Form 1120- Best Comprehensive Guide

Table of Contents

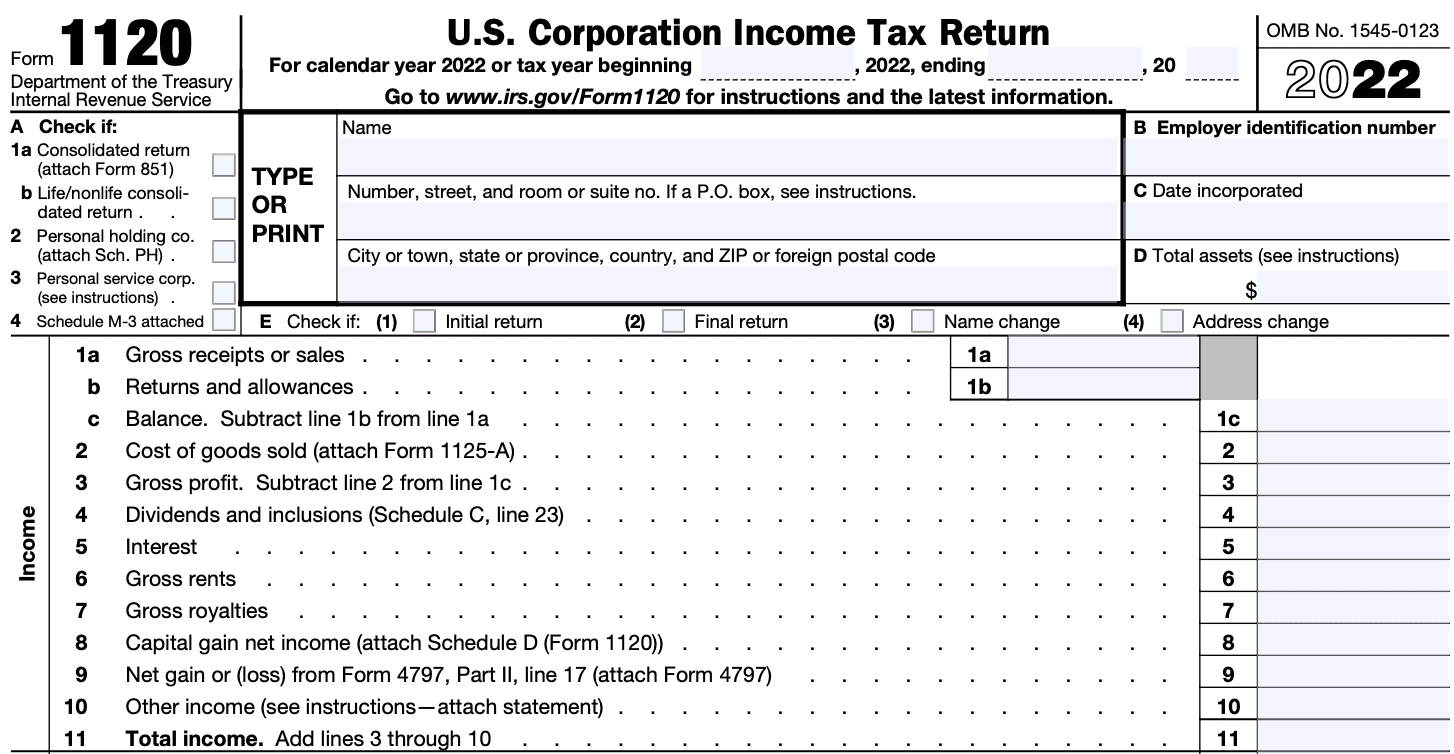

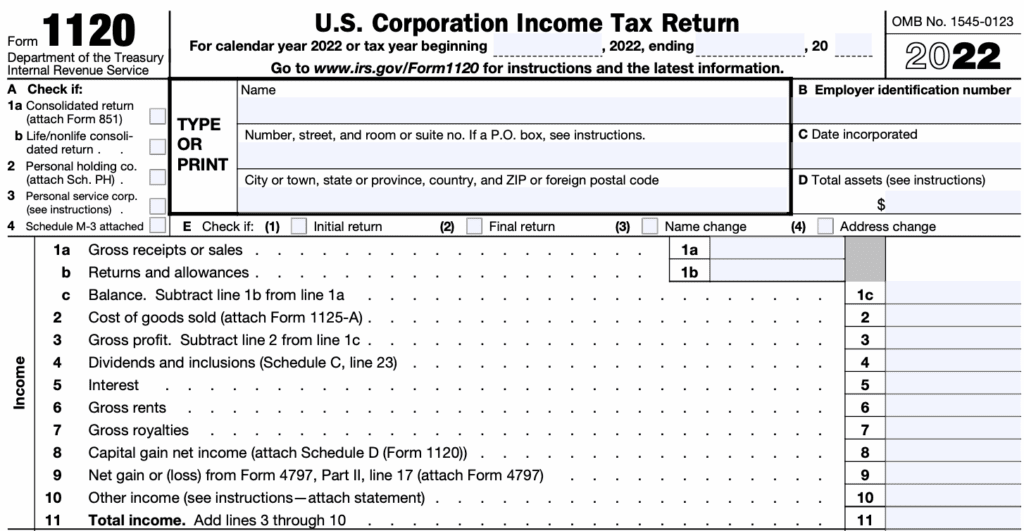

IRS Form 1120, titled “U.S. Corporation Income Tax Return,” is a foundational tax document used by C corporations to report their income, calculate their federal income tax liability, and disclose detailed financial and operational information to the Internal Revenue Service (IRS). It is one of the most comprehensive tax forms in the U.S. tax system, reflecting both the taxable income of a business and its financial position for the year.

This guide will walk you through every aspect of Form 1120, from who needs to file it, to step-by-step breakdowns of each section, key schedules, recordkeeping, due dates, penalties, and common compliance issues.

What Is IRS Form 1120 and Who Must File It?

Unlike individuals, who file IRS Form 1040, or partnerships, which file Form 1065, C corporations are considered separate legal and taxable entities. This means the corporation itself must file its own tax return and pay taxes on its income—independently of its shareholders.

Purpose and Scope of Form 1120

Form 1120 serves several key functions:

- Income Reporting: Captures total gross receipts and other types of income (e.g., dividends, rents, royalties, capital gains).

- Expense Deductions: Reports deductible business expenses like salaries, rent, depreciation, advertising, and contributions to employee benefit programs.

- Tax Calculation: Applies the corporate tax rate (a flat 21%) to determine federal tax owed.

- Disclosure of Financials: Includes supporting schedules for balance sheets, retained earnings, book-to-tax reconciliations, and officer compensation.

- Compliance Reporting: Discloses additional information required by the IRS, such as foreign ownership, tax elections, and accounting methods.

Form 1120 functions as both a tax computation tool and a compliance disclosure document, making it a cornerstone of corporate taxation.

