Effectively Connected Income (ECI)- Complete Guide 2025

Table of Contents

What is ECI (Effectively Connected Income)?

Effectively Connected Income (ECI) is any income that is earned by a nonresident alien individual or a foreign corporation that is effectively connected with the conduct of a trade or business within the United States. This income is taxed on a net basis, allowing for deductions of related expenses, and is subject to graduated U.S. tax rates. ECI typically includes business profits, services performed in the U.S., rental income from active real estate operations, and gains on U.S. real property.

This includes income generated from:

- Operating a business in the U.S.

- Services performed in the U.S.

- Rents or royalties from assets used in a U.S. business

- Income from partnerships or LLCs engaged in U.S. activities

Key Traits of ECI

Effectively Connected Income (ECI) possesses several defining traits that distinguish it from other types of U.S.-source income earned by non-resident aliens and foreign entities. First and foremost, ECI must be directly linked to the conduct of a trade or business within the United States, whether through physical presence, employees, or a permanent establishment. Unlike passive income (FDAP), ECI is taxed on a net basis, allowing the taxpayer to deduct ordinary and necessary expenses related to the income-generating activity.

ECI may arise from active business operations, including sales, services, or rental activities, and it can also include certain gains from the disposition of U.S. real property under FIRPTA rules. Taxpayers earning ECI are subject to U.S. tax filing obligations and are generally taxed at the same graduated rates applicable to U.S. persons (individual or corporate).

Additionally, ECI requires the use of specific IRS forms (e.g., Form 1040-NR or 1120-F) and proper certification to avoid erroneous withholding (e.g., Form W-8ECI). One unique feature is that foreign corporations earning ECI may also be liable for a branch profits tax, which functions similarly to a dividend withholding tax on repatriated earnings.

| Trait | Description |

| Source | U.S.-sourced or foreign-sourced (if linked to U.S. business) |

| Tax Basis | Net basis (deductions allowed) |

| Taxpayer | Applies to nonresident individuals and foreign entities |

| Connection Requirement | Must be effectively connected to a U.S. trade or business |

| Tax Treatment | Taxed similarly to U.S. persons, using graduated rates |

| Withholding | Not subject to flat 30% withholding like FDAP, but may require estimated tax payments or backup withholding |

Who Is Eligible / Subject to ECI Rules?

Effectively Connected Income (ECI) rules apply to nonresident aliens, foreign corporations, and certain foreign entities that generate income through a U.S.-based trade or business. A taxpayer becomes subject to ECI taxation when they are engaged in commercial, entrepreneurial, or service activities within the United States, either directly or through a partnership, LLC, agent, or permanent establishment.

Non-resident aliens are subject to ECI rules if they:

- Perform services in the U.S. (such as consulting, freelancing, or employment),

- Own and actively manage rental real estate in the U.S. that qualifies as a business,

- Are partners in a U.S. partnership that earns ECI.

Foreign corporations are subject to ECI if they:

- Operate branches, subsidiaries, or fixed places of business in the U.S.,

- Engage in trade activities such as manufacturing, distributing, or selling products within U.S. borders,

- Derive gains from U.S. real estate or tangible personal property used in a U.S. business,

- Receive passthrough income from a U.S. partnership or LLC that conducts a U.S. trade or business.

ECI rules also extend to foreign trusts, estates, and other pass-through entities with U.S.-connected operations. Additionally, income that is not inherently U.S.-sourced can still be treated as ECI if it is effectively connected with a U.S. business, such as certain foreign-source income linked to U.S.-based operations. These taxpayers must file U.S. tax returns (Form 1040-NR or Form 1120-F) and calculate tax on a net-income basis, unlike FDAP income which is taxed gross.

In summary, any foreign person or entity conducting meaningful business activities within the U.S., whether directly or indirectly, may fall under ECI rules and must comply with related tax obligations.

Common Examples of ECI Income

| Income Type | ECI? |

| Compensation for services in U.S. | Yes |

| Income from U.S. rental property operated as a business | Yes |

| Dividends from a U.S. corp | No (FDAP) |

| Business profits from U.S. sales | Yes |

| Gain on sale of U.S. real estate | Yes (via FIRPTA) |

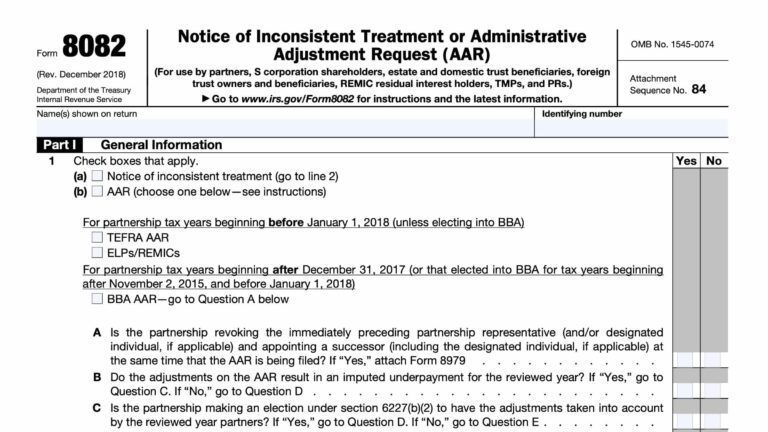

Forms Required for ECI Reporting

- Form 1040-NR – For nonresident individuals reporting ECI.

