Carried Interest Calculation- Explanation Simplified In 2025

Table of Contents

Carried Interest Calculation-Step By Step Guide

Carried interest is a core incentive mechanism used in private equity, venture capital, and hedge funds to compensate General Partners (GPs) based on the fund’s investment performance. It represents a share of the profits—commonly 20%—allocated to GPs after Limited Partners (LPs) have received back their original capital plus a minimum preferred return (hurdle rate). This ensures that GPs only benefit after LPs are adequately compensated, aligning interests and motivating GPs to maximize fund returns.

Key Concepts in Carried Interest Calculation

1. Capital Commitment / Capital Contribution

This is the total amount of money LPs commit or contribute to the fund. Carried interest is calculated only after LPs have been returned this capital.

2. Preferred Return (Hurdle Rate)

Most funds set a hurdle rate (e.g., 7%-10% annually), which is the minimum rate of return LPs must receive before the GP earns carry. This protects LPs by prioritizing their returns.

3. Catch-Up Clause

Some funds include a catch-up provision where, after the hurdle is met, the GP receives a higher share of profits until they “catch up” to their agreed carried interest percentage on total profits.

4. Carried Interest Percentage

Typically 20%, but it can vary. This percentage applies to profits above the hurdle and catch-up.

5. Clawback Provisions

Some agreements include clawback clauses ensuring that if the GP receives more carried interest than entitled (due to subsequent losses), they must return the excess to LPs.

Step-by-Step Carried Interest Calculation Process

Step 1: Return of Capital

LPs first receive back the full amount of their original invested capital. No carry is paid until this is complete.

Step 2: Payment of Preferred Return (Hurdle Rate)

LPs receive a preferred return on their capital, typically compounded annually. This ensures LPs earn a minimum return before GP shares in profits.

Step 3: Catch-Up Phase (If Applicable)

In this phase, the GP may receive a higher percentage of profits (sometimes 100%) until the GP’s total carry equals the agreed percentage (e.g., 20%) of total profits.

Step 4: Profit Sharing Beyond Hurdle and Catch-Up

Remaining profits are split according to the carried interest percentage, commonly 80% to LPs and 20% to GP.

Example: Detailed Walkthrough

Assume a fund with:

- LP capital: $100 million

- Fund profit on exit: $50 million

- Preferred return: 8% per annum (assumed 1 year)

- Carried interest: 20%

- Catch-up provision: Yes (GP receives 100% until carry percentage is reached)

Calculation

- Return capital to LPs: $100 million

- Preferred return (8% of $100M): $8 million

- Total amount before carry: $108 million

- Remaining profit: $50 million – $8 million = $42 million

Catch-up phase

- GP receives 100% of next profits until carry equals 20% of total profits.

- Total profits = $50 million; GP’s carry = 20% × $50M = $10 million.

- GP gets next $10 million (catch-up) fully.

- Remaining profit for LPs: $42 million – $10 million = $32 million.

Final Distribution Summary

- LPs get back: $100 million (capital) + $8 million (preferred return) + $32 million = $140 million

- GP receives carried interest: $10 million

Additional Considerations

- Multiple Hurdles: Some funds use tiered hurdle rates with increasing carry percentages.

- Compounding Preferred Returns: Preferred returns often compound annually, increasing hurdle payments.

- Clawbacks: Ensure fair adjustment if earlier carry payments exceed final entitlements.

- Timing: Carried interest is usually calculated at the fund’s exit or liquidity events but may be accrued periodically based on unrealized gains under GAAP.

Why The Catch-Up Matters

The catch-up provision allows the GP to quickly “catch up” to their full carried interest entitlement after the LP hurdle is satisfied. Without catch-up, carry might be shared pro-rata, diluting GP incentives early in the profit-sharing waterfall.

Understanding the carried interest calculation is vital for investors and fund managers because it:

- Clarifies how profits are shared, ensuring transparency.

- Aligns incentives between GPs and LPs by rewarding performance.

- Affects fund economics, investor returns, and tax planning.

- Influences accounting and financial reporting for fund managers.

Variations & Complexities

1. Tiered Hurdles

Some funds have multiple hurdle rates with escalating carry percentages, e.g., 8% hurdle at 20% carry, then 15% hurdle at 30% carry.

2. Compounded Preferred Returns

Hurdle returns may be compounded annually, increasing the hurdle amount and delaying carry.

3. Catch-Up Variations

Catch-ups might be “partial” (e.g., 50%) or “full” (100%), affecting GP’s share timing.

4. Clawback Provisions

Post-final distribution audits may trigger clawbacks if GP carried interest exceeds their rightful share due to interim calculations.