Who Is Required to File Form 1120?

1. Domestic C Corporations

Any corporation organized under U.S. law that is not exempt under Section 501(a) must file Form 1120 annually, regardless of whether it had taxable income, zero income, or even a loss. C corporations are taxed at the entity level—unlike pass-through entities like S corporations or partnerships.

2. Personal Service Corporations (PSCs)

These are closely held corporations where substantially all the activities involve the performance of services in fields like health, law, engineering, accounting, consulting, or actuarial science. PSCs must file Form 1120 and are subject to the flat 21% corporate tax rate, with historically unique treatment prior to TCJA.

3. Corporations in Bankruptcy or Receivership

Even if a corporation is under a court-appointed trustee (bankruptcy, receivership, or reorganization), the entity itself must continue to file Form 1120 annually. The filing obligation remains in place throughout the process unless the entity is formally dissolved and no longer exists.

4. Foreign-Owned Domestic Corporations

A domestic corporation that is at least 25% foreign-owned is still required to file Form 1120. These corporations often also have to file Form 5472 to report transactions with related foreign parties.

5. LLCs Electing to be Taxed as Corporations

Limited Liability Companies (LLCs) are usually taxed as pass-through entities by default (either as disregarded entities or partnerships), but they can elect to be treated as corporations for tax purposes by filing Form 8832 (Entity Classification Election). Once that election is made, the LLC must file Form 1120 each year.

6. Foreign Corporations Engaged in U.S. Business (in certain cases)

While foreign corporations typically file Form 1120-F, they may be required to file Form 1120 instead in limited situations, such as when the IRS classifies their operations under a U.S. branch structure or reorganization.