- Form 1120-F – For foreign corporations with U.S. effectively connected income.

- Form W-8ECI – Given to U.S. payers to certify income is ECI and exempt from withholding.

- Form 5472 – For foreign-owned U.S. corporations or foreign corporations engaged in U.S. trade with reportable transactions.

- Schedule ECI – Attached to returns to declare income effectively connected to a U.S. trade or business.

- Form 8833 – To disclose any tax treaty positions related to ECI treatment.

These forms ensure proper ECI reporting, withholding relief, and compliance with U.S. tax regulations.

Tax Rates for ECI

Effectively Connected Income (ECI) is taxed similarly to U.S. taxpayers but varies based on the filer type:

- Non-resident Individuals: Taxed at graduated U.S. income tax rates ranging from 10% to 37%, after allowable deductions.

- Foreign Corporations: Subject to a flat 21% corporate tax rate on net ECI, plus a possible 30% Branch Profits Tax on repatriated earnings, unless reduced by a tax treaty.

Unlike FDAP income, which is taxed at a flat 30% on gross amounts, ECI is taxed on a net basis, allowing the deduction of business-related expenses. Tax treaties may also reduce applicable rates or eliminate the branch profits tax.

Due Dates for ECI Filings

- Form 1040-NR (Non-resident Individuals):

Due April 15 if wages are earned; June 15 if no wages. Extensions available via Form 4868. - Form 1120-F (Foreign Corporations):

Due April 15 following the end of the tax year. Can be extended to October 15 using Form 7004. - Estimated Tax Payments (if required):

Due quarterly — April 15, June 15, September 15, and January 15. - Form W-8ECI:

Must be provided before income is paid to avoid withholding.

Meeting these deadlines is crucial to avoid penalties, interest, and disallowance of deductions.

How to File ECI: Step-by-Step Procedure

Filing taxes on Effectively Connected Income (ECI) involves several important steps, whether you are a non-resident individual or a foreign corporation. Here’s a detailed guide to ensure compliance:

For Non-resident Individuals

- Determine U.S. Trade or Business Status:

Confirm you are engaged in a trade or business within the U.S., which creates ECI. - Gather Income and Expense Records:

Collect all income effectively connected with your U.S. trade or business, including wages, business profits, and rents. Also compile all allowable expenses such as office rent, travel, supplies, and salaries. - Complete Form 1040-NR:

Use IRS Form 1040-NR, the U.S. Non-resident Alien Income Tax Return, to report your ECI. Attach Schedule C if you are self-employed or Schedule E for rental income. - Calculate Net Taxable Income:

Subtract your deductible business expenses from your gross income to arrive at net ECI, which is subject to graduated U.S. tax rates. - Claim Treaty Benefits (If Applicable):

If your country has a tax treaty with the U.S., determine if it offers relief or exemptions on your income. File Form 8833 to disclose treaty positions. - File by Due Date:

Submit your return by April 15 (or June 15 if no wages are earned), including any payments due.

For Foreign Corporations:

- Identify ECI Activities:

Confirm that your corporation conducts a U.S. trade or business generating effectively connected income. - Document Income and Expenses:

Gather detailed records of all income related to U.S. business operations and associated deductible expenses. - Complete Form 1120-F:

File the U.S. Income Tax Return of a Foreign Corporation (Form 1120-F) reporting your net ECI. - Attach Required Schedules:

Include Form 5472 if there are reportable related-party transactions, and other schedules as applicable. - Calculate Corporate Tax and Branch Profits Tax:

Pay the 21% corporate tax on net income. Additionally, calculate the 30% Branch Profits Tax on repatriated earnings unless reduced by treaty. - Claim Treaty Benefits:

Apply tax treaty provisions to reduce tax liability if eligible, and file Form 8833 to disclose treaty-based positions. - File and Pay on Time:

File by April 15, or extend to October 15 using Form 7004, and ensure all taxes are paid timely to avoid penalties.

Notes

- Use Form W-8ECI: Provide this form to U.S. withholding agents to certify income is effectively connected and avoid automatic 30% withholding.

- Maintain Accurate Records: Keep thorough documentation of all U.S. business activities, income, and expenses.

- Consult a Tax Professional: U.S. tax laws on ECI can be complex, especially regarding treaty benefits and entity classifications.

Following these steps ensures proper compliance, minimizes tax liabilities, and avoids costly penalties when dealing with Effectively Connected Income.

ECI Income Calculation Example

Scenario:

A foreign individual operates a consulting business in the U.S. During the tax year, the business earns $150,000 in gross income. The individual incurs the following deductible expenses related to the U.S. business:

- Office rent: $20,000

- Travel and meals: $10,000

- Salaries paid to assistants: $15,000

- Other business expenses: $5,000

Step 1: Calculate Total Expenses

$20,000 + $10,000 + $15,000 + $5,000 = $50,000

Step 2: Calculate Net Effectively Connected Income

Gross Income $150,000 – Expenses $50,000 = $100,000

Step 3: Determine Taxable Amount

The net ECI of $100,000 is subject to U.S. graduated income tax rates applicable to non-resident individuals.