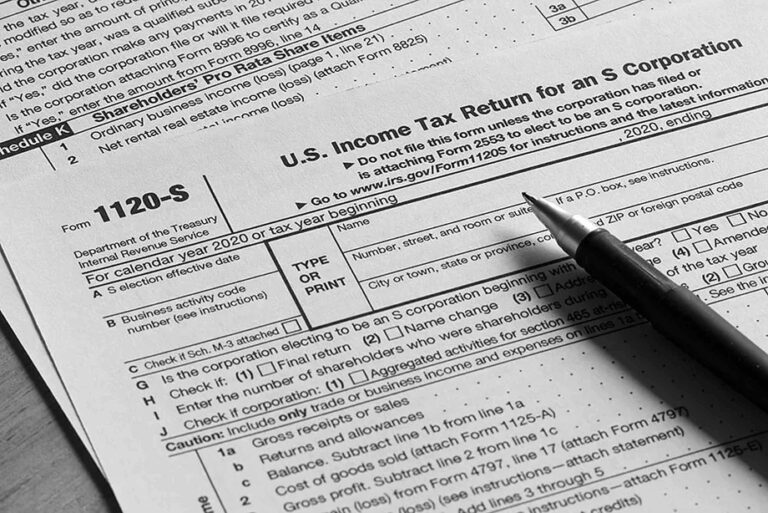

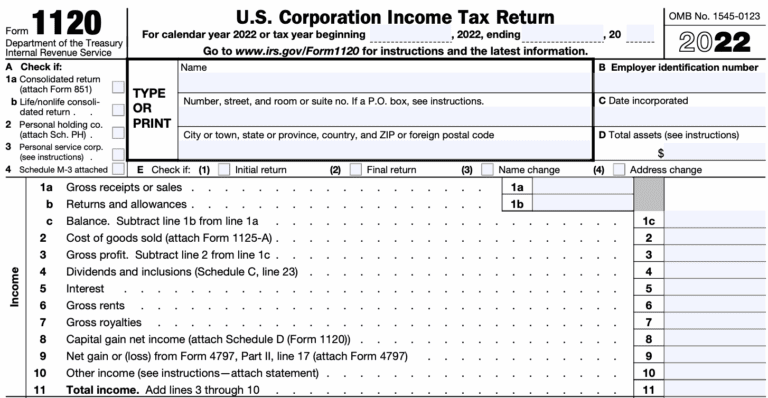

Accounting & Tax Implications of Carried Interest

Carried interest presents a unique challenge in both fund accounting and tax reporting, due to its nature as a performance-based profit allocation rather than a traditional fee. From an accounting perspective, carried interest is not recorded as an expense of the fund. Instead, it is reflected as an allocation of profit to the General Partner (GP) or fund managers, typically under the equity section in financial statements.

This means it does not reduce the fund’s net income but rather redirects a portion of that income from the Limited Partners (LPs) to the GP based on the partnership agreement’s profit-sharing waterfall. The fund must accurately accrue carried interest based on realized or unrealized gains (depending on the fund’s accounting policy—realization-based or fair value reporting under GAAP), often necessitating complex performance-tracking mechanisms.

From a tax standpoint, carried interest is particularly significant due to its favorable capital gains treatment under U.S. tax law. Under current IRS rules, particularly Internal Revenue Code §1061, carried interest can qualify as long-term capital gain (taxed at 20%) rather than ordinary income (taxed up to 37%), provided the underlying assets are held for more than three years.

This has made carried interest a focal point of tax reform debates, as critics argue it provides preferential treatment to fund managers. Tax reporting for GPs involves detailed tracking of gain allocations and compliance with §1061’s holding period rules, while LPs must reflect reduced profit allocations. Additionally, management fees—which are taxed as ordinary income and treated as fund expenses—are treated separately from carried interest, further complicating tax and accounting treatment.

In essence, carried interest straddles two domains: it must be accounted for transparently and fairly within fund financials to ensure accurate investor reporting and navigated carefully for tax efficiency, requiring expert guidance in partnership tax law, financial reporting standards, and waterfall modeling.

Real-World Impact of Carried Interest

Carried interest has profound real-world implications across the private investment ecosystem—shaping fund economics, influencing investor behavior, driving talent retention, and even sparking public policy debates. For General Partners (GPs), carried interest serves as a powerful incentive mechanism, linking compensation directly to investment performance. This aligns the GP’s interest with that of the Limited Partners (LPs), promoting disciplined asset selection, active portfolio management, and long-term value creation.

High potential for carried interest payouts attracts top-tier investment professionals and supports the entrepreneurial risk-taking nature of private equity and venture capital. For LPs, carried interest structures—especially when coupled with hurdles and clawbacks—offer a degree of performance protection, ensuring that GPs only share in upside after minimum return benchmarks are met.

However, the impact extends beyond fund agreements. Carried interest significantly affects fund cash flow timing, as distributions must be managed carefully to satisfy capital return and preferred return priorities before carry is paid. It also shapes valuation strategies, since unrealized gains can trigger accounting accruals of carried interest under fair value GAAP standards, even before cash is realized.

Moreover, in the public policy arena, carried interest has become a focal point of tax fairness debates. Critics argue it allows wealthy fund managers to pay capital gains tax on what is essentially labor income, prompting ongoing legislative efforts to recharacterize it as ordinary income. This makes tax structuring around carried interest a complex and evolving task for fund advisors.

In summary, carried interest is more than just a line in a partnership agreement—it is a strategic, financial, and political lever with ripple effects throughout the investment lifecycle, from deal structuring and investor alignment to tax policy and wealth distribution.

Summary

Carried interest calculation is a multi-step profit-sharing mechanism that ensures LPs are protected through capital return and preferred returns before GPs earn their incentive compensation. Its complexity stems from varying hurdle rates, catch-up clauses, and clawback provisions that create a structured waterfall ensuring fair distribution aligned with performance.