Summary Table

| Business Type | Files Form 1120? | Notes |

| C Corporation | Yes | Required regardless of income or activity |

| LLC Electing Corporate Status | Yes | Must file Form 8832 first |

| Personal Service Corporation | Yes | Taxed like a C Corp |

Entities That Should NOT File Form 1120

While Form 1120 is the primary federal income tax return for C corporations, not every business entity is required—or even eligible—to file it. The U.S. tax code distinguishes between taxable entities (such as C corporations) and pass-through or exempt entities, each with their own specific filing obligations. Understanding which types of entities should not file Form 1120 is crucial for avoiding misclassification, penalties, and audit triggers.

Below is a comprehensive breakdown of entity types that are not required or permitted to file IRS Form 1120, including the correct forms they must file instead, along with nuanced explanations.

1. S Corporations

Filing Required: Form 1120-S (U.S. Income Tax Return for an S Corporation)

S corporations are corporations that have elected pass-through taxation under Subchapter S of the Internal Revenue Code by filing Form 2553. Instead of paying corporate income tax at the entity level, S corps pass their income, deductions, losses, and credits through to their shareholders, who report this information on their personal tax returns.

Key Points:

- Avoids double taxation (no entity-level tax).

- Limited to 100 shareholders (who must be U.S. citizens or residents).

- Still a corporation under state law, but not under federal tax classification.

Why Not Form 1120?

Form 1120 is for C corporations subject to corporate income tax. Filing Form 1120 as an S corp would negate the pass-through treatment and result in improper taxation.

2. Partnerships and Multi-Member LLCs (Default Classification)

Filing Required: Form 1065 (U.S. Return of Partnership Income)

A partnership is a business structure involving two or more partners who carry on a trade or business. Similarly, multi-member LLCs are treated as partnerships by default unless they elect corporate status via Form 8832. Partnerships do not pay income tax at the entity level; instead, they pass profits, losses, and other tax attributes to their partners using Schedule K-1.

Key Points:

- Must file Form 1065 annually, even if there’s no income.

- Profits taxed only at the partner level.

- Significant IRS reporting obligations (K-1s, capital accounts, etc.).

Why Not Form 1120?

Filing Form 1120 would incorrectly classify the partnership as a corporation, violating its default pass-through tax status and likely triggering IRS scrutiny.

3. Sole Proprietorships and Single-Member LLCs (Default Classification)

Filing Required: Schedule C (Profit or Loss from Business) attached to Form 1040

A sole proprietorship is the simplest business form, where the business and the individual are legally one and the same. Single-member LLCs are treated as disregarded entities for federal income tax purposes (unless they elect otherwise). This means all business income is reported directly on the owner’s personal tax return.

Key Points:

- Business profits are subject to self-employment tax.

- No separate federal tax return for the entity.

- Can elect corporate treatment using Form 8832, in which case Form 1120 would apply.

Why Not Form 1120?

By default, these entities are not separate tax filers. Filing Form 1120 would imply that the business is a taxable C corporation, which it is not unless a formal election has been made.

4. Tax-Exempt Organizations

Filing Required:

- Form 990 (Return of Organization Exempt From Income Tax)

- Form 990-EZ or 990-N (for smaller organizations)

- Form 990-T (if the organization has unrelated business taxable income)

Organizations recognized under Section 501(c)(3) and other exempt categories are not subject to federal income tax on most income and thus are not required to file Form 1120—unless they engage in for-profit activity unrelated to their exempt purpose, in which case they file Form 990-T for that income.

Key Points:

- Must apply for exempt status via Form 1023 or Form 1024.

- Annual filing depends on gross receipts and total assets.

- Subject to disclosure and transparency rules.

Why Not Form 1120?

These entities are exempt under federal law and only pay tax on income not related to their core mission. Filing Form 1120 would treat them as taxable C corporations—an error unless they’ve lost or forfeited exempt status.

5. Foreign Corporations (in most cases)

Filing Required: Form 1120-F (U.S. Income Tax Return of a Foreign Corporation)

Foreign corporations doing business in the United States must file Form 1120-F, not 1120. This specialized form allows foreign entities to report effectively connected income (ECI), claim deductions, and compute U.S. tax owed.

Key Points

- Must file if engaged in a U.S. trade or business.

- Report both ECI and fixed/determinable annual income (FDAP).

- Treaties may affect taxability and filing thresholds.