Summary

- Gross U.S. Business Income: $150,000

- Deductible Business Expenses: $50,000

- Net ECI (Taxable Income): $100,000

The taxpayer reports this net amount on Form 1040-NR and pays tax according to U.S. tax brackets after considering any applicable tax treaty benefits.

Impact of Tax Treaties on ECI

Tax treaties between the U.S. and foreign countries can reduce or eliminate U.S. tax on Effectively Connected Income (ECI) by defining when a foreign person has a taxable presence (permanent establishment) in the U.S. If no permanent establishment exists, certain business income may be exempt from U.S. tax. Treaties can also lower tax rates or provide relief from additional taxes like the branch profits tax. To claim these benefits, taxpayers must disclose treaty positions using Form 8833 and comply with specific documentation requirements.

- Income may be exempt or taxed at lower rates if the individual/entity does not have a permanent establishment (PE) in the U.S.

- Must file Form 8833 to disclose treaty positions affecting ECI.

- Use Form W-8ECI to prevent withholding by U.S. payers.

Penalties on Effectively Connected Income (ECI)

Failure to properly report and pay taxes on Effectively Connected Income (ECI) can lead to significant penalties imposed by the IRS. Common penalties include:

- Late Filing Penalty: If the tax return reporting ECI (e.g., Form 1040-NR or 1120-F) is filed after the due date without an approved extension, the IRS may charge a penalty of 5% of the unpaid tax per month, up to a maximum of 25%.

- Late Payment Penalty: If the tax due on ECI is not paid by the deadline, a penalty of 0.5% of the unpaid tax per month may apply, accruing until the tax is paid in full.

- Accuracy-Related Penalty: If there is an underpayment due to negligence or substantial understatement of tax related to ECI, a penalty of 20% of the underpaid amount may be assessed.

- Failure to Provide Form W-8ECI: Not providing this form to withholding agents can result in incorrect withholding at 30%, leading to cash flow issues and delayed refunds.

- Information Reporting Penalties: Failure to file required forms like Form 5472 or Form 8833 when applicable can result in penalties starting at $10,000 per form, increasing for continued non-compliance.

Timely and accurate reporting, proper documentation, and compliance with IRS requirements are essential to avoid these costly penalties related to ECI.

IRS Guidance & Resources

The IRS provides detailed guidance on Effectively Connected Income (ECI) through various publications and instructions to help taxpayers understand their U.S. tax obligations. Key resources include Publication 519 (U.S. Tax Guide for Aliens), which explains when income is considered effectively connected and how to report it, and Publication 515 (Withholding of Tax on Nonresident Aliens and Foreign Entities), which covers withholding rules related to ECI.

These IRS guidelines clarify who qualifies as engaged in a U.S. trade or business, outline the types of income subject to ECI taxation, and specify required forms and filing deadlines. They also explain deductions allowed against ECI and how to apply tax treaty benefits. Following IRS guidance is essential to ensure accurate reporting, proper tax calculation, and compliance with withholding requirements, helping foreign taxpayers avoid penalties and disputes.

Conclusion

Effectively Connected Income (ECI) is a crucial concept for non-resident aliens and foreign entities engaged in business activities within the United States. Understanding ECI’s traits, eligibility criteria, and tax treatment helps ensure compliance with U.S. tax laws while optimizing tax obligations through allowable deductions and treaty benefits. Proper filing, timely payments, and adherence to IRS guidance are essential to avoid penalties and maximize tax efficiency. Whether you are an individual or a corporation, staying informed about ECI rules is key to navigating cross-border taxation successfully.

FAQs on Effectively Connected Income (ECI)

1. What is Effectively Connected Income (ECI)?

A simple explanation of what ECI means and why it matters for nonresident aliens and foreign corporations.

2. Who is subject to ECI tax rules in the U.S.?

Details on which foreign individuals and entities must report and pay tax on ECI.

3. How is ECI different from FDAP income?

Clear comparison between Effectively Connected Income and Fixed, Determinable, Annual, Periodical (FDAP) income.

4. What forms are required to report ECI?

Overview of IRS forms like Form 1040-NR, 1120-F, and W-8ECI related to ECI reporting.

5. How is ECI calculated?

Step-by-step explanation of how to compute net taxable income from ECI.

6. What are the tax rates on ECI?

Information on graduated rates for individuals and flat corporate tax rates for foreign corporations.

7. When are ECI tax returns due?

Important filing deadlines for individuals and corporations earning ECI.

8. Can tax treaties reduce ECI tax?

How U.S. tax treaties impact ECI taxation and the process for claiming benefits.

9. What is the procedure to file taxes on ECI?

A guide to the filing process, including documentation and payment requirements.

10. What penalties apply for failure to report ECI?

Consequences of non-compliance and the importance of timely filing and payment.