Form 1120-S directly to the IRS through the software. - Receive Acknowledgement:

The IRS sends an electronic acknowledgment confirming receipt and acceptance or rejection with error codes to correct.

4. Payment Options for Taxes Owed on Form 1120-S

Though most S corporations do not owe federal income tax at the entity level, some may have tax liabilities (e.g., built-in gains tax). The IRS provides multiple convenient payment options:

a) Electronic Funds Withdrawal (EFW)

- Available when e-filing, taxpayers can authorize a direct debit from their bank account on a chosen date.

b) Electronic Federal Tax Payment System (EFTPS)

- A free service provided by the U.S. Department of Treasury allowing businesses to schedule payments online or by phone.

- Must enroll in advance, but once set up, it is a preferred method for business tax payments.

c) Direct Pay

- Allows taxpayers to pay directly from a checking or savings account without enrolling.

- Available via the IRS website.

d) Credit or Debit Card Payments

- Taxpayers can pay using credit or debit cards through third-party payment processors.

- Convenience fees may apply.

e) Check or Money Order

- If paying by mail, send a check or money order with a completed Form 1120-S payment voucher (Form 8453-S) to the IRS address listed in the instructions.

5. Deadlines for Filing and Payment

- Form 1120-S is due by March 15 (or the 15th day of the 3rd month after the tax year ends).

- Payment of any taxes owed must be made by this date to avoid penalties and interest.

- Extensions to file can be requested using Form 7004, but this is an extension to file only — tax payments are still due on the original deadline.

6. Tips for Smooth E-Filing and Payment

- File early to avoid last-minute issues.

- Double-check shareholder info on Schedule K-1 for accuracy.

- Verify payment details before authorizing any electronic withdrawals.

- Use trusted tax software or a qualified tax professional.

- Keep electronic or paper copies of your return and payment confirmations for your records.

7. Troubleshooting Common E-Filing Issues

- Rejected Returns: Usually due to incorrect EINs, SSNs, or formatting errors. Correct and resubmit promptly.

- Payment Failures: Check bank details carefully; contact your bank or IRS EFTPS support if issues arise.

- Missing Acknowledgments: Contact your software provider or IRS e-file help line.

Summary

E-filing and electronic payment options for Form 1120-S simplify the tax filing process, reduce errors, and help ensure timely compliance. Leveraging these modern tools benefits both S corporations and the IRS through faster processing and better accuracy.

Form 1120-S Compliance & Penalties: What S Corporations Must Know

Maintaining compliance when filing Form 1120-S is crucial for S corporations to avoid costly penalties and legal complications. The IRS requires timely and accurate filing of Form 1120-S by the due date (typically March 15), along with proper submission of Schedule K-1 forms to shareholders. Failure to file or late filing can result in a penalty of $210 per shareholder per month, capped at 12 months, which can add up quickly for corporations with many shareholders.

Additionally, inaccurate or incomplete information, such as incorrect shareholder data or misreported income, may trigger IRS audits, delays, or further penalties. If the corporation owes tax—such as on built-in gains or excess passive income—failure to pay on time can lead to interest charges and additional penalties. To ensure compliance, S corporations should use reliable tax software or professional tax services, maintain thorough records, and meet all IRS deadlines precisely.

Frequently Asked Questions (FAQs) About Form 1120-S Tax Calculation and Compliance

1. Do S corporations pay federal income tax on Form 1120-S?

No, S corporations generally do not pay federal income tax at the corporate level. Instead, income passes through to shareholders, who pay tax on their individual returns. However, certain taxes like built-in gains or excess passive income tax may apply at the corporate level.

2. What is the corporate tax rate for S corporations?

S corporations pay corporate-level taxes only on specific items like built-in gains or excess net passive income, typically taxed at a flat rate of 21%. Otherwise, income is taxed at shareholders’ individual tax rates.

3. How is ordinary business income taxed for S corporations?

Ordinary business income reported on Form 1120-S passes through to shareholders and is taxed at their individual income tax rates, ranging from 10% to 37%, depending on their taxable income.

4. What happens if an S corporation misses the Form 1120-S filing deadline?

Late filing can result in penalties of $210 per shareholder per month, up to 12 months. Additionally, interest may accrue on any unpaid tax liabilities.

5. Are there corporate-level taxes on Form 1120-S?

Yes. Corporate-level taxes may apply for built-in gains, excess net passive income, and other specific tax situations. These taxes are reported on Form 1120-S schedules and paid at the corporate tax rate.

6. How do shareholders report income from an S corporation?

Shareholders receive a Schedule K-1, which details their share of the corporation’s income, deductions, and credits. They report this information on their individual tax returns.

7. Can an S corporation have more than one class of stock?

No, one of the IRS requirements for S corporations is to have only one class of stock.

8. What are the penalties for inaccurate or incomplete Form 1120-S filings?

Penalties may include fines, increased risk of IRS audits, and potential adjustments leading to additional taxes owed with interest.

9. Is e-filing mandatory for Form 1120-S?

Yes, e-filing is mandatory for S corporations with 250 or more shareholders. Smaller corporations are encouraged to e-file but can still file paper returns.

10. What payment options are available for taxes owed on Form 1120-S?

Payments can be made via Electronic Federal Tax Payment System (EFTPS), electronic funds withdrawal during e-filing, credit/debit card, direct pay from bank accounts, or check/money order with the payment voucher.