Why Not Form 1120?

Form 1120 is for U.S.-based domestic corporations only. Filing it as a foreign corporation would be inaccurate and could lead to tax misstatements, loss of treaty protections, or penalties.

Comparison Chart: Who Should NOT File Form 1120

| Entity Type | Files Form 1120? | Correct Form | Key Reason |

| S Corporation | No | Form 1120-S | Pass-through tax treatment |

| Partnership | No | Form 1065 | Income flows to partners |

| Sole Proprietor | No | Schedule C + Form 1040 | Not a separate taxable entity |

| Single-Member LLC (default) | No | Schedule C + Form 1040 | Disregarded for tax purposes |

| Tax-Exempt Org (501(c)) | No | Form 990 or 990-T | Not subject to income tax unless earning UBTI |

| Foreign Corporation | No | Form 1120-F | Specialized form for foreign entities with U.S. income |

Important Notes and Exceptions

- LLCs can elect to be taxed as corporations by filing Form 8832. Once elected, the LLC must file Form 1120.

- Losing tax-exempt status (e.g., due to non-filing) can require a 501(c) organization to file Form 1120 temporarily until exemption is restored.

- Hybrid or international structures (e.g., foreign disregarded entities owned by U.S. corps) may have dual or special filing requirements.

Form 1120 Filing Obligation

Misfiling your federal return using the wrong form—such as incorrectly filing Form 1120 when another return is appropriate—can result in:

- IRS rejection or processing delays

- Miscalculated tax liabilities

- Penalties for failure to file correct information returns

- Increased audit risk

Understanding whether Form 1120 is required, optional, or prohibited for your business structure is foundational to proper tax compliance.

The Importance of Filing Form 1120

Form 1120 is not just a tax form — it is the cornerstone of corporate taxation in the United States. Required for every C corporation, this form serves as the primary mechanism through which the Internal Revenue Service (IRS) enforces the federal income tax laws applicable to corporate entities. It captures the financial heartbeat of a business, revealing profitability, tax liability, capital structure, and more.

Let’s explore in detail why Form 1120 is essential—both from a legal, financial, and strategic perspective.

1. Legal Requirement for C Corporations

All domestic C corporations are legally obligated to file Form 1120 with the IRS annually, regardless of whether they have taxable income. This requirement is embedded in Internal Revenue Code (IRC) Section 6012(a)(2), which mandates that corporations report their income, deductions, and tax liability.

Noncompliance Consequences:

- Substantial failure-to-file and failure-to-pay penalties

- IRS audits or legal action

- Suspension of loss carryforwards or other tax benefits

Why It Matters:

Form 1120 is not optional — it’s a statutory filing duty. Even inactive or zero-revenue corporations must file it to maintain compliance.

2. Determines Federal Tax Liability for C Corporations

Form 1120 computes a corporation’s total federal income tax liability by documenting:

- Gross receipts or sales

- Cost of goods sold

- Ordinary and necessary business expenses

- Credits, deductions, and adjustments

It then calculates the net taxable income and applies the federal corporate tax rate (currently 21% under the TCJA) to determine the tax due.

Why It Matters:

It’s the IRS’s primary tool to assess whether the corporation has:

- Correctly reported its financial activity

- Accurately paid the taxes it owes

Errors or omissions on Form 1120 can result in:

- Underpayment penalties

- Denial of credits or deductions

- Long-term financial and reputational harm

3. Records Crucial Financial and Tax Data

Form 1120 is far more than just a tax calculation form—it includes:

- Schedule C (Dividends, interest, royalties)

- Schedule J (Tax computation and payments)

- Schedule K (General corporate info)

- Schedule L (Balance sheet)

- Schedule M-1 & M-2 (Book-to-tax reconciliations and retained earnings)

This data provides the IRS with a comprehensive picture of the company’s:

- Financial position

- Profitability

- Book-to-tax differences

- Tax planning methods

Why It Matters

Form 1120 is used by the IRS to detect tax avoidance strategies, improper deductions, and inconsistencies between financial reporting and tax reporting. It’s also used by lenders, investors, and auditors to evaluate financial health.

4. Supports Tax Planning and Strategic Decision-Making

Corporations use the information compiled for Form 1120 to make informed tax planning decisions, such as:

- Timing income or deductions

- Maximizing credits and deductions (e.g., R&D Credit, Foreign Tax Credit)

- Structuring dividends or compensation

- Utilizing net operating loss (NOL) carry forwards

- Implementing transfer pricing strategies

Why It Matters:

A well-prepared Form 1120 can optimize tax outcomes and minimize legal risks. It also facilitates year-over-year comparison, trend analysis, and better decision-making.

5. Required for Other Tax Filings and Financial Reporting

The information on Form 1120 is used to support or trigger various other federal and state filings:

- State Corporate Income Tax Returns (often based on federal taxable income)

- Schedule UTP (Uncertain Tax Positions, if required)

- Form 5471/5472 (foreign ownership and international reporting)

- Form 1125-A/B/E (cost of goods sold, officer compensation, etc.)

Why It Matters:

Form 1120 often acts as the base return for other regulatory filings, especially for multi-state corporations or those with international operations. Inaccuracies here can cascade into larger tax and compliance failures.

6. Vital for Startups, Investors, and Financial Institutions

Startups and growing corporations often rely on their filed Form 1120 to:

- Show profitability to attract investors

- Qualify for loans and lines of credit

- Provide assurance to venture capital firms, lenders, or government agencies

- Demonstrate legitimate tax compliance for due diligence

Why It Matters:

Form 1120 helps build credibility. It’s a formal government document that proves a company’s income, stability, and legitimacy.

7. Penalties and Enforcement Risks for Misfiling or Nonfiling

Failing to file Form 1120 (or filing it incorrectly) can result in:

- Late filing penalties: 5% per month (up to 25%)

- Late payment penalties: 0.5% per month of unpaid tax

- Interest on unpaid balances

- Criminal charges in cases of tax evasion or fraud

Why It Matters:

The IRS uses Form 1120 to enforce tax law. Filing late or inaccurately draws scrutiny and increases the risk of audits, penalties, or prosecution.

Whether you’re a startup, a multinational, or a domestic enterprise, Form 1120 is the central document that keeps your corporation legally and financially aligned with federal tax laws.

Due Dates for Filing IRS Form 1120 (U.S. Corporation Income Tax Return)

Understanding the filing deadlines for IRS Form 1120 is critical for ensuring timely tax compliance and avoiding costly penalties. The due date varies depending on the corporation’s tax year, whether it follows a calendar year or a fiscal year, and whether an extension has been requested.

Let’s explore all the key due dates and rules in detail:

1. General Due Date for Calendar-Year Corporations

For corporations that use the calendar year as their tax year (i.e., their year ends on December 31), the due date for filing Form 1120 is:

April 15 of the following year

Example:

If your corporation’s tax year ends on December 31, 2024, then:

- Form 1120 is due on April 15, 2025

Note: If April 15 falls on a weekend or a legal holiday, the due date is pushed to the next business day.

2. Due Date for Fiscal-Year Corporations

A fiscal-year corporation is one that ends its tax year on a month other than December. For these corporations, the filing due date is:

The 15th day of the 4th month after the close of the tax year

Example:

If a corporation’s tax year ends on June 30, 2025, then:

- Form 1120 is due by October 15, 2025

This rule applies to all fiscal-year filers, regardless of the month in which their year ends (except for special situations discussed below).

3. Special Rule: Corporations with Tax Years Ending June 30 (Prior to TCJA)

Historically, corporations with a tax year ending June 30 had a due date that was the 15th day of the 3rd month (i.e., September 15). However, under the Tax Cuts and Jobs Act (TCJA) of 2017, the rule changed.

For tax years beginning after July 1, 2026, the due date becomes:

October 15 (4th month after June 30)

Until then, June 30 year-end corporations still follow the old rule:

September 15, not October 15

4. Extended Due Date (with Form 7004)

Corporations can apply for an automatic 6-month extension of time to file Form 1120 by submitting:

Form 7004 – Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns

Important notes about Form 7004:

- Must be filed on or before the regular due date of the return (e.g., April 15).

- The extension only applies to filing, not to payment. Any tax due must be paid by the original due date to avoid interest and penalties.

Example:

If your corporation uses a calendar year ending December 31:

- Regular due date: April 15

- Extended due date: October 15 (if Form 7004 is timely filed)

5. Payment Due Date (Regardless of Filing Extension)

Even if you file for an extension with Form 7004, the corporate income tax owed is still due by the original filing deadline.

Failure to pay taxes by the original due date (e.g., April 15) will result in:

- Late payment penalties (0.5% per month of unpaid tax)

- Interest charges on the unpaid amount

Thus, corporations should estimate their tax liability and submit payment with Form 7004 to stay compliant.

Summary Table: Form 1120 Due Dates

| Tax Year Type | Tax Year End | Original Due Date | Extended Due Date (with Form 7004) |

| Calendar Year | December 31 | April 15 (next year) | October 15 (6-month extension) |

| Fiscal Year | Varies | 15th day of 4th month after year-end | 6 months after original due date |

| Special Rule (June 30)* | June 30 | September 15 (until 2026) | March 15 of following year |

*Changes under TCJA effective after July 1, 2026

Late Filing and Payment Penalties

Missing Form 1120’s due date—without an approved extension—can trigger significant penalties:

- Late Filing Penalty:

- 5% of the unpaid tax per month (or part of a month), up to 25% maximum.

- Late Payment Penalty:

- 0.5% of unpaid tax per month, up to 25% maximum.

- Failure to Pay Estimated Taxes (Form 1120-W):

- Additional penalties if a corporation doesn’t pay required quarterly estimated taxes.

Conclusion: Form 1120 as the Cornerstone of Corporate Tax Filing

IRS Form 1120 is far more than just a tax document — it is the foundational instrument through which U.S. C corporations report their income, claim deductions and credits, and fulfill federal tax obligations. Its proper preparation, timely filing, and accurate reporting are essential not only for legal compliance but also for financial transparency, strategic tax planning, and corporate credibility.

Whether your corporation is newly formed, well-established, or experiencing complex financial activity, Form 1120 plays a direct role in determining your tax liability and protecting your business from penalties, audits, or reputational risk. It supports other tax filings, serves as a key document during due diligence, and helps position your business for sustainable growth.

In an era of increasing IRS scrutiny and digital reporting, understanding and correctly filing Form 1120 is not optional — it’s essential. Corporations that prioritize accurate tax reporting through Form 1120 not only stay compliant but also gain a competitive advantage in financial governance, investor confidence, and long-term profitability.

FAQs On IRS Form 1120

1. What is IRS Form 1120 used for?

Form 1120 is used by C corporations to report their income, gains, losses, deductions, and tax liability to the IRS. It is the primary corporate income tax return for U.S.-based corporations.

2. Who is required to file Form 1120?

All domestic C corporations, regardless of income or business activity, must file Form 1120 annually. This includes newly incorporated businesses, dormant corporations, and corporations operating at a loss.

3. When is IRS Form 1120 due?

The standard due date for calendar-year C corporations is April 15. For fiscal-year corporations, Form 1120 is due on the 15th day of the 4th month after the end of the tax year.

4. Can I file Form 1120 electronically?

Yes, Form 1120 can be e-filed using IRS-approved tax software or through a tax professional. E-filing is encouraged by the IRS for faster processing and fewer errors.

5. What is the penalty for late filing of Form 1120?

The late filing penalty is 5% of the unpaid tax per month, up to a maximum of 25%. Additional interest and late payment penalties may apply if taxes are not paid by the original due date.

6. How do I get an extension for Form 1120?

File Form 7004 by the original due date to receive a 6-month automatic extension to file Form 1120. Note: this extends the filing deadline only — tax payments are still due by the original date.

7. What’s the difference between Form 1120 and Form 1120-S?

- Form 1120 is for C corporations, which pay tax at the corporate level.

- Form 1120-S is for S corporations, which are pass-through entities and do not pay federal income tax at the corporate level.

8. Do I need to file Form 1120 if my corporation made no money?

Yes. Even if your C corporation had no revenue or activity, you are still required to file Form 1120 to remain in compliance with IRS regulations.

9. What supporting schedules are included with Form 1120?

Commonly required schedules include:

- Schedule C (Dividends & special income)

- Schedule J (Tax computation)

- Schedule K (Other information)

- Schedule L (Balance Sheet)

- Schedule M-1 & M-2 (Reconciliations & retained earnings)

10. Can a single-member LLC file Form 1120?

Only if the single-member LLC elects to be taxed as a C corporation by filing Form 8832. Otherwise, it is disregarded for federal tax purposes and typically files on Schedule C of the owner’s return.